The permitting process is progressing as BKV works to line up CO2 emission sources. (Source: Shutterstock/ BKV)

BKV Corp.’s carbon capture and power businesses are gaining momentum as the company looks for M&A opportunities and pushes what it calls a “winning formula” of natural gas and carbon capture and storage (CCS) to power data centers.

Speaking on Nov. 12 during the company’s first earnings call since going public in September, BKV CEO Chris Kalnin said the Barnett Zero carbon capture facility has sequestered about 140,000 tons of CO2 since it began operating last year. BKV’s Cotton Cove facility is also on track for first injection in the first half of 2026.

“Carbon capture is a crucial piece of BKV’s closed-loop strategy. The carbon capture projects that we are pursuing make money standalone based on 45Q tax credits, which we believe have strong bipartisan support,” Kalnin said. “In addition to the 45Q, we take the environmental attributes of sequestering CO2 and combine these with our natural gas products to create an innovative new natural gas product called carbon sequestered gas or CSG. This new gas product is a carbon neutral product when combusted.”

BKV is the top natural producer in the Barnett Shale and is considered a leading refrac operator in the U.S., having done 360 refracs in the last three years with 2,100 more in its remaining inventory. Shale operations are BKV’s core, but the company is building up its CCS and power businesses.

The efforts come amid a continued sustainability push, goals to lower emissions and growing power demand needs driven in part by data centers. CCS is expected to play an essential role.

