The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

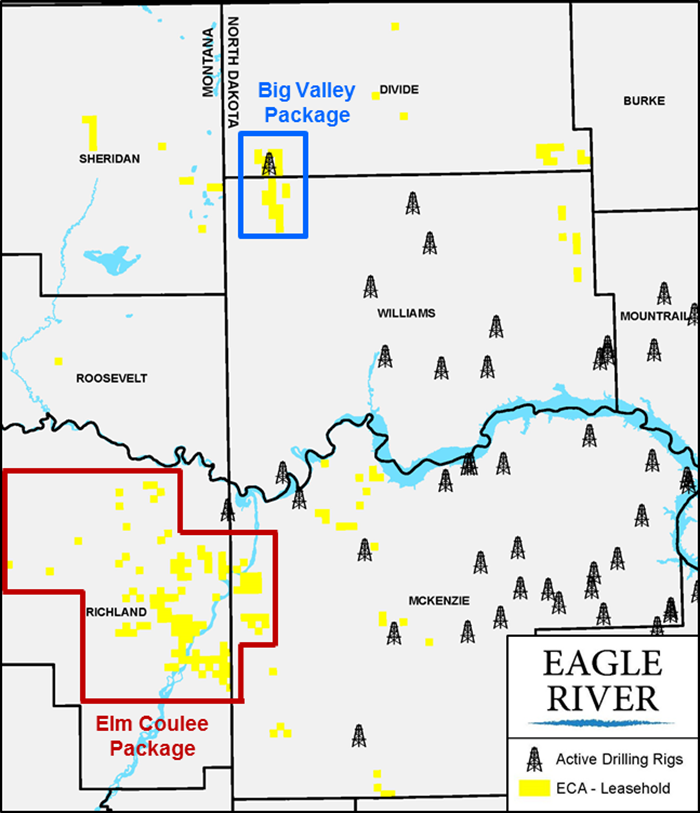

Eagle River Energy Advisors LLC has been exclusively retained by Encana Oil & Gas (USA) Inc. to divest certain operated and nonoperated working interest assets in the Williston Basin of Montana and North Dakota.

Highlights:

Elm Coulee Package

- About 35,900 gross (26,600 net) acres majority operated leasehold

- About 93 wells in the Bakken and conventional Reservoirs

- 401 barrels of oil equivalent per day (boe/d) net production / 84% Oil (July 2018 through December 2018 average)

- 82% of net production from Encana operated wells

- $4.6 million 2018 operating cash flow

- Kraken Oil & Gas LLC has delineated the Bakken offsetting acreage with economic well results with IP-30 rates as high as 1,110 boe/d

- White Rock Oil & Gas LLC has proven significant upside in recompletions from multiple Bakken wells offsetting acreage

Big Valley Package

- About 6,900 gross (6,700 net) acres majority operated leasehold

- About seven wells in the Middle Bakken and Three Forks

- 67 boe/d net production / 100% Oil (July 2018 through December 2018 average)

- 100% of net production from Encana operated wells

- $700,000 2018 operating cash flow

- Koda Resources Ltd. recently drilling within the Big Valley Package

- Kraken Oil & Gas has proven significant uplift in historical EURs by implementing modern completion designs East of acreage

OBO Leasehold Package

- About 15,700 gross (5,400 net) acres nonoperated leasehold

- Certain lands outside of Elm Coulee and Big Valley Packages

- About 100 wells in conventional and unconventional reservoirs

- 144 boe/d net production / 84% Oil (July 2018 through December 2018 average)

- $1.3 million 2018 operating cash flow

- Basin-leading operators including Continental Resources Inc., Whiting Petroleum Corp. and others

The transaction effective date will be July 1. Bids may be submitted for entire assets or by asset package, according to Eagle River.

Bids are due by 4 p.m. MT Oct. 9. The virtual data room will be available starting Sept. 9.

For information visit eagleriverholdingsllc.com or contact Brian Green, managing director of Eagle River, at BGreen@EagleRiverEA.com or 832-680-0110.

Recommended Reading

Predictions 2025: Downward Trend for Oil and Gas, Lots of Electricity

2025-01-07 - Prognostications abound for 2025, but no surprise: ample supplies are expected to keep fuel prices down and data centers will gobble up power.

Trump Ambiguous Whether Canadian-Mexico Tariffs to Include Oil

2025-01-31 - At a news conference, President Trump said that he would exclude oil from tariffs before backtracking to say that he “may or may not” impose duties on crude.

Bernstein Expects $5/Mcf Through 2026 in ‘Coming US Gas Super-Cycle’

2025-01-16 - Bernstein Research’s team expects U.S. gas demand will grow from some 120 Bcf/d currently to 150 Bcf/d into 2030 as new AI data centers and LNG export trains come online.

Analysts: Trump’s Policies Could Bring LNG ‘Golden Era’ or Glut

2024-11-27 - Rystad warns that too many new LNG facilities could spell a glut for export markets.

DOE Report on LNG Pause Climate to Arrive Before January

2024-12-08 - The White House said it implemented a permit pause on export facilities to allow time for an analysis of LNG climate impacts.