The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

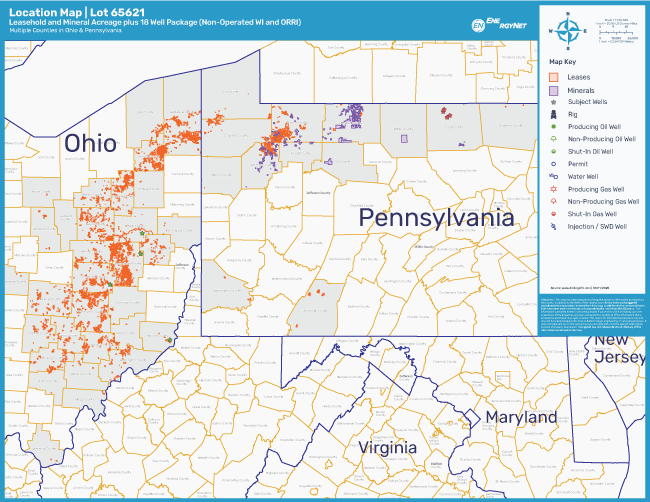

EnergyNet has been retained by EnerVest Energy Institutional Fund XII-WIB LP to offer for sale an Appalachia asset package located in various counties in Ohio and Pennsylvania through an auction closing June 17.

The offering comprises Marcellus and Utica shale leasehold and mineral acreage plus 18 wells including nonoperated working interest and overriding royalty interest (ORRI).

Highlights:

- Leasehold Acreage:

- 175.09 Net Marcellus Acres

- 2,060.00 Net Shallow Acres

- 4,071.27 Net Knox Acres

- 57,892.99 Net Utica Acres

- Mineral Acreage:

- 0.02 Net Shallow Acres

- 34,974.16 Net Utica Acres

- Non-Operated Working Interest in Three Wells:

- 3.1446% to 0.130689% Working Interest / 2.75195% to 0.114353% Net Revenue Interest

- An Additional ORRI in All Three Wells

- One Producing Well | Two Non-Producing Wells

- Operators: EAP Ohio LLC and Geopetro LLC

- ORRI in 15 Producing Wells:

- 0.566407% to 0.002898% ORRI

- Operators: Equinor USA Onshore Properties and SWEPI LP

- Six-Month Average Net Income: $6,374 per Month

- Six-Month Average 8/8ths Production: 92.389 MMcf/d of Gas and 3 bbl/d of Oil

- Further Subject to Documentary Stamp Fees

Bids are due by 1:30 p.m. CT June 17. For complete due diligence information visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.