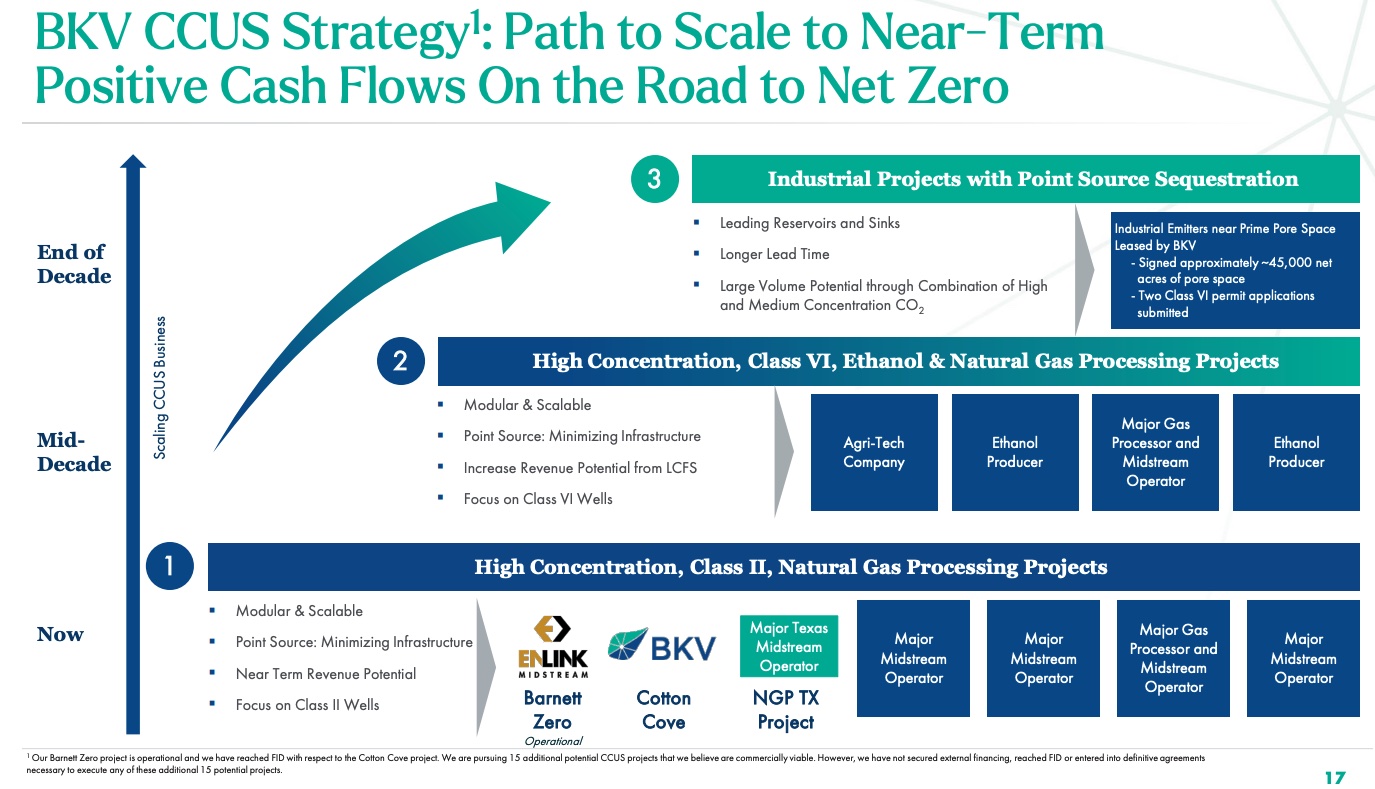

“Our project pipeline remains strong and we continue to gather momentum in our CCUS [carbon capture, utilization and storage] business,” said BKV COO Eric Jacobsen. “Importantly, as the industry has seen some permitting delays at the federal level, I wanted to mention that BKV has pursued both Class II and Class VI well permits for CO2 injection” for flexibility.

Getting permits

The U.S. Environmental Protection Agency’s (EPA) permitting process for Class VI wells, which gives companies permission to inject CO2 into underground formations for permanent storage, has been slow due to a backlog of applications and the time it takes for regulators to make sure such projects are safe.

However, states that have secured primacy—North Dakota, Wyoming and Louisiana—are taking over regulatory control and helping to speed the process. States such as Texas, where BKV operates, already regulate other types of wells, including Class II wells.

Class II wells are faster to permit, Jacobsen said. The permits allow for sequestration of CO2 from natural gas processing facilities, “which complements our core upstream business.” Texas Railroad Commission has approved for a Class II permit for BKV’s Cotton Cove project. In addition, BKV filed two Class VI well permit applications within the last year. Both were deemed administratively complete by regulators—one by the Environmental Protection Agency with jurisdiction in Texas and the other with the state of Louisiana, which has primacy, Jacobsen said.

The permitting process is progressing as BKV works to line up CO2 emission sources.

“When it comes to competition for CO2 emission sources, we believe BKV operates in a unique white space that has limited competition from large integrated oil and gas companies,” Kalnin said. “BKV focuses on bespoke high concentration and point source projects, which are typically profitable but are too small for major energy companies to pursue. The momentum we have with potential projects underscores the strength of this strategy.”

BKV’s CCS efforts are being noticed by midstream operators looking to lower emissions.

“We’re in conversation with a large number of public and private midstream operators,” Jacobsen said. “To date, we have three emitter agreements in total and five more under exclusivity across our entire portfolio.”

Power, data centers

BKV is also positioning itself to meet the growing electricity needs of data centers. Its joint venture with Banpu Power includes two combined cycle natural gas power plants in Temple, Texas, with a combined capacity of about 1,500 megawatts.

And within the Electric Reliability Council of Texas, which manages electricity for millions of customers, BKV is focused on the growing data center segment, which Kalnin said is the second fastest data center market in the U.S.

“We believe that BKV offers a unique value proposition to these potential data center customers through our ability to provide baseload around the clock gas fired generation while decarbonizing that generation through our carbon capture business,” Kalnin said. “We believe that the combination of natural gas and carbon capture provides a winning formula that will help fuel the continued growth in AI [artificial intelligence] data center buildouts in a sustainable and scalable manner.”

McKinsey & Co. estimates U.S. data center power consumption could hit 35 gigawatts (GW) by 2030, up from 17 GW in 2022.

Kalnin explained that BKV can provide hour-by-hour offsetting, which is desirable for companies looking to meet energy needs with sustainability in mind.

“Depending on the party you’re talking about, each group has different internal carbon offset evaluators and I think in general the receptivity of carbon capture has been very strong,” Kalnin said.

