Titan Energy LLC, formerly Atlas Resource Partners LP, is offering coalbed methane (CBM) assets in a sale handled by Detring Energy Advisors.

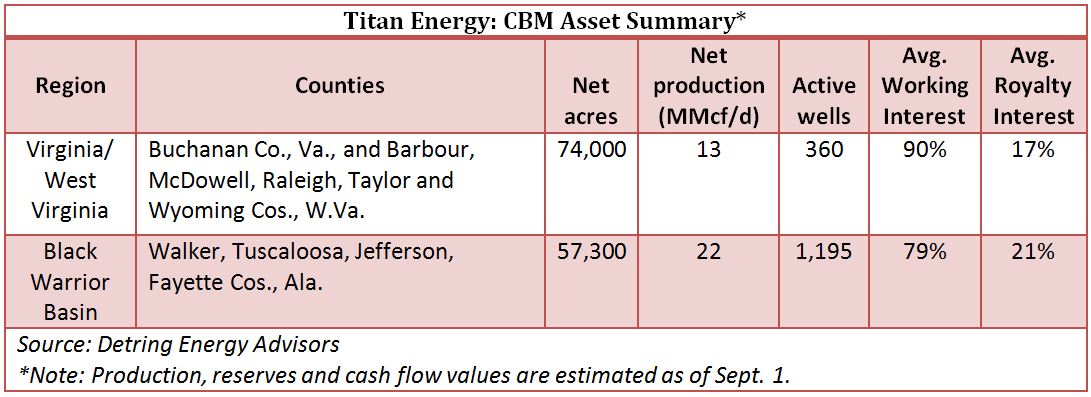

The offer includes CBM and related assets in Virginia, West Virginia and Alabama's Black Warrior Basin plus 131,300 net HBP acres.

Highlights:

- More than $20 million operated cash flow;

- 35 million cubic feet per day (MMcf/d) net production;

- 100% gas;

- 92% operated;

- About 10% annual decline;

- About 150 Bcf net proved developed producing reserves;

- 131,300 net acres (roughly 100% HBP);

- 1,555 active wells (75% operated);

- Average 82% working interest and 20% royalty; and

- Inventory of about 175 high-return workover candidates, Detring said.

Bids are due Oct. 11. For information visit detring.com or contact Melinda Faust, director with Detring, at 713-907-2003.

Recommended Reading

TotalEnergies, Air Liquide Form Hydrogen Joint Venture

2025-02-18 - TotalEnergies says it will work with Air Liquide on two projects in Europe, producing about 45,000 tons per year of green hydrogen.

Diamondback Acquires Permian’s Double Eagle IV for $4.1B

2025-02-18 - Diamondback Energy has agreed to acquire EnCap Investments-backed Double Eagle IV for approximately 6.9 million shares of Diamondback and $3 billion in cash.

Type One Energy, Private Equity Firm Partner to Advance Fusion Energy

2025-02-14 - The partnership between Pine Island New Energy Partners and Type One Energy focuses on identifying and evaluating fusion industry supplier chain companies to grow the sector.

Report: Diamondback in Talks to Buy Double Eagle IV for ~$5B

2025-02-14 - Diamondback Energy is reportedly in talks to potentially buy fellow Permian producer Double Eagle IV. A deal could be valued at over $5 billion.

Bloom Energy, Chart Industries Form CCUS Partnership for Low-Emissions NatGas

2025-02-14 - Bloom Energy and Chart Industries aim to use natural gas and fuel cells to generate power through their carbon capture partnership.