National oil companies (NOCs) are poised for a resurgence of international M&A, according to Wood Mackenzie research. (Source: Shutterstock.com)

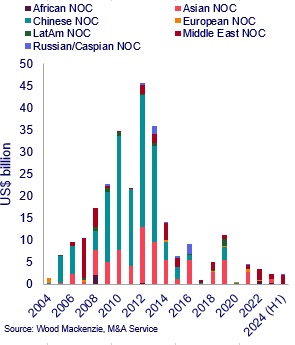

National oil companies (NOCs) used to account for nearly half of global M&A spending. Today, they make up less than 5% of the international M&A market.

But with international M&A valuations attractive and financial ratings for NOCs at all-time highs, the potential for NOCs to fill gaps in their portfolios has never been stronger, according to researchers at Wood Mackenzie.

“NOCs were once big spenders in international business development, but M&A spend has slumped in recent years,” said Neivan Boroujerdi, Wood Mackenzie’s director of corporate research.

International M&A spend from NOCs was coming in at over $30 billion per year from 2009 through 2013. But that has dwindled to less than $5 billion per year from 2019 through 2023.

International oil companies (IOCs) have made up the bulk of the frenzied M&A market in recent years.

But NOCs—particularly from nations in the Middle East and Asia—could become bigger players in the M&A market as they search for diversification outside of their domestic reserves and shore up asset portfolios.

Energy demand by Asian nations is expected to increasingly outstrip local supply as populations grow, economies expand and power generation fuel sources switch from coal to natural gas.

By 2030, Wood Mackenzie forecasts an aggregate oil and gas supply shortfall of 13 Bboe per year across Asia, up from a 9 Bboe per year shortfall today.

“Despite successful efforts at growing domestic production, homegrown resources are becoming increasingly costly and in short supply,” Boroujerdi said.

RELATED

Japan’s Mitsui Deepens Texas Shale Gas Footprint Through M&A

Middle East

Middle East NOCs are particularly well-suited to outlast other producers, Boroujerdi said, but they’re not without weaknesses. Portfolios for Middle East NOCs are “overwhelmingly concentrated towards either domestic oil or gas—significantly more so than other NOC peer groups.”

Saudi Aramco and the UAE’s Abu Dhabi National Oil Co. (ADNOC) are each diving into international LNG exposure.

Last month, Aramco announced offtake agreements with two LNG developers with projects on the Texas Gulf Coast.

Aramco signed a 20-year LNG sale and purchase agreement from Train 4 of NextDecade’s Rio Grande LNG facility in Brownsville, Texas. The Saudi oil company also announced a 20-year offtake agreement from Sempra’s Port Arthur LNG Phase 2 expansion project, near the Texas-Louisiana border.

ADNOC announced two agreements related to Rio Grande LNG in May. The company acquired an 11.7% stake in Rio Grande LNG Phase 1 from Global Infrastructure Partners (GIP) and signed a 1.9-mtpa offtake agreement from the Phase 2 expansion.

QatarEnergy is also looking to grow through international exploration. In May, QatarEnergy signed a farm-in agreement with Exxon Mobil to acquire a 40% interest in two exploration blocks offshore Egypt.

The company also announced a final investment decision to develop the second phase of the Sépia field, located in the Santos Basin offshore Brazil.

RELATED

Recommended Reading

Halliburton Secures Drilling Contract from Petrobras Offshore Brazil

2025-01-30 - Halliburton Co. said the contract expands its drilling services footprint in the presalt and post-salt areas for both development and exploration wells.

SLB Launches Electric Well Control Tech to Replace Hydraulics

2025-03-04 - SLB says the new systems reduce costs and provide real-time data for operators.

Halliburton, Sekal Partner on World’s First Automated On-Bottom Drilling System

2025-02-26 - Halliburton Co. and Sekal AS delivered the well for Equinor on the Norwegian Continental Shelf.

E&P Highlights: March 3, 2025

2025-03-03 - Here’s a roundup of the latest E&P headlines, from planned Kolibri wells in Oklahoma to a discovery in the Barents Sea.

Inside Prairie’s 11-Well Program in the D-J

2025-04-08 - Prairie Operating Co.’s 11-well program in the Denver-Julesburg Basin is drilling horizontal 2-milers with a Precision Drilling rig.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.