Gas Processing Management Inc. and energy-industry-focused performance improvement company HSB Solomon Associates LLC said Sept. 16 that they completed their comprehensive assessment of Alberta’s high-condensate Montney play’s potential to produce natural gas and NGL in the vicinity of the Wapiti River.

The assessment:

--Examined gas and NGL take-away infrastructure and optimization required for future production;

--Focused on new gas gathering and processing facilities where required; developed a logical case for infrastructure development, operation, and management;

--Forecast natural gas--raw gas and sales gas--and hydrocarbon liquids byproduct as part of a Western Canadian natural gas demand and supply model;

--Examined larger gas processing facilities in the area that have the capacity to handle the forecast growth; and

--Incorporated a full geological look at the production potential from the entire Montney play and all other plays in the Wapiti area.

The assessment also considered the area’s natural /NGL gathering and processing infrastructure and takeaway pipelines.

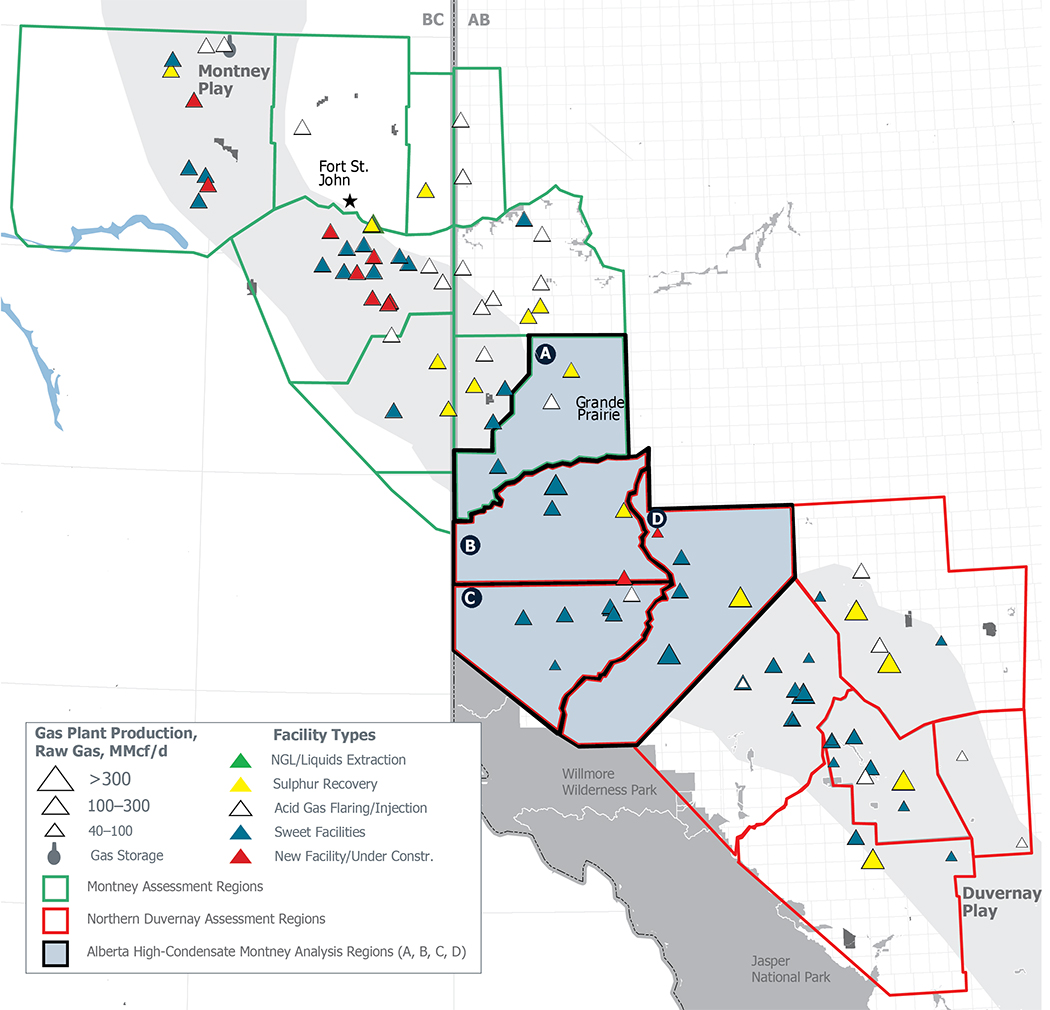

The Alberta Montney play has been analyzed as part of the larger geographic assessments completed by Solomon and GPMi —the 2015 Montney Growth Resource & Infrastructure Assessment and the 2016 Northern Duvernay & Tight Gas Growth Resource & Infrastructure Assessment.

These assessments examined key growth areas of the Cretaceous, Montney, and Duvernay plays in Alberta and British Columbia from northwest of Fort St. John to west of the town of Drayton Valley.

Recommended Reading

Elliott Nominates 7 Directors for Phillips 66 Board in Big Push for Restructuring

2025-03-04 - Elliott Investment Management, which has taken a $2.5 billion stake in Phillips 66, said the nominated directors will bolster accountability and improve oversight of Phillips’ management initiatives.

Shell Shakes Up Leadership with Upstream and Gas Director to Exit

2025-03-04 - Zoë Yujnovich, Shell’s Integrated Gas and Upstream director, will step down effective March 31.

Occidental Temporarily Reduces Warrants Price to Raise $1.6B

2025-03-03 - Occidental Petroleum’s offer to warrant-holders at a reduced exercise price of $21.30 would raise $1.6 billion, the company said.

Dividends Declared Week of Feb. 24

2025-03-02 - As 2024 year-end earnings wrap up, here is a compilation of dividends declared from select upstream and midstream companies.

Q&A: Patterson’s OFS Perspective on the Shale Boom, Pandemic and Current Upswing

2025-02-27 - Former Basic Energy Services CEO Roe Patterson details his perspective on the shale boom and the lessons learned to get back to the current upswing in the industry.