The following information is provided by Eagle River Energy Advisors LLC. All inquiries on the following listings should be directed to Eagle River. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

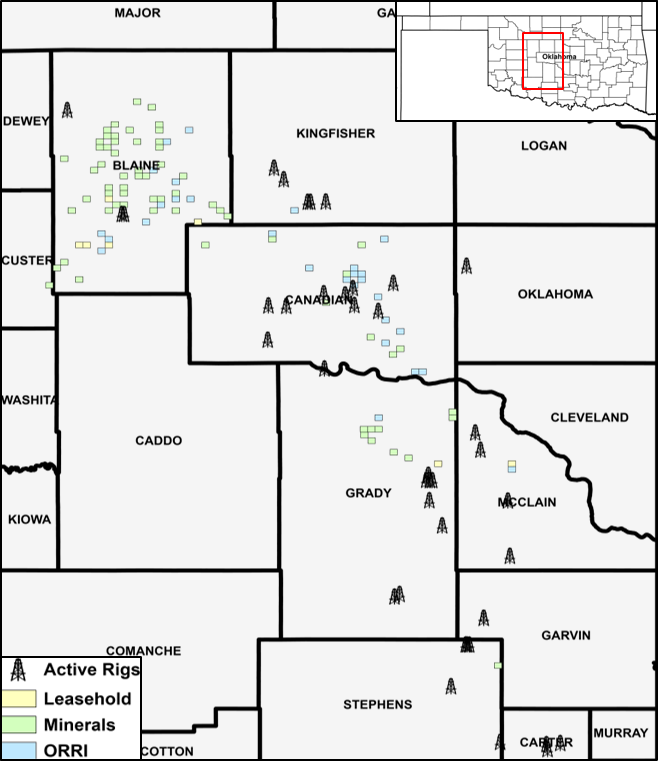

Midwest Energy Investments LLC retained Eagle River Energy Advisors LLC for the sale of mineral, lease and overriding royalty interest (ORRI) assets and associated development rights in the Stack play of Oklahoma.

Highlights:

- About 1,166 Net Royalty Acres (Normalized to 1/8th)

- Minerals: 1,016 Net Royalty Acres (23% Average Royalty Rate)

- ORRI: 150 Net Royalty Acres across 104 Drilling and Spacing Units

- 32 Net Leasehold Acres (82% Average Net Revenue Interest)

- About 112 Boe/d net production (67% Liquids)

- $111,000 per month net cash flow (Average April-September 2019)

- 171 Proved Developed Producing wells provide stable and diversified production profile

- 16 Drilled but Uncompleted wells and 62 proposed wells provide near-term upside

- Signficant remaining Reserves with 900,000 to 2.8 million boe EURs from multibench development across the acreage

- Economic development of the Woodford and Mississippian yield internal rate of returns greater than 50%

- 500-plus remaining, economic drilling locations provide multiple years of stacked-pay development potential

- Recent successful Woodford and Mississippian delineation across entire position

- Additional, unquantified resources potential in multiple other formations currently being tested

- Portfolio operators include Continental Resources Inc., Devon Energy Corp., EOG Resources Inc., Cimarex Energy Co., Marathan Oil Corp. and Encana Corp. (currently operating as Ovintiv Inc.)

- Portfolio operators actively permitting and are drilling with 32 of 53 total active rigs in the Basin

Bids are due 4 p.m. MT March 10. Virtual data room opens Feb. 11. The transaction is expected to have a March 1 effective date.

For information visit eagleriverholdingsllc.com or contact James Barnes, director of Eagle River, at JBarnes@EagleRiverEA.com or 832-680-0112.

Recommended Reading

Exxon Slips After Flagging Weak 4Q Earnings on Refining Squeeze

2025-01-08 - Exxon Mobil shares fell nearly 2% in early trading on Jan. 8 after the top U.S. oil producer warned of a decline in refining profits in the fourth quarter and weak returns across its operations.

Phillips 66’s NGL Focus, Midstream Acquisitions Pay Off in 2024

2025-02-04 - Phillips 66 reported record volumes for 2024 as it advances a wellhead-to-market strategy within its midstream business.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.