As service companies anticipate a Lower 48 slowdown in activity, analysts at Wood Mackenzie say efficiency gains, not price reductions, will drive down well costs and equipment demand.

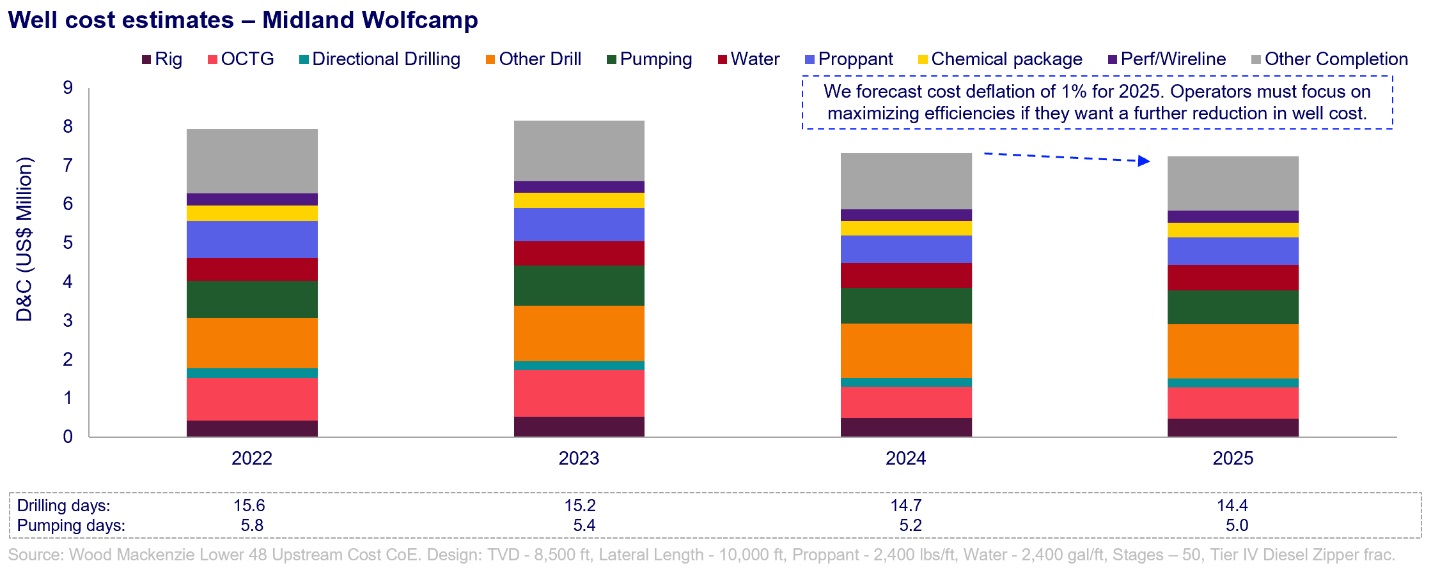

Well costs in the U.S. Lower 48 are projected to decline 10% in 2024 and by an additional 1% in 2025, according to new research by Wood Mackenzie.

Despite market factors, including slower E&P activity, the reduction in well costs will be a function of snowballing efficiencies rather than price cuts by oilfield service (OFS) companies.

“Both E&Ps and service providers are emphasizing significant efficiency improvements, albeit for different reasons,” said Nathan Nemeth, principal analyst for Wood Mackenzie. “More efficient operations are helping E&Ps drill and complete wells faster, cutting costs. At the same time, OFS firms are utilizing more efficient kit and workflows to sustain elevated prices.

“If E&Ps look to reduce costs more, it must come from additional efficiency improvements, as OFS pricing is unlikely to fall.”

The industry faces a complex landscape where the balance between efficiency and rising unit prices will heavily influence future cost trends.

During the current earnings season, several major service companies—including NOV, Halliburton, SLB, Liberty Energy, Helmerich & Payne (H&P) and Weatherford—have reported expectations of softer North American E&P activity in the second half of the year. The anticipated slowdown is largely driven by consolidation within the industry as well as production curtailments by gassy E&Ps, which could impact OFS firms’ profitability.

