The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Grizzly Energy LLC is offering for sale two packages of oil and gas assets in the Midcontinent region, according to EnergyNet, which has been retained as exclusive adviser to assist with the divestments.

Grizzly Energy is the new moniker of Vanguard Natural Resources. Following the completion of a financial restructuring in July, Vanguard emerged with the new name as well as a new focus on operating long-lived producing properties primarily in the Rockies, Permian Basin and Midcontinent regions.

The two packages comprise of sealed-bid opportunities in the Northern Scoop/Stack and Anadarko Southeast. Bids for the Northern Scoop/Stack package are due Oct. 24 and the Anadarko Southeast bids are due Oct. 31.

The Northern Scoop/Stack package includes assets in Northern Oklahoma across portions of Alfalfa, Blaine, Canadian, Dewey, Garfield, Garvin, Kingfisher, Logan, Major, McClain, Oklahoma, Woods and Woodward counties.

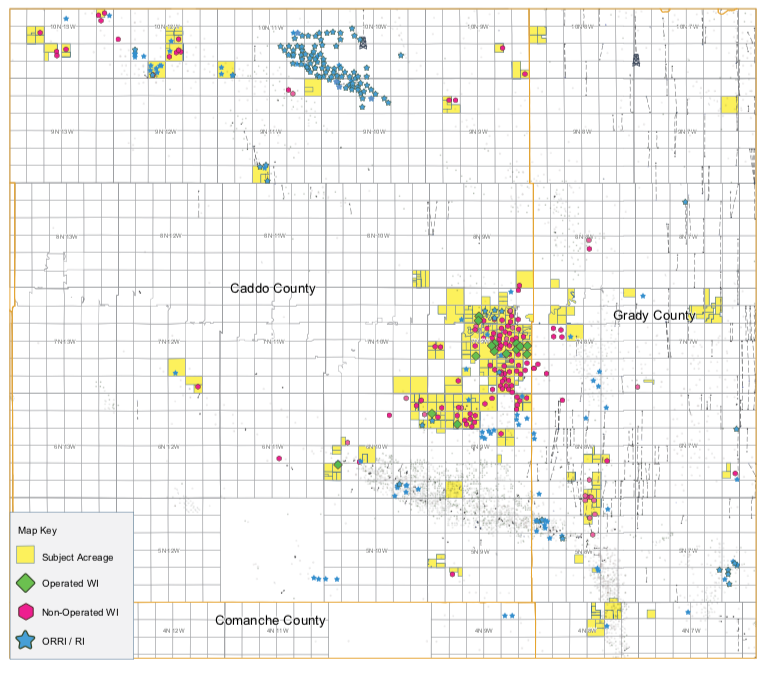

Meanwhile, the Anadarko Southeast package is comprised of 380 properties and includes operations, nonoperated working interest, royalty interest and overriding royalty interest (ORRI) plus leasehold acreage in Caddo, Comanche and Grady counties, Okla.

For complete due diligence information visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Grizzly Energy - Northern Scoop/Stack - Bids Due Oct. 24

Highlights:

- Operations in 53 Wells:

- 73.80% Average Working Interest / 57.68% Average Net Revenue Interest

- 20 Producing Wells | One Saltwater Disposal | 30 Non-Producing Wells | Two Shut-In Wells

- Net Revenue Interest on Some Wells Contain ORRI/Royalty Interest

- Nonoperated Working Interest in 218 Wells:

- 60.94238% to 0.0323% Working Interest / 43.75% to 0.02792% Net Revenue Interest (After Payout)

- 158 Producing Wells | Two Saltwater Disposals | 56 Non-Producing Wells | One Temporarily Abandoned Well | One Plugged and Abandoned Well

- Net Revenue Interest on Some Wells Contain ORRI/Royalty Interest

- Select Operators include Chesapeake Operating LLC, Mewbourne Oil Co. and White Star Petroleum II LLC

- Royalty or ORRI in 326 Properties (Multiple Wells):

- 7.748251% to 0.00011% Royalty Interest/ORRI

- 188 Producing Properties | 135 Non-Producing Properties | Three Plugged and Abandoned Properties

- Select Operators include BP America Production Co., Chesapeake Operating LLC and Sandridge Exploration & Production LLC

- 12-Month Average Net Income: $94,152 per Month

- Six-Month Average 8/8ths Production: 2,089 barrels per day (bbl/d) of Oil and 18.410 million cubic feet per day (MMcf/d) of Gas

- 6,168.617 Net Leasehold Acres

Bids are due by 4 p.m. Oct. 24.

Grizzly Energy - Anadarko Southeast - Oct. 31

Highlights:

- Operations in 15 Producing Wells:

- 98.980428% to 17.842843% Working Interest / 76.993825% to 14.948888% Net Revenue Interest

- Nonoperated Working Interest in 155 Properties (Multiple Wells):

- 10.95% Average Working Interest / 8.82% Average Net Revenue Interest After Payout (Net Revenue Interest on Some Wells Contain ORRI/Royalty Interest)

- 137 Producing Properties | 17 Non-Producing Properties | One Water Supply Well

- Four Well are After Payout Only

- Select Operators include Sanguine Gas Exploration LLC, Unit Petroleum Co. and Zarvona Energy LLC

- Royalty or ORRI in 208 Properties (Multiple Wells):

- 6.25% to 0.001227% Royalty Interest/ORRI

- The Bruce-1-23 Well Converts to Nonoperated Working Interest After Payout

- 86 Producing Properties | 116 Non-Producing Properties | Four Saltwater Disposal Wells | One Water Supply Well | One Plugged and Abandoned Well

- Select Operators include Binger Operations LLC, Chesapeake Operating LLC and Riviera Operating LLC

- Unknown Interest in the Bradley SE B Spring Unit and Glover 3 Well

- 12-Month Average Net Income: $103,492/Month (excludes Titanium Wells)

- Titanium Wells: 12-Month Average Net Income: $19,965/Month (Dec 2017 thru Nov 2018)

- Six-Month Average 8/8ths Production: 2,219 bbl/d of Oil and 56.123 MMcf/d of Gas

- 3,737.249 Net Leasehold Acres

Bids are due by 4 p.m. Oct. 31.