Chesapeake Energy Corp. (NYSE: CHK) said on Nov. 3 it received a request from the U.S. Securities and Exchange Commission (SEC), seeking information on its accounting methodology for the acquisition and classification of oil and natural gas properties.

The second largest U.S. natural gas producer has also received a subpoena from the Department of Justice (DOJ) related to the same issue, the company said in September.

A class action lawsuit was filed in a U.S. District Court on Oct. 4 against Chesapeake, alleging violations of securities laws for "purported misstatements" in its public filings, the company said in a regulatory filing on Nov. 3.

Chesapeake said it had engaged in discussions with the DOJ and the SEC.

The company said in May it received subpoenas and demands for documents from the DoJ and some state government agencies in connection with investigations into possible violations of antitrust laws relating to the purchase and lease of oil and natural gas rights.

Chesapeake had come under scrutiny when former CEO Aubrey McClendon, who helped transform the U.S. energy industry with shale gas, was charged in March with conspiring to rig bids to buy oil and natural gas leases in Oklahoma.

McClendon died a day later, when his car slammed into an overpass.

Reuters reported in 2012 that McClendon had taken out more than $1 billion in loans using his personal stakes in thousands of company wells as collateral.

The U.S. natural gas producer reported a surprise adjusted profit on Nov. 3, helped by lower expenses, and said it expects to exit the next two years at higher production rates.

ExxonMobil Corp. (NYSE: XOM) is also being probed by the SEC and New York Attorney General Eric Schneiderman on how the company has valued its oil reserves in the wake of low prices and potential curbs on carbon emissions.

RELATED: New York Reportedly Investigating ExxonMobil's Accounting Practices

Recommended Reading

Norway's Massive Johan Sverdrup Oilfield Shut by Power Outage

2024-11-18 - Norway's Equinor has halted output from its Johan Sverdrup oilfield, western Europe's largest, due to an onshore power outage, the company said on Nov. 18.

US Oil, Gas Rig Count Unchanged this Week

2024-11-01 - The oil and gas rig count held at 585 to Nov. 1. Baker Hughes said that puts the total rig count down 33 rigs, or 5% below this time last year.

Utica’s Encino Boasts Four Pillars to Claim Top Appalachian Oil Producer

2024-11-08 - Encino’s aggressive expansion in the Utica shale has not only reshaped its business, but also set new benchmarks for operational excellence in the sector.

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

2024-10-04 - Recently unconstrained by new rail capacity, operators are now putting laterals into the oily, western side of this long-producing basin that comes with little associated gas and little water, making it compete with the Permian Basin.

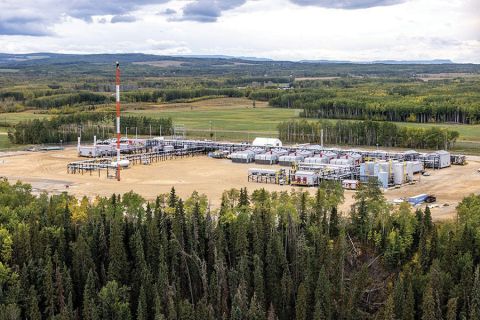

With Montney Production Set to Grow, US E&Ps Seize Opportunities

2024-10-02 - Canada’s Montney Shale play has already attracted U.S. companies Ovintiv, Murphy and ConocoPhillips while others, including private equity firms, continue to weigh their options.