Scale matters

For E&Ps, however, OFS costs are expected to vary based on what each producer needs as well as the scale of its operations.

The largest producers with the scale to commit to one- to three-year contracts for equipment and technologies will unlock additional efficiency gains and keep costs lower, WoodMac said.

“Smaller producers will be most exposed to inflation headwinds—arguably motivating even more M&A,” Nemeth said.

The most in-demand equipment will be high-spec, efficient and enable lower emissions. Competition is high for super-spec rigs and high-efficiency equipment, insulating advanced rigs from price declines.

“Service rates are forecast to remain steady as the super-spec rig market remains tight and service providers have locked in … multi-year contracts for new electric pressure pumping equipment,” WoodMac said in its analysis.

AI, machine learning and downhole monitoring could unlock further upside for larger companies, while again representing a detriment to small-scale E&Ps unable to take advantage.

With strong financial positions, higher activity levels and high demand for efficient equipment, OFS companies are less likely to lower prices.

H&P reported resilience in its U.S. land operations despite a general industry slowdown. The company’s North America Solutions segment showed stable rig counts and improved margins during the quarter. H&P’s performance contrasts with the broader trend of declining rig counts. H&P has managed to maintain a relatively stable, active rig count, and the company’s focus on capital discipline and efficiency is seen as a positive factor for future industry outlook.

H&P is also expanding its international presence, evidenced by the arrival of its first super-spec flex rig in Saudi Arabia. This move is part of a broader strategy to adapt to a changing U.S. market and seek growth opportunities abroad. The company’s deal to supply Saudi Aramco with super-spec rigs highlights its commitment to expanding its operational footprint in key regions. H&P also said it is responding effectively to industry consolidation and increased operational efficiency through recent M&A.

Focus on efficiency

Future cost trends in oilfield services will be determined by the way efficiency improvements mix with gradually rising unit prices. While efficiency gains are expected to contribute to cost reductions, the overall impact on well costs will also depend on the broader pricing environment.

Efficiency improvements, rather than price cuts, are the primary drivers behind the reduction in well costs.

Operators are looking for step-change cost savings that are sustainable through market cycles. The deployment of “simul-frac” and “trimul-frac”, completing two or three wells at once, provides step-change savings. These techniques increase pumping hours per day, reducing spend on idle time and fuel. Fewer completion days save money on rentals and ancillary services.

The adoption of new electric pumping units has accelerated the trend of faster, cheaper and more reliable operations with fewer emissions, WoodMac said. “Electric units use smaller pads that require fewer crew members and less routine maintenance. Cheaper fuel for natural gas and electricity replaces high diesel costs, and mobilisation and non-productive time on location are minimised.”

Operators that have adopted electric frac spreads and simul-frac have already released significant cost savings. Choices on completion technique and equipment type result in a cost range of $100 per lateral foot.

Other factors include “declining input pricing for oil country tubular goods (OCTG), proppant and diesel, combined with substantial drilling and completion efficiency gains are pushing costs lower,” Nemeth said.

Liberty credited innovation within its supply chain to innovate and drive efficiencies in procurement, construction and “delivery of essential materials for frac operations” for a bolstering second-quarter performance. Liberty additionally deployed its AI software platform, Sentinel, across all U.S. basins, helping lower customer costs, the company said in its July 17 earnings release.

Despite this, rig and pressure pumping rates have remained relatively stable due to sustained demand for advanced, high-performance equipment.

Electric units require less maintenance and use cheaper natural gas and electricity instead of high-cost diesel, contributing to lower operational costs.

The frac industry has recently experienced a slowdown in activity, attributed to reduced drilling in both oil and gas basins during the first half of 2024. Liberty Energy CEO Chris Wright anticipates that North American completion activity will be somewhat softer in the latter half of 2024 due to budget front-loading by some operators.

