Step aside, oil and natural gas. NGLs have become America’s hottest export product. Terminals to export ethane and LPGs are running full throttle now, and new expansions under construction will bring big growth to markets starting in 2025.

NGLs are often lost in the discussion about the U.S. hydrocarbon export machine. Yet markets for purity products like ethane and LPGs (propane, normal butane, isobutane) have all the elements for a sustained run: a robust supply outlook, strong interest from international buyers, and investors willing to back new infrastructure to connect the two.

The engine for the boom is steady production growth from the oil patch. East Daley Analytics forecasts U.S. NGL production to grow by 600,000 bbl/d over the next three years, from 6.4 MMbbl/d in 2023 to over 7 MMbbl/d by 2026.

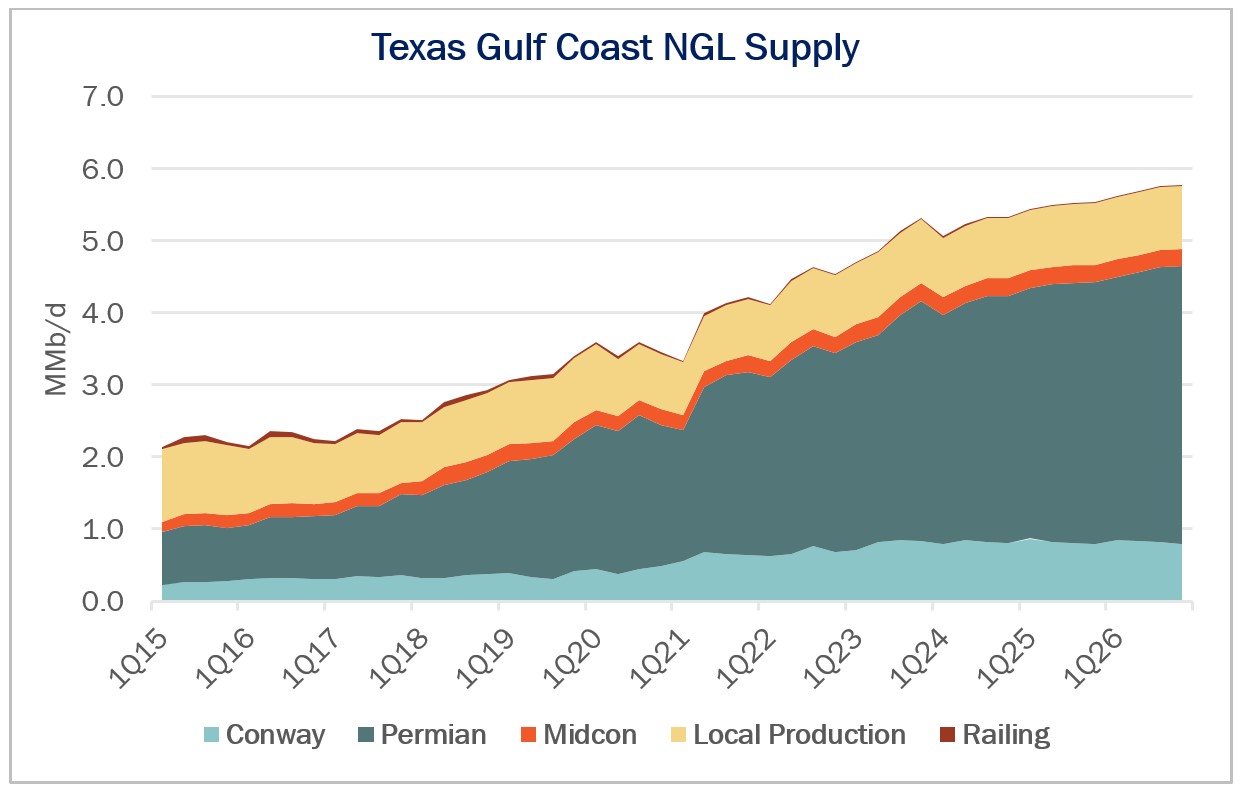

Operators in the Permian Basin in West Texas and New Mexico drive most of the gains in our NGL Hub Model. New investments in midstream processing plants and pipelines, led by the 2.5 Bcf/d Matterhorn Express Pipeline, enable rapid growth in Permian natural gas production over the next several years. The additional Permian gas must be processed, translating into more NGL production as bundled Y-grade. Other U.S. basins, including the Marcellus and Utica shales in the Northeast and the Eagle Ford in South Texas, also contribute to supply growth.

