Norwegian oil and gas firm Equinor ASA and German utility RWE have joined an initial phase of a Dutch project led by Royal Dutch Shell Plc to produce "green" hydrogen by using offshore wind power.

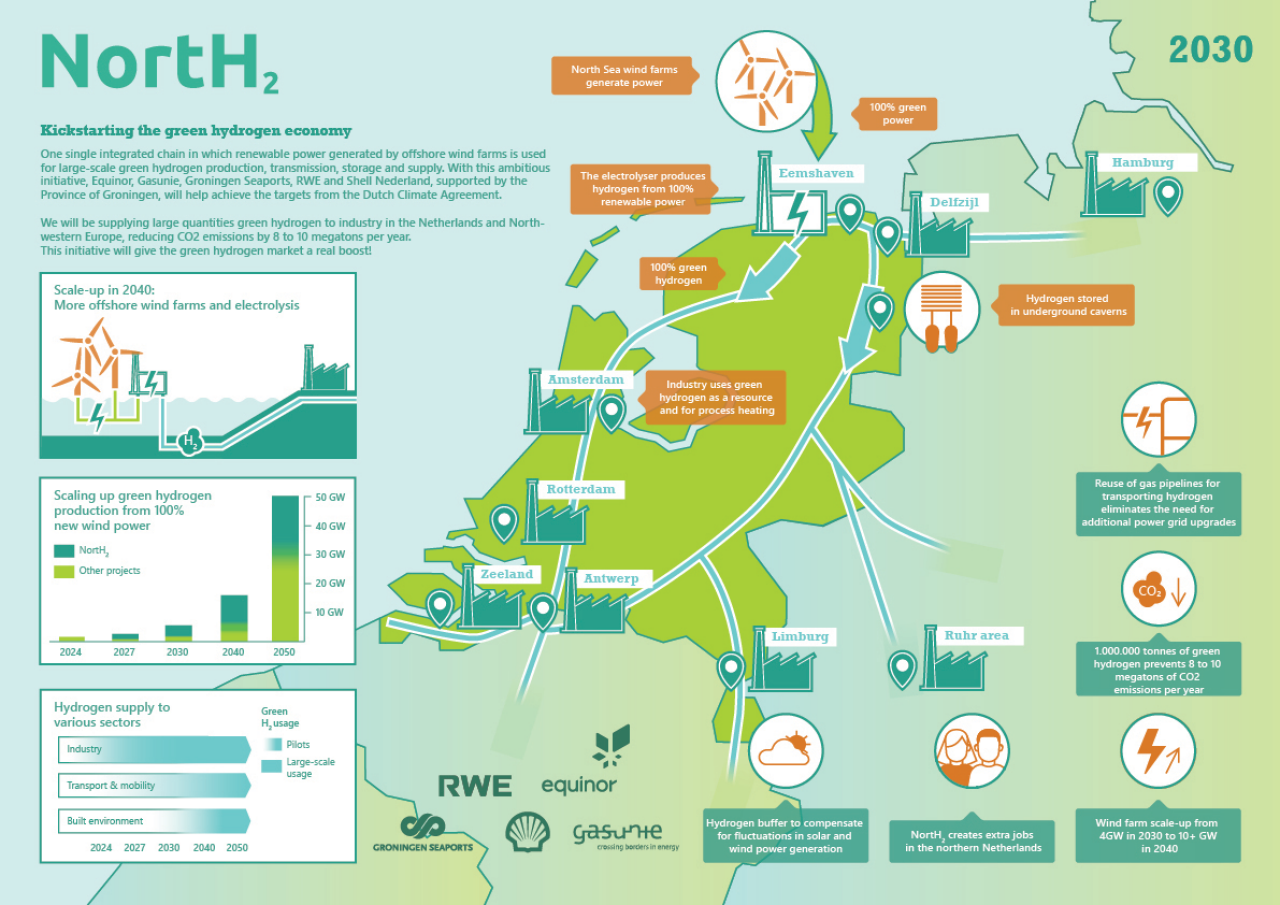

The NorthH2 project, launched in February by Dutch Gasunie, Groningen Seaports and Shell, will use electricity to produce hydrogen from water avoiding CO₂ emissions associated with hydrogen's production from fossil fuels.

The partners plan to build 4-gigawatt (GW) electrolysis capacity by 2030, scaling it up to more than 10 GW by 2040, which would allow for the production of 0.4 million and 1 million tonnes of hydrogen respectively.

Hydrogen is now mostly produced from fossil fuels, mainly natural gas, a carbon-emitting process, as electrolysis is too expensive due to the amount of power needed.

Electrolysis can be a carbon-free process if the power used is generated from renewables.

"We are entering the [project] consortium at a feasibility stage, with the option of further joining the project into development, together with RWE," Equinor's spokesman said in an email to Reuters.

The feasibility stage running until July 2021 will assess the business case and costs, as well as seek to engage with potential customers and policymakers, he added.

The Norwegian oil and gas firm aims to become a "broad energy" company increasing share of non-fossil energy and achieving net-zero CO₂ emissions by 2050.

German utility RWE said it would contribute its know-how on green hydrogen production and access to gas storage to store hydrogen, while supplying the fuel to industrial customers.

Hydrogen is seen as an energy source which could partly replace natural gas in the future, helping to cut emissions. The European Union aims to have 40 GW of electrolysis capacity installed by 2030.

The NorthH2 project could contribute to avoiding about 8-10 million tonnes of CO₂ emissions per year, Gasunie has said.

Recommended Reading

Colonial Shuts Pipeline Due to Potential Gasoline Leak

2025-01-14 - Colonial Pipeline, the largest refined products pipeline operator in the United States, said on Jan. 14 it was responding to a report of a potential gasoline leak in Paulding County, Georgia and that one of its mainlines was temporarily shut down.

Colonial’s Line 1 Gasoline Service Restored, Company Says

2025-01-20 - Colonial Pipeline Co. stopped flows on the gasoline transport line following reports of a leak in Georgia.

MPLX Acquires Remaining Interest in BANGL for $715MM

2025-02-28 - MPLX LP has agreed to acquire the remaining 55% interest in BANGL LLC for $715 million from WhiteWater and Diamondback.

Kinder Morgan Acquires Bakken NatGas G&P in $640MM Deal

2025-01-13 - The $640 million deal increases Kinder Morgan subsidiary Hiland Partners Holdings’ market access to North Dakota supply.

Tallgrass, Bridger Call Open Season on Pony Express

2025-02-14 - Tallgrass and Bridger’s Pony Express 30-day open season is for existing capacity on the line out of the Williston Basin.