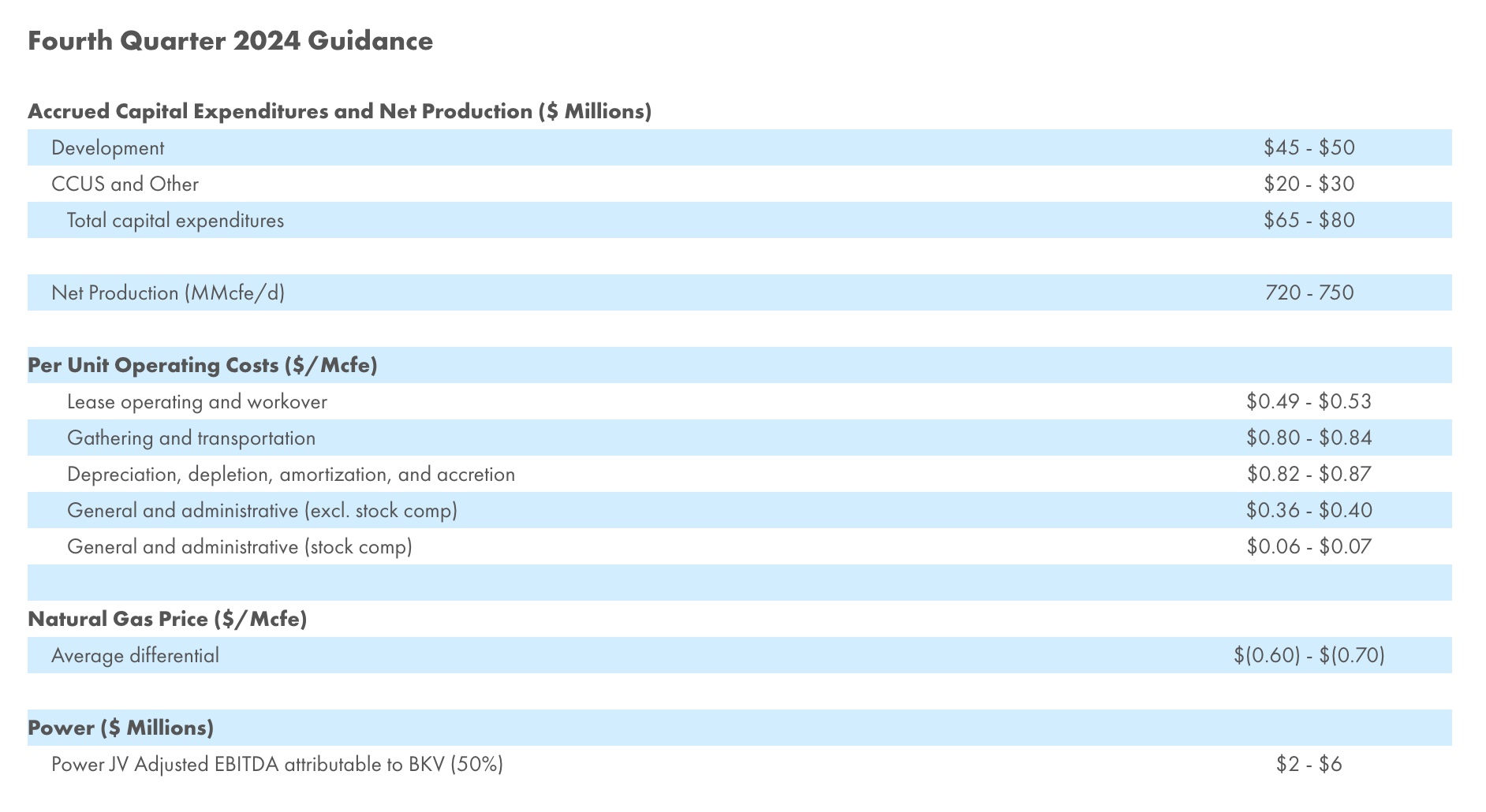

In related CCS news, BKV said it continues to evaluate third-party investments and partnerships to help fund the business. This could include a joint venture, project-based equity partnerships, financing arrangements and federal grants, any of which can provide additional capital to help us fund our carbon capture business.

On the power side, given the expected rise in demand, BKV will be “leaning forward on the acquisition side. … I think now is the moment,” Kalnin said. “If you look forward in the next few years, I think the opportunity to acquire existing power plants at reasonable prices will be hard. … Obviously, M&A markets are unpredictable. We got to kind of see the right opportunities. We’ve bought smart in all our deals so far.”

