Danish offshore wind developer Ørsted booked about $574 million in impairments and scrapped a green fuels project in Europe. (Source: Ørsted)

Impairments and project delays are again bringing challenges for Danish wind powerhouse Ørsted as it works to construct massive wind farms offshore the U.S.

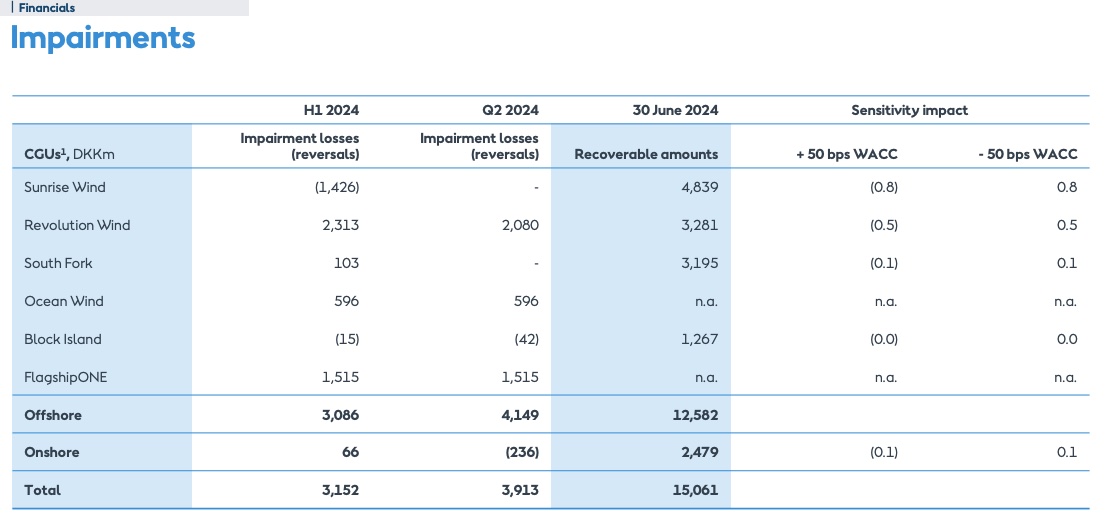

Ørsted booked about 3.9 billion Danish kroner ($574 million) in impairment losses in the second quarter due mostly to U.S. offshore wind projects and an e-methanol project in Europe, the company said on Aug. 15.

Construction delays associated with the onshore substation for the 704-megawatt (MW) Revolution Wind project being developed with partner Eversource led to an impairment loss of about 2.1 billion Danish kroner (DKK).

The delay prompted Ørsted to push back the start of commercial operations for the project offshore Connecticut and Rhode Island by a year to 2026.

The company also decided to halt its FlagshipONE project designed to use a wind-powered electrolyzer to produce e-methanol for the shipping industry. The liquid e-fuel market is developing slower than anticipated, the company said. A 1.5 billion DKK impairment loss was recorded for the quarter.

Losses also included a 596 million DKK impairment related to Ocean Wind off New Jersey.

The company and some of its peers struggled with supply chain woes, higher interest rates and inflation in 2023. The obstacles caused Ørsted to pull out of some of its U.S. offshore wind projects, seek better contract terms and book more than $4 billion in impairment charges last year. Challenges have since eased amid improving conditions and regulatory support; however, project-specific obstacles have surfaced for the company.

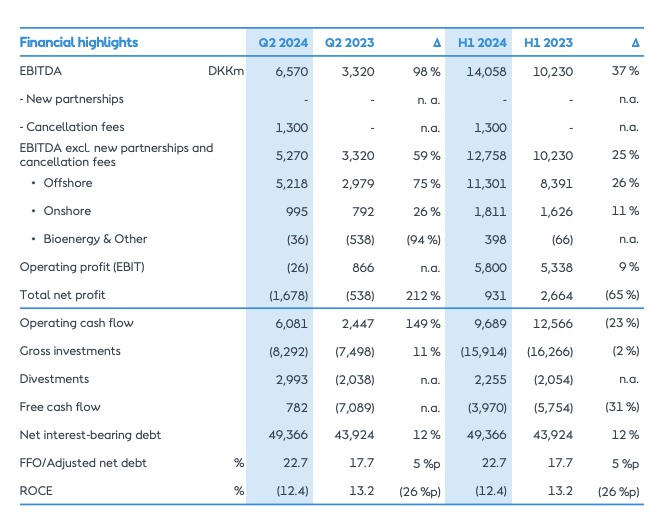

Still, Ørsted appears to be adapting to adversities following a portfolio review earlier this year that refocused its U.S. offshore strategy and capital allocation. Second-quarter 2024 saw EBITDA rise.

“Despite continued industry challenges and an unsatisfactory project-specific issue at our legacy U.S. offshore project Revolution Wind, our long-term financial targets remain unchanged, and we have a fully funded business plan,” Ørsted CEO Mads Nipper said. “Looking at our financials for the second quarter, our underlying business continues to perform well and our operational portfolio continues to deliver strong earnings.”

Financials

Ørsted reported a net loss of about 1.7 billion DKK, up from 538 million DKK a year earlier. But the company’s EBITDA—excluding new partnerships and cancellation fees—increased nearly 60% to 5.3 billion DKK.

