When Equitrans Midstream started construction in February 2018, it estimated Mountain Valley would cost about $3.5 billion and be completed by the end of 2018. (Source: Equitrans Midstream Corp.)

Equitrans Midstream Corp. said on Nov. 3 it pushed back the expected completion of its long-delayed Mountain Valley natural gas pipe from West Virginia to Virginia to the second half of 2021 and boosted the project cost to $5.8 billion to $6.0 billion.

Previously, the company targeted an early 2021 full in-service date and a cost of around $5.4 billion to $5.7 billion.

When Equitrans started construction in February 2018, it estimated Mountain Valley would cost about $3.5 billion and be completed by the end of 2018.

Mountain Valley is one of several U.S. oil and gas pipelines delayed by regulatory and legal fights with environmental and local groups that found problems with federal permits issued by the Trump administration.

Equitrans said the latest change was due to “unanticipated delays during the prime 2020 construction season resulting from the current inability to complete certain construction work.”

Those delays included a U.S. Fourth Circuit Court of Appeals decision in October to issue a temporary administrative stay of the project’s Nationwide Permit 12, which prevents waterbody crossings under the U.S. Army Corps of Engineers' permit program.

The company also said the U.S. Federal Energy Regulatory Commission's stop work order covering about 25 miles (40 kilometers) of the project, and a challenge to the its Biological Opinion, which allows construction in areas inhabited by endangered and threatened species, held up progress.

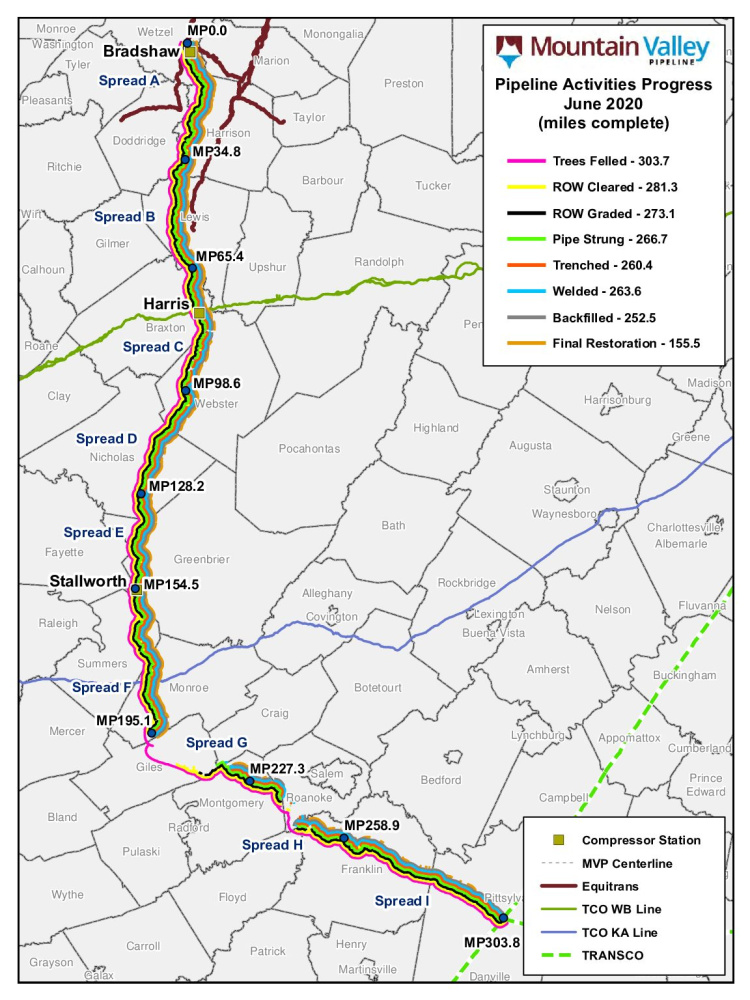

The 303-mile (487.6 km) pipeline was designed to deliver 2 billion cubic feet per day of gas from the Marcellus and Utica shale in Pennsylvania, Ohio and West Virginia to consumers in the Mid Atlantic and Southeast. One billion cubic feet is enough to supply about 5 million U.S. homes for a day.

Mountain Valley is owned by units of Equitrans, NextEra Energy Inc, Consolidated Edison Inc, AltaGas Ltd and RGC Resources Inc.

Equitrans shares fell 4% earlier on Nov. 4 to their lowest level since May.

Recommended Reading

PE Firm Hy24 Commits $50MM to StormFisher Hydrogen

2025-02-11 - The funding, made via Hy24’s Clean Hydrogen Infrastructure Fund, will go toward StormFisher Hydrogen’s efforts to produce clean fuel in North America.

DOE Awards Two More Hydrogen Hubs Initial Funding

2025-01-22 - The awards were announced days before President Donald Trump directed federal agencies to pause disbursement of funds appropriated through the Infrastructure Investment and Jobs Act.

Baker Hughes CEO: Expect ‘Volatility, Noise’ Around Energy Transition

2025-03-12 - Baker Hughes and Linde executives spoke about lower carbon resources such as hydrogen and geothermal, which will be part of the energy mix but unlikely to displace natural gas.

Treasury’s New Hydrogen Tax Credit Regs Open Door to NatGas Producers

2025-01-05 - The U.S. Treasury Department’s long awaited 45V hydrogen tax credit will enable “pathways for hydrogen produced using both electricity and methane” as well as nuclear, the department said Jan. 3.

Plug Power CEO Sees Hydrogen as Part of US Energy Dominance

2025-01-29 - Plug Power CEO Andy Marsh says the U.S., with renewable energy resources, should be the world’s leading exporter of hydrogen as it competes globally, including with China.