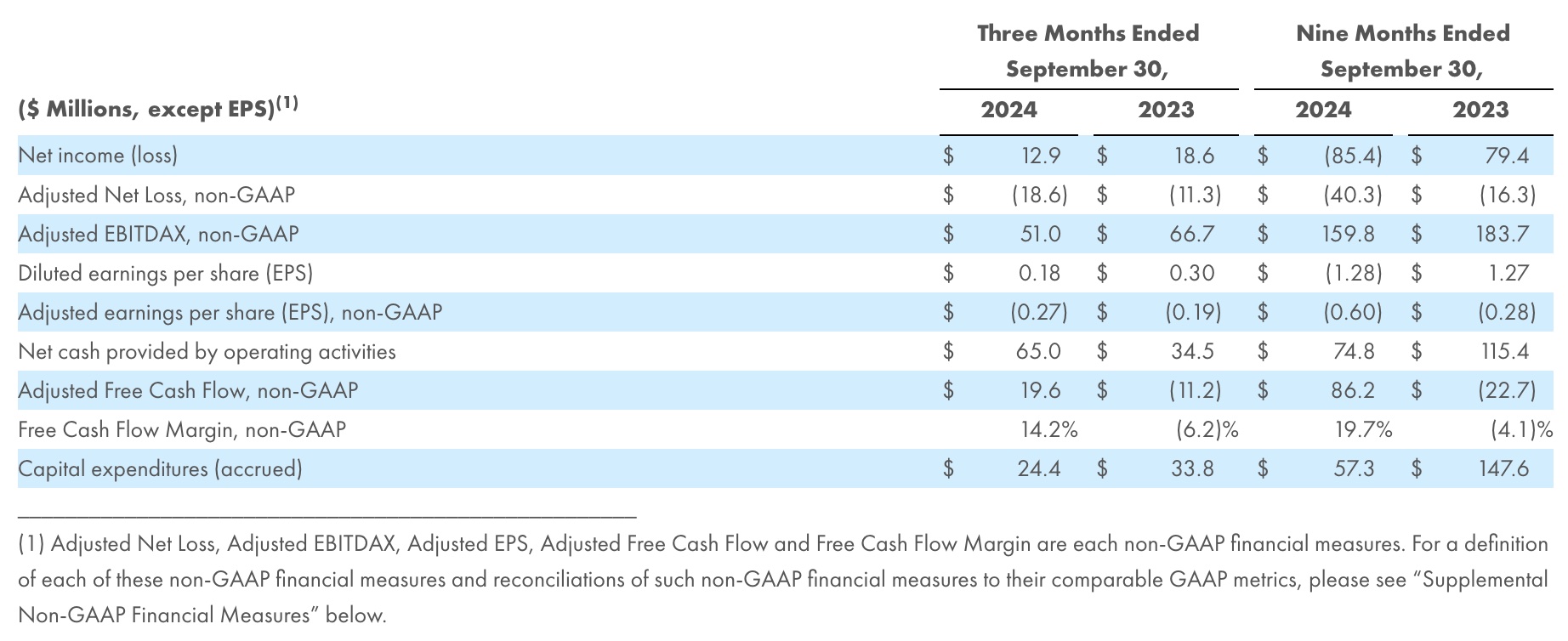

Analysts said the third-quarter 2024 results were in line with expectations.

Evercore described it as a “prelude to the dream.”

The “3Q results [were] a good opening act for what’s likely an active 6 [months]-12 months here with a CCUS JV partnership announcement expected in early 2025, and a series of FID [final investment decision] announcements next year to help inform the ongoing value debate here,” analysts wrote in a Nov. 12 note.

Recommended Reading

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

Venture Global LNG Pares IPO Hopes by 15% to $2.2B

2025-01-22 - LNG exporter Venture Global nearly halved the price per share, while increasing the number of shares it expects to offer.

Utica Liftoff: Infinity Natural Resources’ Shares Jump 10% in IPO

2025-01-31 - Infinity Natural Resources CEO Zack Arnold told Hart Energy the newly IPO’ed company will stick with Ohio oil, Marcellus Shale gas.

Viper to Buy Diamondback Mineral, Royalty Interests in $4.45B Drop-Down

2025-01-30 - Working to reduce debt after a $26 billion acquisition of Endeavor Energy Resources, Diamondback will drop down $4.45 billion in mineral and royalty interests to its subsidiary Viper Energy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.