The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Caddo Minerals Inc. retained EnergyNet as agent for Bluestem Royalty Partners LP for the sale of a Permian package in an auction closing Sept. 24.

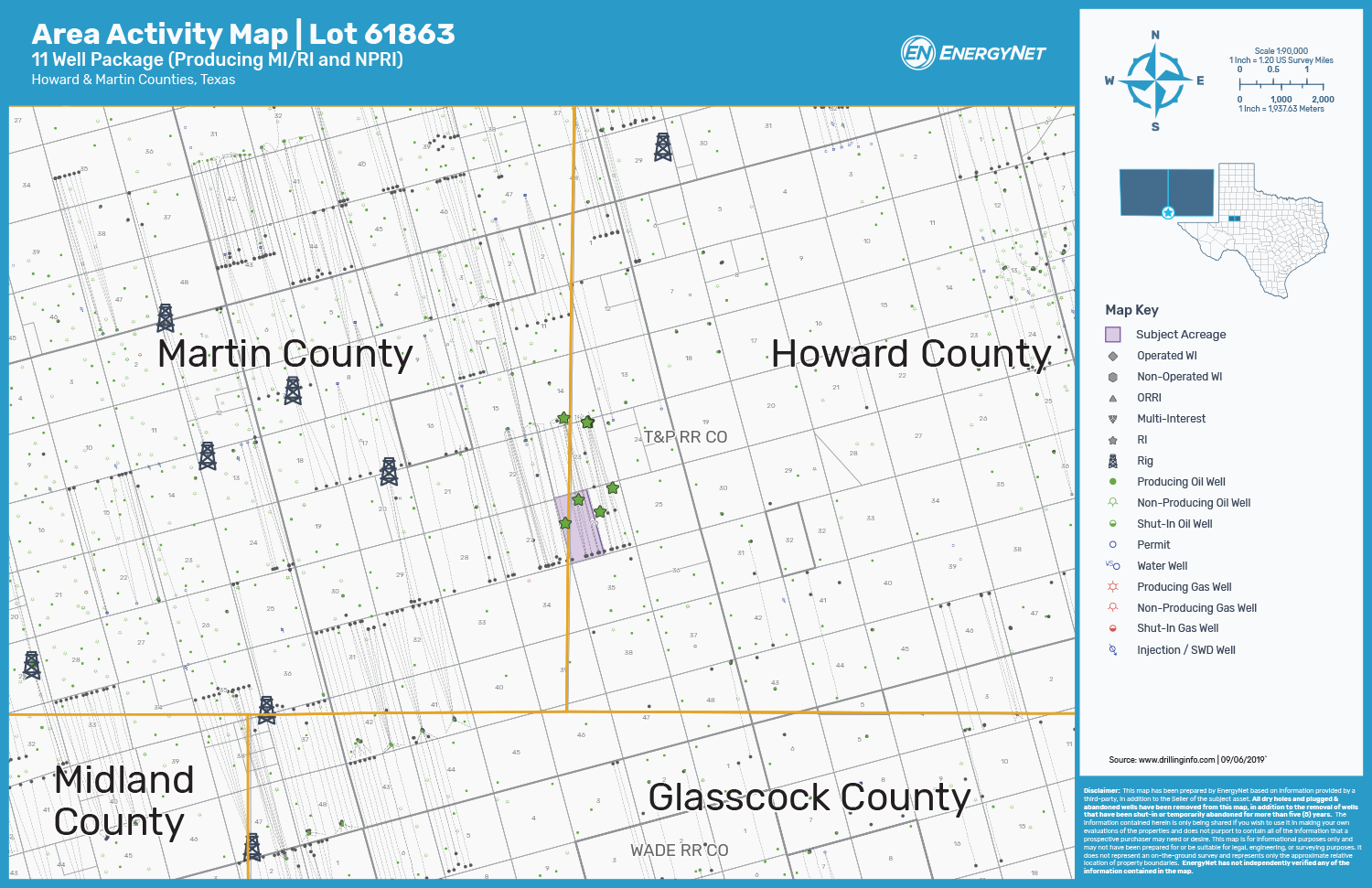

The offering comprises of mineral and royalty interests located in Howard and Martin counties, Texas.

Highlights:

- 0.270359% Royalty Interest and a 0.317173% Non-Producing Royalty Interest in the Producing Duke Unit

- 0.118194% Royalty Interest in the Producing Hamilton 26 Unit

- Six-Month Average 8/8ths Production: 2,272 barrels per day of Oil and 3.500 million cubic feet per day of Gas

- 10-Month Average Net Income: $30,554 per Month

- Operator: SM Energy Co.

Bids are due by 3:55 p.m. CDT Sept. 24. For complete due diligence information energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.