The following information is provided by Detring Energy Advisors LLC. All inquiries on the following listings should be directed to Detring. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

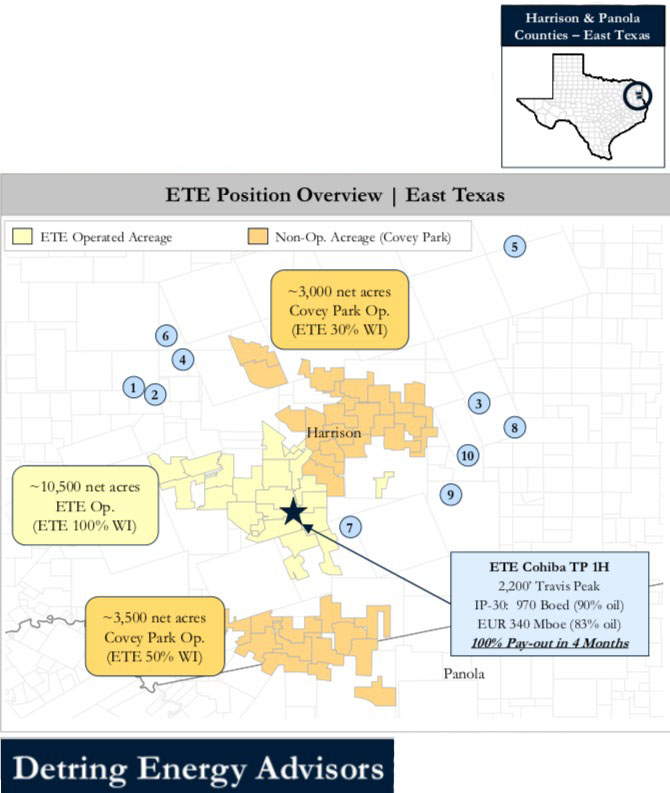

East Texas Exploration LLC (ETE) is offering for sale its oil and gas leasehold and related assets located in Harrison and Panola counties, Texas.

The assets offer an attractive opportunity to acquire about 17,000 contiguous net acres (62% Operated, 100% HBP) with exposure to multiple liquids-rich, stacked-pay horizontal targets across the Cotton Valley and Travis Peak formations. ETE has retained Detring Energy Advisors as its exclusive adviser relating to the transaction.

Asset Highlights:

- 17,000 Net Acres (100% HBP)

- Large, contiguous, HBP acreage position with rights to all zones above the Haynesville Shale

- 10,500 net acres operated (~100% avg. WI)

- 6,500 net acres operated by Covey Park (~40% avg. WI)

- Liquids-rich Stacked Pay (Primary Targets: Lower Taylor Cotton Valley and Travis Peak Sands)

- Cotton Valley de-risked with optimized completion techniques yielding ~1.5 Bcfe/1,000 ft EUR

- The Burnett interval of the Travis Peak formation has yielded robust economics with the strongest well delivering ~1,000 boe/d IP-30 (90% oil) from ~2,200 ft of treated lateral, achieving pay-out in four months

- Additional resource potential includes both Upper Cotton Valley Sands (BCD and Davis) and the Travis Peak McJimsey interval

- Large, contiguous, HBP acreage position with rights to all zones above the Haynesville Shale

- Significant Proved Reserves & Cash Flow

- 4 MMcfe/d net operated production (45% liquids)

- ~$3.8 million NTM cash flow (PDP only)

- 41 Bcfe net proved reserves (45% liquids)

- 10.7 Bcfe net PDP reserves (48% liquids)

- $42 million PV-10 value (1P)

Process Overview:

- Evaluation materials available via the Virtual Data Room on July 30

- Data room presentations available upon request

- Proposals due on Aug. 29

Contact Matt Loewenstein at matt@detring.com or 713-595-1003 to request a confidentiality agreement, schedule a presentation or learn more about this opportunity. For further questions visit detring.com or contact Melinda Faust at mel@detring.com or 713-595-1004.

Recommended Reading

Devon Energy Announces Changes to Executive Leadership Team

2025-01-13 - Among personnel moves, Devon Energy announced John Raines and Trey Lowe have been promoted to senior vice president roles.

Berry Closes Debt Refinancing to Uphold Growth Commitments

2024-12-26 - Berry Corp. closed a debt refinancing agreement to continue its corporate strategy of promoting scale and diversification.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Chevron Names Laura Lane as VP, Chief Corporate Affairs Officer

2025-01-13 - Laura Lane will succeed Al Williams in overseeing Chevron Corp.’s government affairs, communication and social investment activities.

Berry Announces Jeff Magids as New CFO

2025-01-21 - Jeff Magids was appointed as Berry Corp.’s new CFO on Jan. 21 in replacement of Mike Helm, effective immediately.