The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

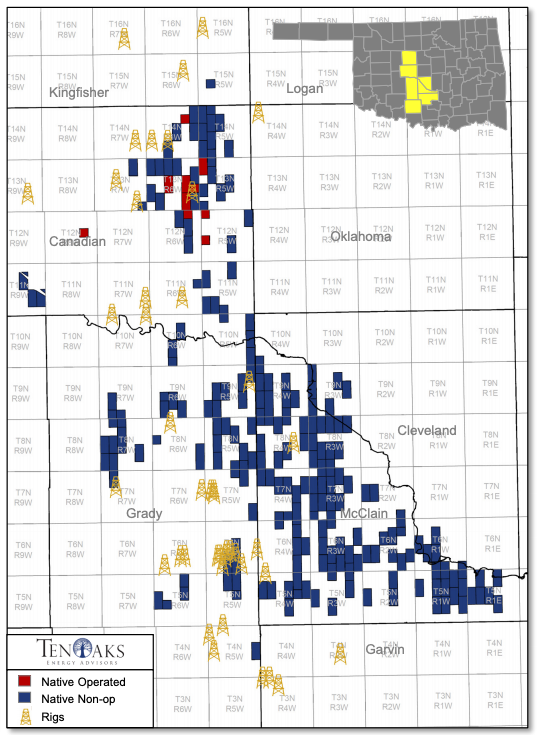

Native Exploration Operating LLC retained TenOaks Energy Advisors for the sale of certain properties in the Scoop, Merge and Stack plays in Oklahoma. The offer is comprised of operated and nonoperated packages located in Canadian, Grady and McClain counties, Okla.

Highlights:

Operated Package

- Drill-ready Stack / Merge footprint (six rigs running in immediate area)

- 8,960 gross (4,172 net) acres in Canadian county (10 units)

- About 100 net boe/d (63% liquids) from one horizontal Meramec well

- More than 100 potential locations in the Woodford and Meramec

Nonoperated Package

- Diversified Merge / Scoop position under high quality operators

- 87,500 gross (6,759 net) acres in Grady, McClain and Canadian counties

- 66 well in progress (41 DUCs and 25 Permits) provide ample immediate development

- 723 net boe/d (63% liquids) from 130 wells

- $506,000 per month in projected net monthly cash flow

- More than 1,700 potential locations

Bids are due by Nov. 14. The virtual data room will be available starting Oct. 11.

For information visit tenoaksenergyadvisors.com or contact Trey Bonvino, TenOaks associate, at 214-420-2331 or Trey.Bonvino@tenoaksadvisors.com.

Recommended Reading

California Resources Continues to Curb Emissions, This Time Using CCS for Cement

2025-03-04 - California Resources’ carbon management business Carbon TerraVault plans to break ground on its first CCS project in second-quarter 2025.

Equinor Secures $3B in Financing for New York’s Empire Wind 1

2025-01-02 - Equinor’s 810-megawatt Empire Wind 1, which is scheduled to begin commercial operations in 2027, has accumulated the equivalent of about $5 billion in capital investments for the offshore New York project.

Biofuels Sector Unsatisfied with Clean Fuels Credit Guidance

2025-01-10 - The Treasury Department released guidance clarifying eligibility for the 45Z credit and which fuels are eligible, but holes remain.

Treasury’s New Hydrogen Tax Credit Regs Open Door to NatGas Producers

2025-01-05 - The U.S. Treasury Department’s long awaited 45V hydrogen tax credit will enable “pathways for hydrogen produced using both electricity and methane” as well as nuclear, the department said Jan. 3.

West Virginia Gains Authority for Class VI Wells for CCS

2025-02-18 - The state joins North Dakota, Wyoming and Louisiana in securing approval from the Environmental Protection Agency for Class VI well primacy for carbon capture and storage.