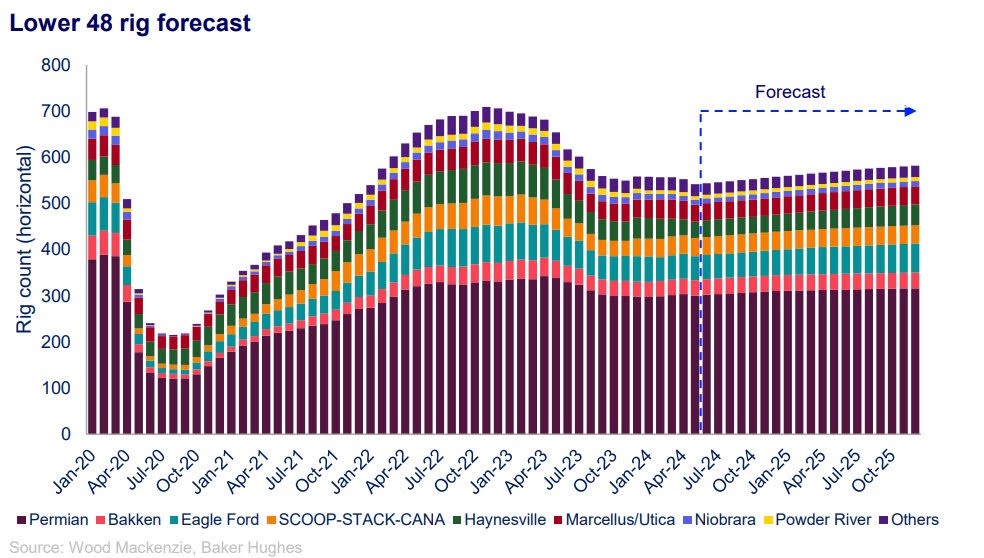

Rig counts are anticipated to gradually increase through 2025, though they will remain below the levels seen in late 2022. The forecast includes a modest increase of 40 rigs by the end of 2025, driven by gas plays and the Permian Basin.

Halliburton Chairman, President and CEO Jeff Miller said during the company’s July 19 earnings call that rig counts and overall service activity in North America declined through the second quarter. That will extend into the second half of the year, “near the low point of activity in this cycle,” he said.

However, faster drilling operations and improved efficiencies will reduce the need for additional rigs, WoodMac reported. Service providers are expected to maintain high utilization rates to support prices and margins, with service rates remaining steady due to the tight market for super-spec rigs and long-term contracts for new electric pressure pumping equipment.

Despite the deflation, well costs aren’t expected to return to levels seen in 2020 and 2021.

“Continued cost reduction must come from additional efficiency improvements as service companies pricing is unlikely to fall significantly,” Nemeth said.

The question is whether efficiency gains enough to offset price inflation, he added.

With Lower 48 activity relatively flat, service providers will look to keep utilization rates high to preserve prices and margins. Service rates are forecast to remain steady as the super-spec rig market remains tight and service providers have locked in multi-year contracts for new e-frac equipment.

While a modest decrease in completions activity and cost pressures are expected, companies like Liberty and H&P are focusing on efficiency and strategic expansion to maintain performance and adapt to evolving market conditions.

With E&Ps sticking to strict capital discipline, the operating environment is steadier but creates slower growth, H&P President and CEO John Lindsay said on the company’s July 25 earnings call.

“We believe that prioritizing return on invested capital will bring about a more positive outlook for the industry over time,” he said.

Recommended Reading

What's Affecting Oil Prices This Week? (March 3, 2025)

2025-03-03 - For the upcoming week, Stratas Advisors expects oil prices to continue bouncing around but overall trend upward.

What's Affecting Oil Prices This Week? (March 17, 2025)

2025-03-17 - The price of Brent crude could get a boost from Trump’s threats of sanctions on Russia, Iran and Venezuela, but it is doubtful it will break $72/bbl, Stratas Advisors says.

What's Affecting Oil Prices This Week? (Jan. 27, 2025)

2025-01-27 - For the upcoming week, Stratas Advisors predict that the price of Brent crude will threaten $75.

What's Affecting Oil Prices This Week? (Feb. 10, 2025)

2025-02-10 - President Trump calls for members of OPEC+ and U.S. shale producers to supply more oil to push down oil prices to the neighborhood of $45/bbl.

What's Affecting Oil Prices This Week? (March 24, 2025)

2025-03-24 - Oil demand will be picking up as we move into warmer months for the northern hemisphere. For the upcoming week, Stratas Advisors think the price of Brent crude will move higher and will test $73.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.