The Danish company reported EBITDA of about 9.5 billion DKK (US$1.4 billion), up 4% from a year earlier. (Source: Shutterstock)

Offshore wind developer Ørsted returned to a nine-month profit, executives said Nov. 5, following divestments and ongoing progress on global projects, including in the U.S.

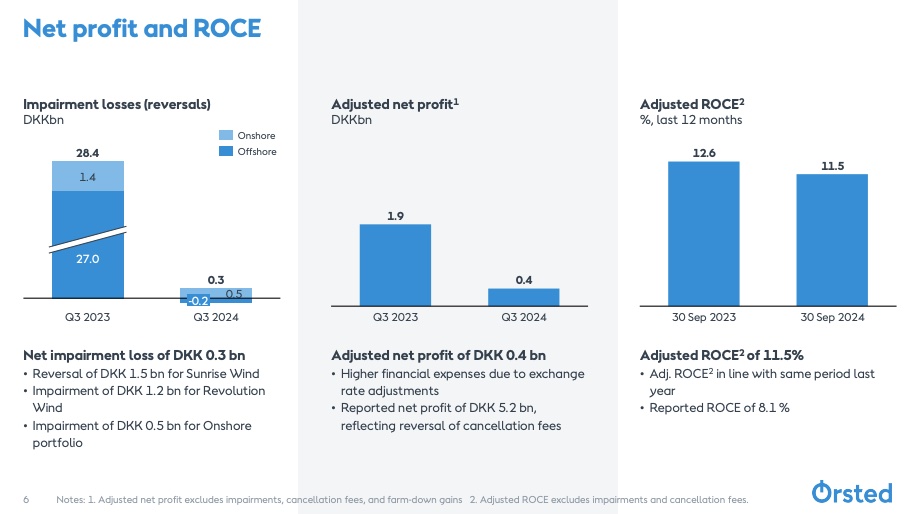

However, there were challenges that led to an impairment loss of about 284 million Danish kroner (DKK) (US$41.6 million), far less than the 28.4 billion DKK (US$4 billion) in impairments booked a year earlier.

“We continue to see solid operational performance across our fleet of assets and good overall progress on our construction projects, though we have seen some unexpected challenges impacting the construction of one of our U.S. offshore projects,” Ørsted CEO Mads Nipper said on an earnings call. “Looking at our financials for the third quarter, our underlying business continues to perform well and our operational portfolio have delivered strong earnings.”

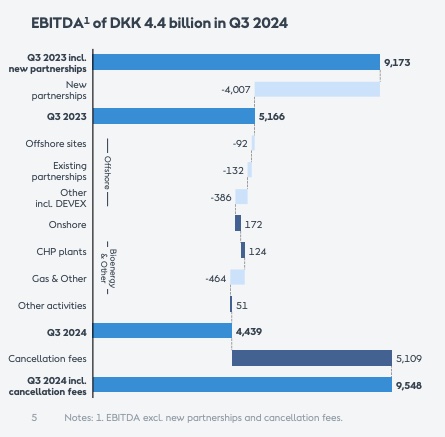

The Danish company reported EBITDA of about 9.5 billion DKK (US$1.4 billion), up 4% from a year earlier. Its total net profit for the quarter was about 5.1 billion DKK (US$747.5 million), up from a loss of about 22.2 billion (US$3.3 billion).

Ørsted also narrowed its full-year earnings forecast to between DKK 24 billion to DKK 26 billion (previously between DKK 23 billion to DKK 26 billion), excluding new partnership agreements and impact cancellation fees.

The revision was reported as the company takes steps to strengthen its balance sheet, including carrying out a divestment program. Its latest move included a deal with Brookfield to sell 12.45% minority stakes in the U.K. wind farms Hornsea 1, Hornsea 2, Walney Extension and Burbo Bank Extension, which have a combined capacity of about 3.5 gigawatts (GW), in a DKK 15.7 billion (US$2.3 billion) deal.

Last year, supply chain woes, inflation and interest rates pushed up costs and forced some offshore wind developers, including Ørsted, to cancel projects and renegotiate contracts. The situation has since improved with U.S. inflation easing, interest rates falling and states and federal governments stepping in with tax incentives and pathways to better contracts.

The impairment loss in the third quarter was driven by “updated assumptions regarding market prices for our U.S. portfolio as well as increased cost and a challenge relating to the installation of the offshore substation monopile at Revolution wind,” Nipper said. “These developments were partly offset by the decrease in the long-dated interest rates.”

Ocean wind

Ørsted on Nov. 5 highlighted additional steps to derisk the canceled Ocean Wind project offshore New Jersey, having finalized negotiations regarding supply contracts. The outcomes were significantly better than assumed last year, Nipper said.

“As a result of these favorable settlements, we have reversed more than 5 billion DKK of cancellation fee provision during the third quarter, which has had a positive effect on reported EBITDA,” Nipper said. “Additionally, we have found further equipment that can be used in other projects in our portfolio, which had a minor positive effect on the provision as well.”

