The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

An affiliate of Chaparral Energy Inc. retained EnergyNet for the sale of a northern Anadarko Basin opportunity through a sealed-bid offering closing Oct. 4.

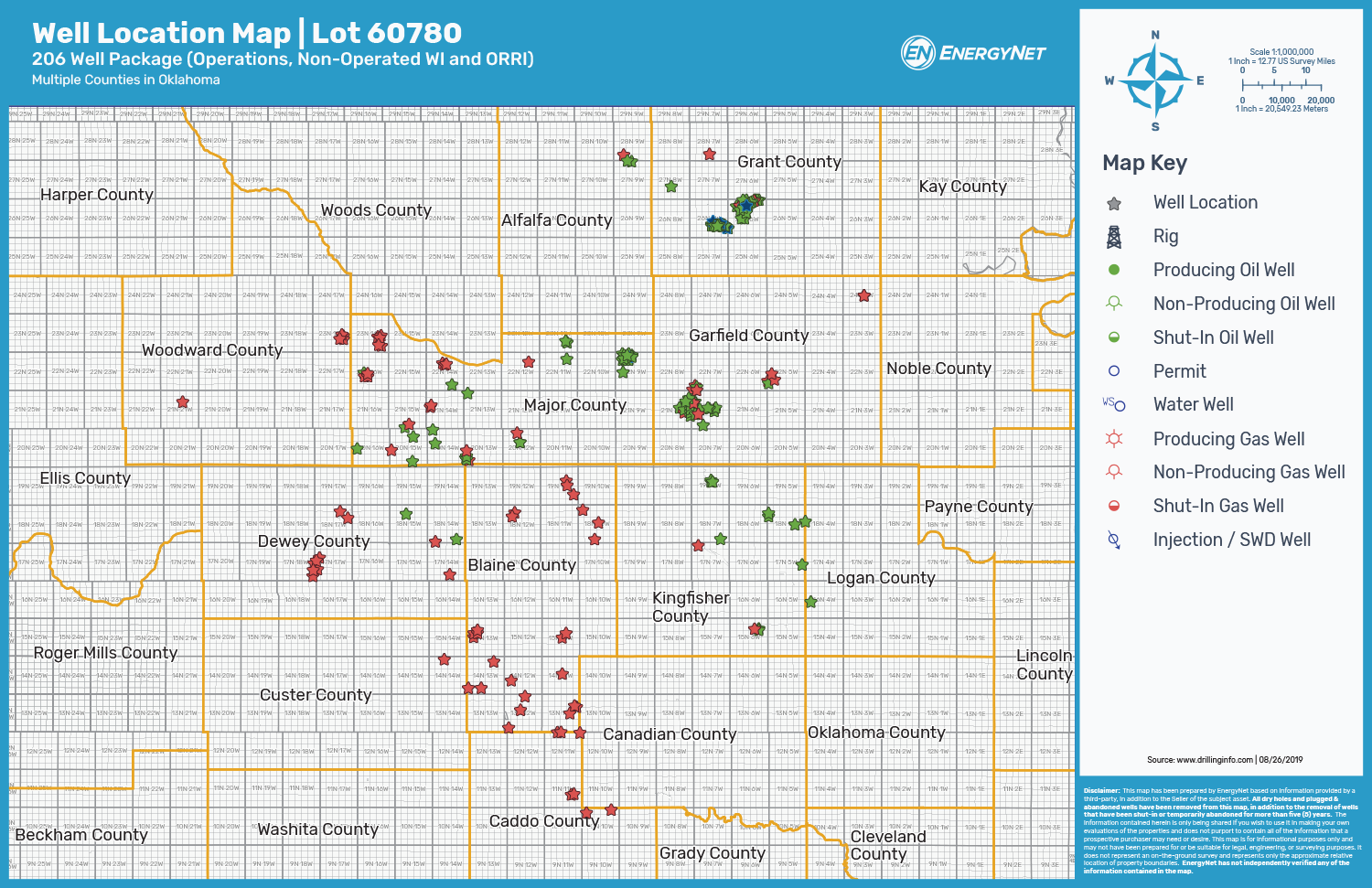

The offering includes operations, nonoperated working interest and overriding royalty interests (ORRI) in more than 200 wells located in multiple Oklahoma counties.

Highlights:

- Operated Working Interest in the Wellbores of 104 Wells:

- 100.00% to 13.125% Working Interest / 87.50% to 10.37712% Net Revenue Interest

- An Additional 6.72448% to 0.17266% ORRI in 35 Wells

- Three Wells Completed in Multiple Formations

- 38 Producing Wells | Eight Saltwater Disposal Wells | One Water Supply Well | 55 Non-Producing Wells | Two Plugged and Abandoned Wells

- Nonoperated Working Interest in the Wellbores of 95 Wells:

- 50.00% to 0.004313% Working Interest / 43.75% to 0.003623% Net Revenue Interest

- An Additional 4.04947% to 0.056372% ORRI in Eight Wells

- The Foster, L.A. #2-21 is Completed in Multiple Zones

- 58 Producing Wells | 33 Non-Producing Wells | Two Shut-In Wells | One Plugged and Abandoned Well | One Temporarily Abandoned Well

- Select Operators include Chesapeake Operating LLC, Devon Energy Production Co. LP, Riviera Operating LLC and Sandridge Exploration & Production LLC

- ORRI in the Wellbores of Seven Wells:

- 3.125% to 0.016382% ORRI

- Five Producing Wells | Two Non-Producing Wells

- Operators include BRG Petroleum LLC, Chesapeake Operating LLC, Cimarex Energy Co. and Riviera Operating LLC

- Six-Month Average 8/8ths Production: 24.406 million cubic feet per day of Gas and 537 barrels per day of Oil

- 10-Month Average Net Cash Flow: $54,495 per Month

Bids are due by 4 p.m. CDT Oct. 4. For complete due diligence information energynet.com or email Ethan House, vice president of business development, at Ethan.House@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Utica’s Infinity Natural Resources Seeks $1.2B Valuation with IPO

2025-01-21 - Appalachian Basin oil and gas producer Infinity Natural Resources plans to sell 13.25 million shares at a public purchase price between $18 and $21 per share—the latest in a flurry of energy-focused IPOs.

Murphy Shares Drop on 4Q Miss, but ’25 Plans Show Promise

2025-02-02 - Murphy Oil’s fourth-quarter 2024 output missed analysts’ expectations, but analysts see upside with a robust Eagle Ford Shale drilling program and the international E&P’s discovery offshore Vietnam.

CPP Wants to Invest Another $12.5B into Oil, Gas

2025-03-26 - The Canada Pension Plan’s CPP Investments is looking for more oil and gas stories—in addition to renewable and other energies.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Michael Hillebrand Appointed Chairman of IPAA

2025-01-28 - Oil and gas executive Michael Hillebrand has been appointed chairman of the Independent Petroleum Association of America’s board of directors for a two-year term.