The increase was driven by higher earnings from offshore sites with a ramp up from new wind farms and higher wind speeds, Nipper said. “Earnings from offshore sites amounted to 4.4 billion [DKK], an increase of 40% compared to the same period last year.”

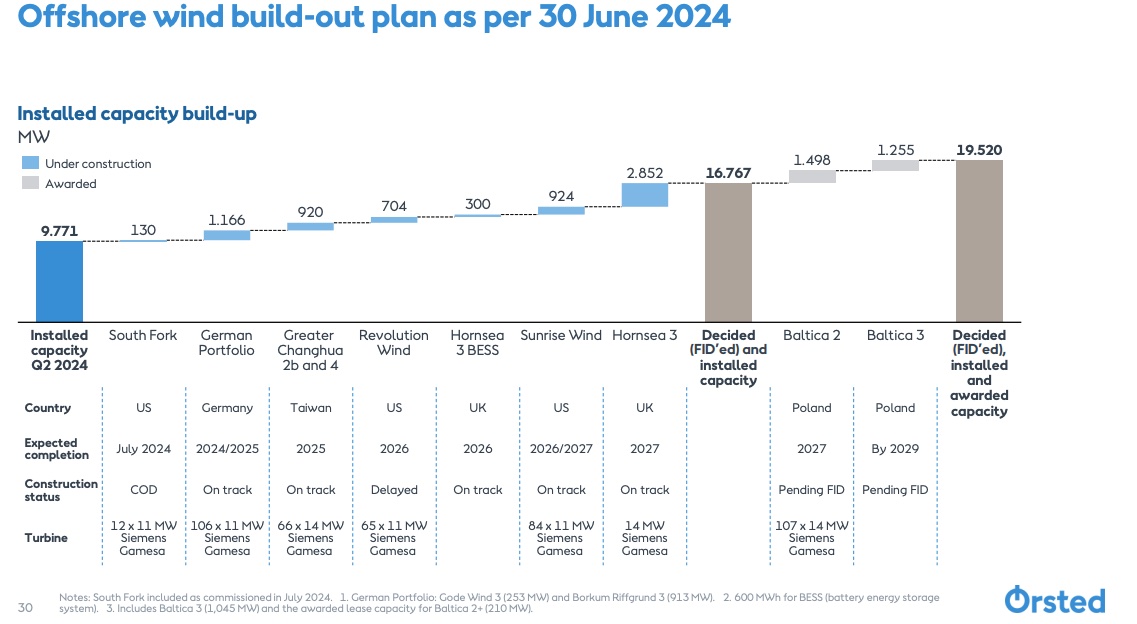

Ørsted commissioned more than 2 gigawatts (GW) of renewable capacity during the second quarter. These included the commissioning of the 130- MW South Fork Wind in the U.S. and the more than 1-GW commission of the Greater Changhua 1 and 2a in Taiwan. The company also brought about 850 MW of solar capacity online, including in the U.S.

“This is a significant contribution to our long-term targets for renewable capacity, where we aim to reach around 35 [GW] to 38 GW by 2030,” Nipper said. “In addition to our installed capacity of 17.6 GW, we are currently constructing 7.6 GW of renewable capacity across our offshore and onshore projects.”

Ørsted also reported first-half 2024 impairment reversals related to Sunrise Wind and Block Island. These included renegotiated contracts and a claim settlement with the state of New Jersey at better than assumed terms, executives said.

The Revolution Wind delay, which led to the largest impairment loss for the quarter, was attributed to contaminated soil at the onshore substation. The discovery mandated the company redesign the substation and acquire additional piling. With a concrete foundation and 2,000 piles now complete, the company said it sees no further stability risks.

Building out

Speaking about the volatility seen in the offshore wind sector, including with interest rates, and possibly diversification moves, Ørsted CFO Trond Westlie said it is likely the company will see ups and downs on U.S. specific projects. But the projects are “still IRR positive,” he said.

“We actually see positive returns coming out of these. So, we’re not throwing money out of the window. … On Revolution, when we look at the forward-looking IRR, there’s significant positive,” Westlie said. “There’s no question of doing anything else. Financially, I’m sad that we’re having these … impairment discussion[s].”

Inflation is at more modest levels today compared to 12 months to 18 months ago, Nipper said, adding “but there is still inflation, and in that sense, we still see LCOE [levelized cost of energy] ticking up.”

If the LCOE for offshore wind remains stubbornly high, an analyst asked, were there other technologies the company would consider diversifying into?

Nipper said he couldn't rule that out.

“But if you look at the entire northern Europe, if you look at the northeast U.S., clearly, there’s a commitment to still see offshore wind playing an absolute key role,” Nipper said. “And I think it is encouraging to see that even though this LCOE development is very well known, we do still see solicitations being brought online.

Nipper cited New York offshore wind solicitations as an example. The state in July launched its fifth solicitation for offshore wind energy.

“That shows that the necessary commitment to keep building out, despite the LCOE increase, is still there,” Nipper said. “And obviously, skill, experience, market building, higher robustness of the supply chain is exactly what it takes to start a downward curve again.”

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.