The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Haymaker Minerals & Royalties II LLC retained EnergyNet to sell multiple packages comprised of assets in the Williston and Permian basins as well as the Midcontinent region through sealed-bid offerings.

In the Williston, Haymaker is offering mineral and royalty interests plus overriding royalty interest in producing Bakken/Three Forks wells in Montana and North Dakota.

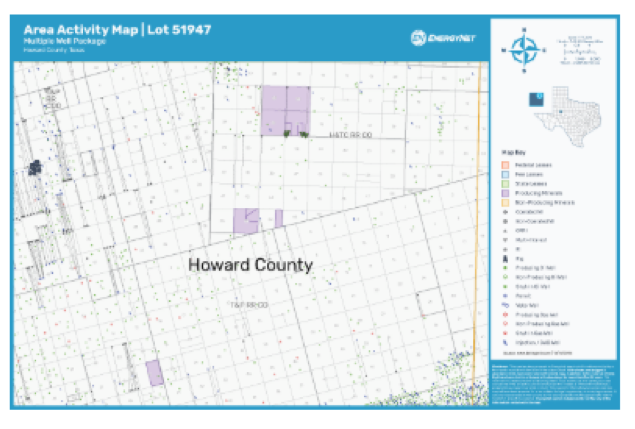

Haymaker's Permian assets consist of two packages of minerals and royalties within the Midland Basin in Howard County, Texas.

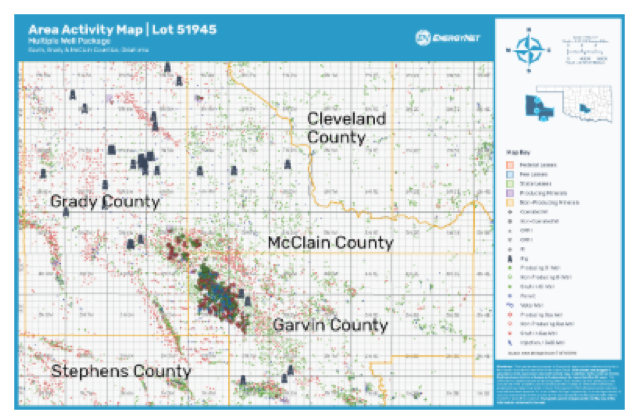

Lastly, the company has three separate packages of producing mineral and royalty assets in the Midcontinent region in Oklahoma, including in the Woodford Shale, Stack and Scoop plays.

Bids for each package are due at 4 p.m. CST Nov. 15. For information on these listings visit energynet.com or contact Cody Felton, vice president of business development for EnergyNet, at Cody.Felton@energynet.com or 281-221-3042. For additional information contact Denna K. Arias, director of transactions and business development for EnergyNet, at Denna.Arias@energynet.com or 832-403-3125.

Williston Basin

Haymaker is offering producing mineral and royalty interest in 34 wells plus 446.10 net royalty acres and overriding royalty interest in the Bakken/Three Forks play in Roosevelt County, Mont., and Williams County, N.D.

Property Highlights:

- 0.015259% to 1.589107% Royalty Interest/Overriding Royalty Interest in 34 Producing Wells

- 446.10 Net Royalty Acres, based on Mineral, Non-Participating Royalty Interest, and Overriding Royalty Interest ownership, normalized to 1/8th lease royalty burden

- Six-Month Average 8/85ths Production: 8,981 barrels per day (bbl/d) of Oil and 8.825 million cubic feet per day (MMcf/d) of Gas

- Six-Month Average Net Income: $114,938/Month

- Operators: Kraken Operating LLC and Hess Bakken Investments II LLC

Permian Basin

Haymaker is offering producing mineral and royalty interest in 53 properties plus 327.81 net royalty acres and overriding royalty interest in the Midland Basin in Howard County, Texas.

Property Highlights:

- 0.001336% to 2.777276% Royalty Interest/Overriding Royalty Interest in 53 Properties (120 Total Wells)

- 49 Producing Properties | 4 Non-Producing Properties

- SE L Fusselman Unit – 53 Wells

- 327.81 New Royalty Acres, based on Mineral, Non-Participating Royalty Interest, and Overriding Royalty Interest ownership, normalized to 1/8th lease royalty burden

- Current Average 8/8ths Production: 19,353 bbl/d of Oil and 15.,331 MMcf/d of Gas

- Five-Month Average Net Income: $103,900/Month

- Select Operators: SM Energy Co., Surge Operating LLC Sabalo Operating LLC and Grenadier Energy Partners II LLC

Haymaker is also offering a two-well package in the Midland Basin comprised of producing mineral and royalty interests plus 96.36 net royalty acres and non-producing overriding royalty interest in Howard.

