Equinor and partners Lundin and Spirit Energy have made a discovery believed to contain up to an estimated 35 million barrels (MMbbl) of recoverable oil equivalent, according to a news release.

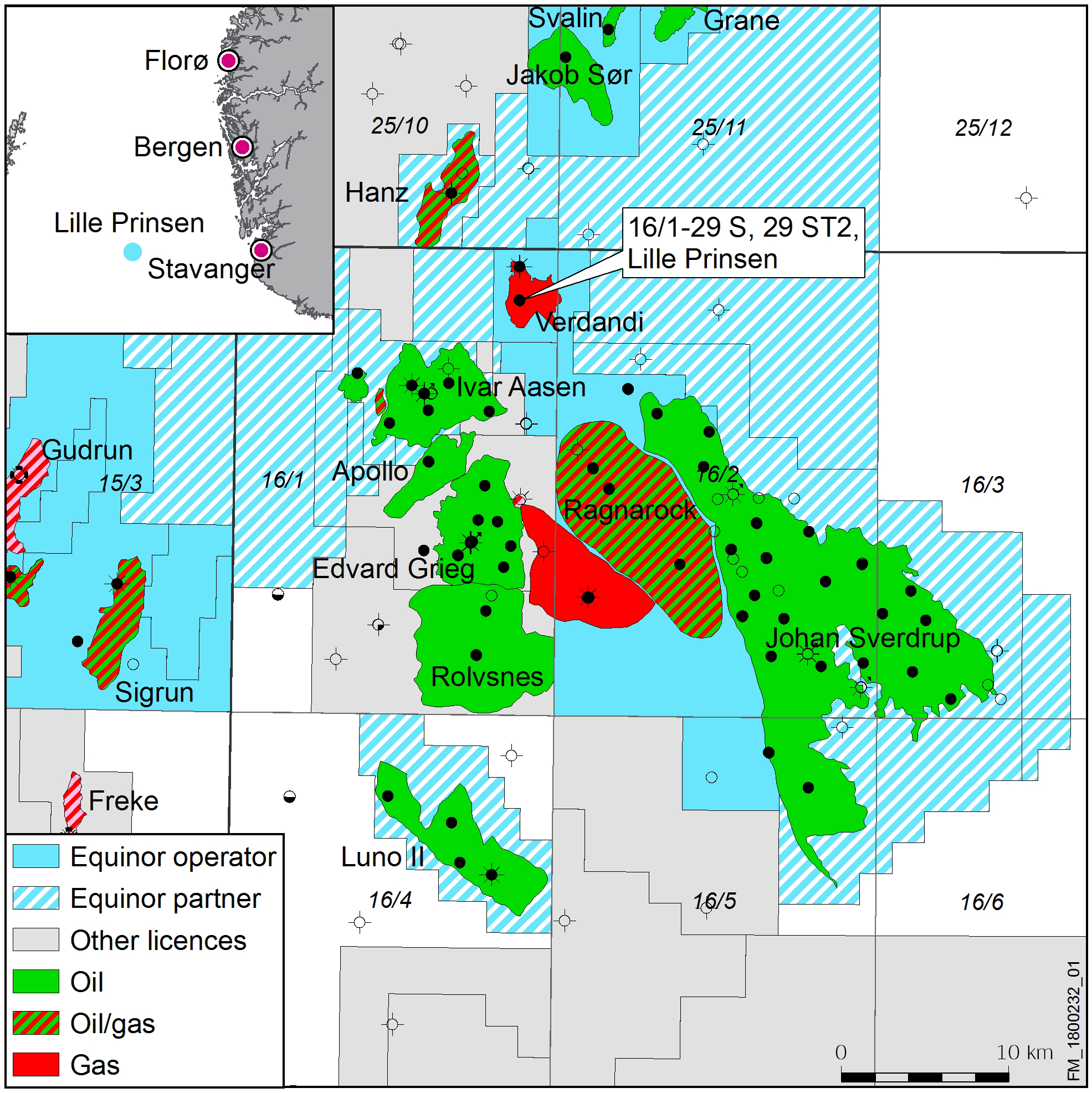

The discovery was made in the PL 167 license at the Utsira High in the North Sea, Equinor said in the news release.

“This is a good discovery which we expect will be commercial. In addition, the results from the drilling indicate an upside potential in this discovery,” said Nicholas Ashton, Equinor’s senior vice president, Exploration, Norway & UK.

Located northwest of the Johan Sverdrup Field, the Lille Prinsen well’s main target is estimated to contain between 15 MMbbl and 35 MMbbl of recoverable oil.

Plus, there is upside as Equinor also said one more discovery with good reservoir quality was made over the main discovery. The volume has not been evaluated yet, the company added.

Equinor said the Lille Prinsen well also appraised the 2004 gas discovery Verdandi, which maintained the estimate of 4 to 11 million recoverable oil equivalent. But more work is needed to determine whether these two shallower reservoirs can be commercially developed.

“This discovery has good quality and adds new volumes in an important area of the North Sea. We also see a substantial upside in the license that we now aim to clarify as soon as possible together with our partners,” Ashton said.

Recommended Reading

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Oil, Gas and M&A: Banks ‘Hungry’ to Put Capital to Work

2025-01-29 - U.S. energy bankers see capital, generalist investors and even an appetite for IPOs returning to the upstream space.

Buying Time: Continuation Funds Easing Private Equity Exits

2025-01-31 - An emerging option to extend portfolio company deadlines is gaining momentum, eclipsing go-public strategies or M&A.

The Private Equity Puzzle: Rebuilding Portfolios After M&A Craze

2025-01-28 - In the Haynesville, Delaware and Utica, Post Oak Energy Capital is supporting companies determined to make a profitable footprint.

E&P Consolidation Ripples Through Energy Finance Providers

2024-11-29 - Panel: The pool of financial companies catering to oil and gas companies has shrunk along with the number of E&Ps.