Faroe Petroleum has struck a deal to swap Norwegian oil and gas assets with Equinor ASA (NYSE: EQNR), in a move that could raise the price that hostile bidder DNO ASA has to pay to secure the British energy company.

While Faroe Petroleum's CEO Stewart said the deal had been in the works before Norway's DNO launched its 608 million pound (US$778 million) offer last month and was not intended to stop the bid, analysts said it would make Faroe a more attractive takeover target.

"The deal hasn't happened overnight. We haven't pulled it as a rabbit out of the hat as a defense strategy even if it looks like [it]," Stewart told Reuters.

He said the company had held discussions about the swap with Equinor for "months," and most intensely during last summer.

RELATED: DNO Launches Hostile Bid For Faroe Petroleum Worth $780 Million

Faroe rejected DNO's 152 pence per share bid on Nov. 26, saying it significantly undervalued the Aberdeen-based firm.

Faroe's CEO declined to discuss what price level could be acceptable to its shareholders but said that the latest swap deal has made the company more valuable.

"We want to secure the best value for our shareholders, and the latest deal cannot be ignored," he added.

DNO, which already owns 28% of Faroe, raised questions over the deal, however, arguing it switched future growth potential for short-term cash flow from fields with declining output.

"While Faroe has asserted this is not designed to stop the DNO offer, we need to ask if this is good value for a company seeking growth... That is the test this deal needs to satisfy," the Oslo-listed firm said in a statement.

Faroe said the swap would significantly reduce the need for capital investments as the company's stake in $1.9 billion Njord re-development project would fall to zero from 7.5%, while it would add 7,000-8,000 barrels of oil equivalent per day (boe/d) for Faroe in 2019.

Its overall output is expected to rise to 18,000–22,000 boe/d in 2019, making the company more confident in its ability to boost production to more than 50,000 boe/d in the medium term, Stewart said.

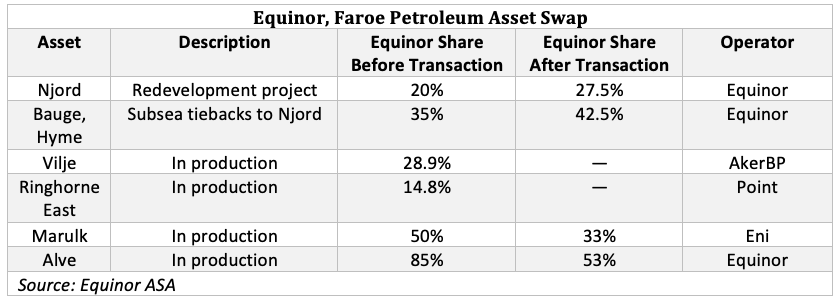

As a result of the swap, Faroe will get Equinor's stakes in the Vilje and Ringhorne East fields, while Equinor gets Faroe's stakes in Bauge and Hyme, an oilfield connected to Njord.

In addition, Faroe will get part of Equinor's stakes in the Marulk and Alve fields.

The companies did not give a value for the assets involved, but RBC Capital estimated that at an oil price of $70 per barrel the overall deal is worth about $140 million.

Sparebank 1 Markets analyst Teodor Sveen-Nilsen said that, at first glance, the deal looked better for Faroe than Equinor, and will make Faroe a more attractive acquisition target.

"We believe 170-180 pence per share will be the final transaction price in the DNO/Faroe drama," Sveen-Nilsen said. "Maybe a tad higher after today's announcement."

Faroe shares were down 1.1% at around 7:35 a.m. CST (13:35 GMT), narrowly outperforming a European oil and gas index down 1.4%, weighed down by weaker crude prices.

Equinor shares were down 1.5% while DNO's were down 2%. (US$1 = 8.4978 Norwegian crowns) (US$1 = 0.7838 pounds)

Recommended Reading

Financiers: Family Offices Worldwide are Queuing to Invest in E&P

2024-10-11 - U.S. family offices have stepped in quickly to fill the void left by other investors while family desks abroad have been slow to move but they’re watching closely, financiers say.

The Karl Rove Oil Executive Poll Result: The Industry Is Not Happy

2024-10-03 - A show of no hands revealed more than 400 attendees at Hart Energy’s Energy Capital Conference are not happy with U.S. politics today—and have no confidence it will be better after Nov. 5.