The following information is provided by TenOaks Energy Advisors LLC. All inquiries on the following listings should be directed to TenOaks. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

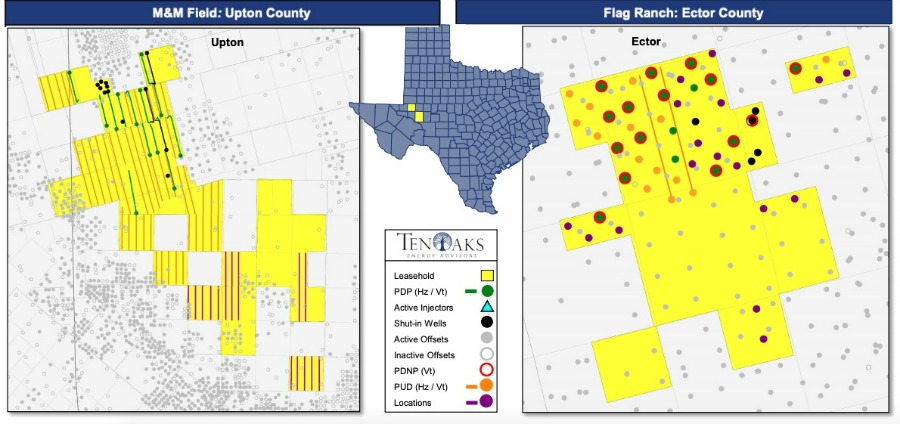

Capstone Natural Resources II LLC retained TenOaks Energy Advisors as its exclusive adviser in connection with the sale of its operated Central Basin Platform properties in Ector and Upton counties, Texas, within the Permian Basin.

Highlights:

- M&M Field: Horizontal San Andres Production Base

- Largely contiguous 10,238 net acres in Upton County

- Optimal for horizontal development

- 74 drilling locations identified with internal rate of returns of more than 90%

- 332 barrels of oil equivalent per day (boe/d); 93% oil

- 2019 Proved Developing Production (PDP) cash flow: $320,000 per month

- Additional upside from cleanouts and operational projects

- Flag Ranch: Conventional vertical project on Wichita Albany structural trend of Central Basin Platform

- 1,276 net acres in Ector County

- 225 boe/d; 59% oil

- 2019 PDP cash flow: $141,000 per month

- Proved Developed Non-Producing (PDNP) projects drive production and cash flow growth (60%+ internal rate of returns)

Bids are due March 21. For information visit tenoaksenergyadvisors.com or contact Jason B. Webb, TenOaks partner, at 214-420-2322 or Jason.Webb@tenoaksadvisors.com.

Recommended Reading

Q&A: Petrie Partners Co-Founder Offers the Private Equity Perspective

2025-02-19 - Applying veteran wisdom to the oil and gas finance landscape, trends for 2025 begin to emerge.

Energy Transfer Announces $3B Senior Notes Offering

2025-02-19 - Midstream company Energy Transfer plans to use the proceeds from its $3 billion offering of senior notes to refinance existing debts and for general partnership purposes.

Energy Careers Platform Offering Free Access to Job Seekers

2025-02-19 - Ally Energy and Parallel say their new energy industry hiring platform has advantages for both job seekers and hiring companies.

Transocean President, COO to Assume CEO Position in 2Q25

2025-02-19 - Transocean Ltd. announced a CEO succession plan on Feb. 18 in which President and COO Keelan Adamson will take the reins of the company as its chief executive in the second quarter of 2025.

Infrastructure Firm HASI Makes Executive Leadership Changes

2025-02-18 - HA Sustainable Infrastructure Capital Inc. announced four executive leadership appointments, effective March 1.