Property Highlights:

- 96.36 Net Royalty Acres, based on Mineral and Overriding Royalty Interest ownership, normalized to 1/8th lease royalty burden

- 0.039997% Royalty Interest in 2 Producing Wells

- 2 Permitted wells

- 0.0576325% Royalty Interest in the Griffin South 21 1H Well

- 0.0288163% Royalty Interest in the Jasmine Unit 1H Well

- Includes Non-Producing Overriding Royalty Interest

- Six-Month Average 8/8ths Production: 17 bbl/d of Oil and 8,000 cubic feet per day of Gas

- Operator: Highpeak Energy Holdings LLC

Midcontinent Region

Haymaker is offering producing mineral and royalty interest in 29 wells plus 564.25 net royalty and non-executive royalty acres within the Woodford Shale in Canadian, Caddo and Grady counties, Okla.

Property Highlights:

- 0.020906% to 2.498284% Royalty Interest in 29 Wells:

- 25 Producing Wells | 4 Non-Producing Wells

- 564.25 Net Royalty Acres

- 4.17 Net Non-Executive Royalty Acres

- Current Average 8/8ths Production: 1,445 bbl/d of Oil and 6.334 MMcf/d of Gas

- Four-Month Average Net Income: $219,867/Month

- Average Income Includes Seller Forecasts for the Shelly 2H-3016X thru Shelly 9H-3106X Wells (8 Total Wells) to have Initial Net Revenues over $30,000/Month Each

- Select Operators: Cimarex Energy Co. and Devon Energy Corp.

Haymaker is also offering producing mineral and royalty interests in 79 properties, which also includes 772.99 net royalty acres and overriding royalty interest, within the Stack Play in Kingfisher County, Okla.

Property Highlights:

- 0.004185% to 2.426897% Royalty/Overriding Royalty Interest in 79 Properties (564 Total Wells):

- 71 Producing Properties | 8 Non-Producing Properties

- East Hennessey Unit - 147 Wells

- Lincoln North Unit - 220 Wells

- Lincoln SE Oswego Unit - 120 Wells

- 772.99 Net Royalty Acres, based on Mineral, Non-Participating Royalty Interest and Overriding Royalty Interest ownership, normalized to 1/8th lease royalty burden

- Current Average 8/8ths Production: 7,623 bbl/d of Oil and 23.409 MMcf/d of Gas

- 12-Month Average Net Income: $63,302/Month

- Select Operators: Alta Mesa Resources (Oklahoma Energy Acquisitions LP) and Chesapeake Operating LLC

Lastly, Haymaker has a 113-property package on the market comprised of producing mineral and royalty interest including 267.63 net royalty acres and overriding royalty interest within the Scoop Play in Garvin, McClain and Grady counties, Okla.

Property Highlights:

- 0.000014% to 1.647945% Royalty Interest/Overriding Royalty Interest in 113 Properties (577 Total Wells):

- 104 Producing Properties | 9 Non-Producing Properties

- Purdy Unit - 464 Wells

- 267.63 Net Royalty Acres, based on Mineral and Overriding Royalty Interest ownership, normalized to 1/8th lease royalty burden

- Current Average 8/8ths Production: 2,895 bbl/d of Oil and 25.337 MMcf/d of Gas

- 12-Month Average Net Income: $12,500/Month

- Select Operators: Casillas Operating LLC, Newfield Exploration Mid-Continent Inc. and Basin Operating Service LLC

Recommended Reading

Marketed: Stapleton Group Gulf Coast Texas Opportunity

2024-10-21 - Stapleton Group has retained EnergyNet for the sale of 51,816 non-producing net mineral acres in Walker, Montgomery and San Jacinto counties, Texas.

Marketed: Bison Energy 30-Well Package in Niobrara Shale

2024-12-02 - Bison Energy has retained EnergyNet for the sale of a 30 well package in Adams and Arapahoe counties, Colorado.

Marketed: Territory Resources 15-well Package in Oklahoma

2024-10-28 - Territory Resources LLC has retained EnergyNet for the sale of 15-well package in Kay, Noble and Pawnee counties, Oklahoma.

Marketed: Hess 3-Well Package in Bakken Shale

2024-12-11 - Hess Corp. has retained EnergyNet for the sale of a three-well Bakken Shale package in Mountrail and Ward counties, North Dakota.

Orion Acquires SCOOP/STACK Interests, Pursuing Permian Deals

2024-11-11 - Orion Diversified Holding Co. is pursuing negotiations with several oil companies in the Permian Basin to acquire oil and gas assets, the company’s CEO said.