RELATED

EnLink Expects Matterhorn Line Operational by September

Led by the Permian, Y-grade supply available to Gulf Coast fractionators and export terminals increases to over 5.7 MMbbl/d by year-end 2026 in our NGL Hub Model, up from an average of 5 MMbbl/d in 2023. While petrochemical expansions on the Gulf Coast will absorb some of this new wedge of supply, we expect most of the NGLs to be bound for overseas markets.

NGL exports: big business

Exporting NGLs has become big business for the oil and gas industry. In 2023, the industry exported 960.6 MMbbl (2.63 MMbbl/d) of ethane and LPGs, a record high according to Energy Information Administration (EIA) data. The latest EIA data show exports are on track to hit another record in 2024, averaging 2.79 MMbbl/d in the first quarter. About 80% of LPG exports take place in the PADD 3 Gulf Coast region, mostly in the southeastern Texas industrial corridor from Houston to Beaumont.

Profits are flowing for the midstream companies that operate the specialized docks for ethane and LPG exports. Enterprise Products Partners (EPD), Energy Transfer (ET), Targa Resources (TRGP) and Phillips 66 (PSX) are the big players, controlling almost 90% of export capacity in PADD 3. The companies in 2023 reported over $1.6 billion in combined gross margin for their LPG export operations. Yet these export docks have much greater intrinsic value for the companies. All of them run vertically integrated NGL operations, and more volume for exports equates to more fee-based cash flow for processing units, pipelines and fractionators along the NGL value chain.

In 2023, China became the largest buyer of U.S. propane, importing the product as feedstock for new propane dehydration units (PDH) to make propylene. The country’s chemicals industry has been on a building spree of late, starting around 15 PDH facilities in 2023, according to industry estimates. These plants together would have the capacity to consume about 250,000 bbl/d of propane.

Dock expansions

Exports of LPGs and ethane have grown so rapidly that many Gulf Coast terminals are operating at capacity. For example, TRGP shipped 435,000 bbl/d of LPGs from its Galena Park export dock in fourth-quarter 2023, or about 98% utilization based on nameplate capacity of about 445,000 bbl/d. East Daley estimates Gulf Coast docks combined ran at 93% utilization in that period.

The industry is planning several dock expansions to address the constraint. Energy Transfer is spending $1.25 billion to add 250,000 bbl/d of export capacity at its Nederland, Texas, terminal, while Enterprise is expanding dock capacity by 120,000 bbl/d at the Enterprise Hydrocarbon Terminal. Enterprise is also planning a new NGL export facility on the Neches River near Beaumont, Texas.

We forecast LPG exports from PADD 3 will increase to 2.2 MMbbl/d by fourth-quarter 2026. The Enterprise and Energy Transfer dock expansions provide room for market growth to keep the U.S. export machine humming. The projects also support new NGL pipelines and fractionators in the works on the Gulf Coast. With so many moving parts, we expect volatility ahead in flows and prices for NGL purity products.

Rob Wilson is vice president of analytics at East Daley Analytics.

Recommended Reading

On The Market This Week (Jan. 6, 2025)

2025-01-10 - Here is a roundup of listings marketed by select E&Ps during the week of Jan. 6.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

E&P Highlights: Jan. 6, 2025

2025-01-06 - Here’s a roundup of the latest E&P headlines, including company resignations and promotions and the acquisition of an oilfield service and supply company.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

E&P Highlights: Dec. 30, 2024

2024-12-30 - Here’s a roundup of the latest E&P headlines, including a substantial decline in methane emissions from the Permian Basin and progress toward a final investment decision on Energy Transfer’s Lake Charles LNG project.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.