The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

NorthStar Energy LLC retained EnergyNet for the sale of a 180 well package in Michigan in an auction closing Dec. 11.

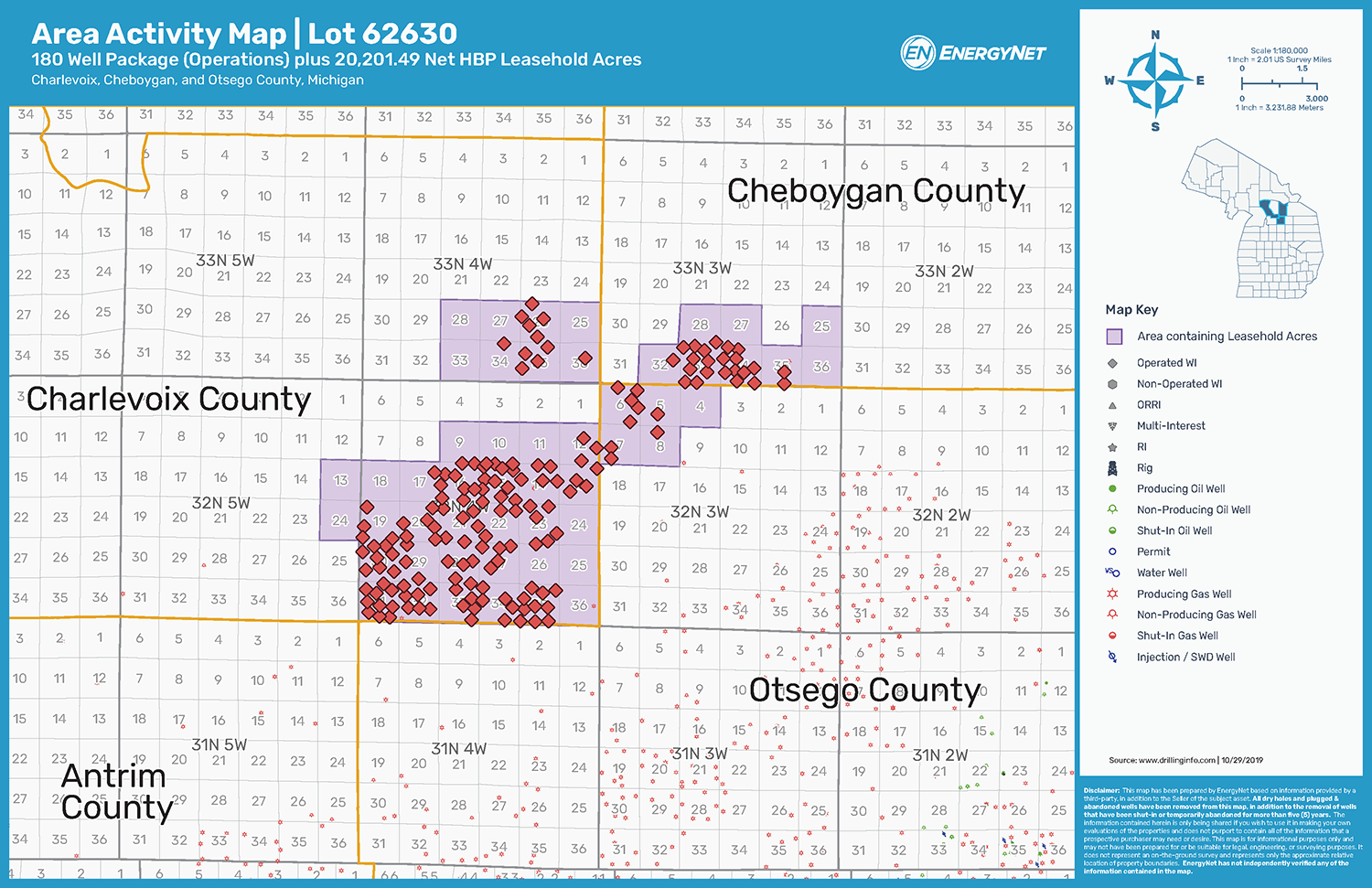

The offering includes 100% gross working interest with operations plus about 20,000 net HBP leasehold acres located in Alpena, Charlevoix, Cheboygan and Otsego counties, Mich.

Highlights:

- Allocates risk between upstream and midstream assets

- 100% owner of processing and pipeline transportation assets that provide transportation of gas for NorthStar production and potential third-party production with volumetric tariffs approved by Michigan regulators

- 183 wells

- 168 wells capable of production

- Current production from only 32 wellbores

- 136 wells available for workover/return to production

- 15 saltwater disposal wells

- 168 wells capable of production

- Approximately 20 miles of Michigan Public Service Commission (MPSC) rate approved pipeline system which can also take 3rd party gas

- Substantial upside from bringing proved developed non-producing (PDNP) wells back online

Bids are due by 1:30 p.m. CST Dec. 11. For complete due diligence information visit energynet.com or email Ethan House, vice president of business development, at Ethan.House@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Rising Phoenix Capital Launches $20MM Mineral Fund

2025-02-05 - Rising Phoenix Capital said the La Plata Peak Income Fund focuses on acquiring producing royalty interests that provide consistent cash flow without drilling risk.

Equinor Commences First Tranche of $5B Share Buyback

2025-02-07 - Equinor began the first tranche of a share repurchase of up to $5 billion.

Chevron Makes Leadership, Organizational Changes in Bid to Simplify

2025-02-24 - Chevron Corp. is consolidating its oil, products and gas organization into two segments: upstream and downstream, midstream and chemicals.

Elliott Nominates 7 Directors for Phillips 66 Board in Big Push for Restructuring

2025-03-04 - Elliott Investment Management, which has taken a $2.5 billion stake in Phillips 66, said the nominated directors will bolster accountability and improve oversight of Phillips’ management initiatives.

Shell Shakes Up Leadership with Upstream and Gas Director to Exit

2025-03-04 - Zoë Yujnovich, Shell’s Integrated Gas and Upstream director, will step down effective March 31.