The company ceased development of Ocean Wind 1 and Ocean Wind 2 in 2023 during a portfolio review. At the time, it cited macroeconomic factors that included high inflation, rising interest rates and supply chain constraints along with a vessel delay that impacted project timing.

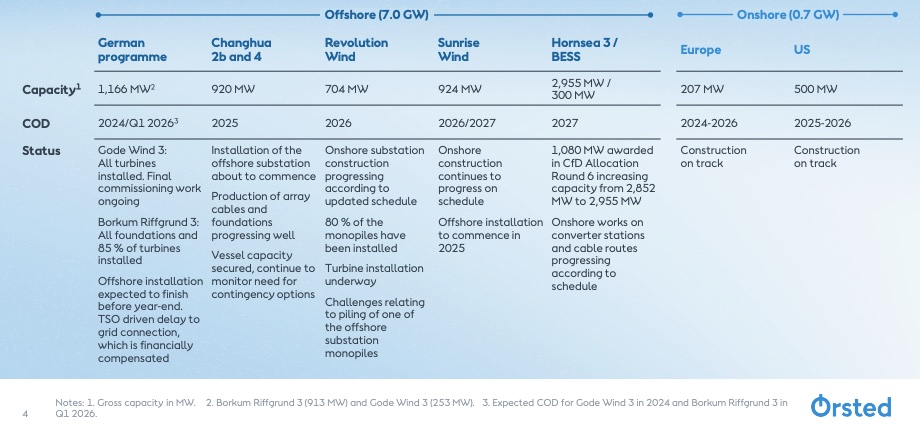

Progress continues on the 704-megawatt (MW) Revolution Wind project being developed off Rhode Island with partner Eversource, but not without challenges.

Revolution wind

So far, 52 turbine foundations, nine turbines and 20 array cables have been installed, Nipper said, adding “since taking FID [final investment decision] last year, the project risk picture has been evolving.”

The project is expected to be complete in 2026.

The contract period was extended for one of the installation vessels being used for the project with “higher than anticipated costs,” he said. The company is also dealing with complications involving the installation of an offshore substation monopile likely due to resistance within the seabed soil, Nipper said, noting it was safely driven to target depth but may be unsuitable for use.

“As a result of this complication, we are expecting additional costs to complete the project, which, despite these developments, still holds a positive value from an absolute life cycle IRR level as well as an attractive, forward looking return,” Nipper said.

Both issues were incorporated into impairment calculations.

Sunrise wind

Offshore installation work for the 924-MW Sunrise Wind project offshore New York is expected to begin in 2025.

“The project is progressing on a tight schedule as we work towards commissioning at the end of 2026 or first half of ‘27,” Nipper said.

Ørsted took full ownership of Sunrise earlier this year when it acquired Eversource’s 50% share.

The company has said it intends to farm down Sunrise, which is on track to be complete by 2026.

“The market is of course challenging. … We have seen the changes,” said Ørsted CFO Trond Westlie. He added that the company is planning its process diligently with input from investors. Negative trends from the U.S. market will present challenges going forward; however, “as we see it now, we haven’t changed our view on the likelihood of being able to farm down going forward. But, of course, it’s election day, so many thing(s) can happen.”

US election

Ørsted delivered its third-quarter results as U.S. voters went to the polls to elect a president.

Asked whether a change in administration could pose any risks, specifically to Revolution Wind and Sunrise Wind and to the investment tax credit (ITC), Nipper appeared to have little concerns.

“Let me remind everyone that that the two under construction projects we have in offshore— Revolution and Sunrise—are both fully permitted,” Nipper said. “Since this is the role that the federal level is playing, this is something where we have not changed that risk outlook at all. And we are we are confident that that the construction can move ahead.”

The ITC is not assessed as a material risk, he added.

On the what if topic of potential incremental levies impacting equipment deliveries and perhaps leading to more impairments and higher costs, Westlie pointed out that Revolution, for example, is well advanced. Assuming the worst, he added there would some sort of implementation period to make it “quite manageable.”

Recommended Reading

DNO ‘Hot Streak’ Continues with North Sea Discovery

2025-03-26 - DNO ASA has made 10 discoveries since 2021 in the Troll-Gjøa exploration and development area.

E&P Highlights: March 24, 2025

2025-03-24 - Here’s a roundup of the latest E&P headlines, from an oil find in western Hungary to new gas exploration licenses offshore Israel.

Black Gold, LGX Find Multiple Pay Zones in Western Indiana

2025-04-04 - Black Gold Exploration Corp. and LGX Energy Corp. are working to start production at the Fritz 2-30 oil and gas well in Indiana within 60 days.

E&P Highlights: Jan. 27, 2025

2025-01-27 - Here’s a roundup of the latest E&P headlines including new drilling in the eastern Mediterranean and new contracts in Australia.

CNOOC Makes Oil, Gas Discovery in Beibu Gulf Basin

2025-03-06 - CNOOC Ltd. said test results showed the well produces 13.2 MMcf/d and 800 bbl/d.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.