The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

Pine Haven Resources LLC retained EnergyNet for the sale of Powder River Basin assets in Wyoming through a sealed-bid offering closing Oct. 16.

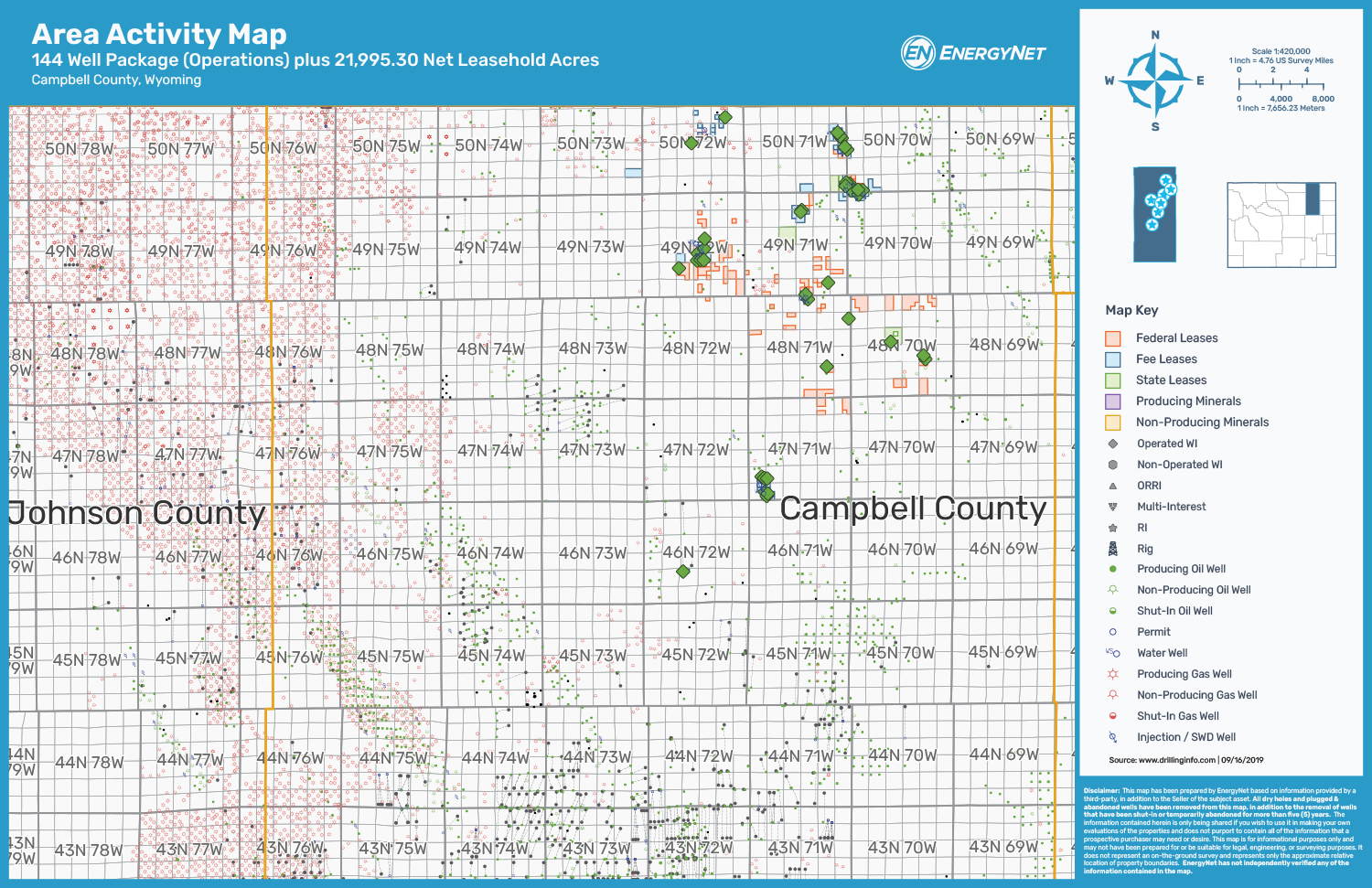

The offer comprises operations in 144 wells plus more than 20,000 net leasehold acres in Campbell, Crook and Weston counties, Wyo.

Highlights:

- 91.38% Average Workign Interest / 78.81% Average Net Revenue Interest

- Three-Month Average 8/8ths Production: 305 barrels per day of Oil

- Three-Month Average Net Profit: $122,034 per Month

- 21,995.30 Net Leasehold Acres

- 12,378.46 Net HBP/HBU Leasehold Acres

- 9,616.84 Net Leasehold Acres in Primary Term

- Average Term Remaining: 7.3 Years

- Earliest Expiration: April 2022

Bids are due by 4 p.m. CDT Oct. 16. For complete due diligence information visit energynet.com or email Heidi Epstein, manager of business development, at Heidi.Epstein@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Energy Transition in Motion (Week of Feb. 14, 2025)

2025-02-14 - Here is a look at some of this week’s renewable energy news, including a geothermal drilling partnership.

Energy Transition in Motion (Week of Feb. 21, 2025)

2025-02-21 - Here is a look at some of this week’s renewable energy news, including a record for community solar capacity in the U.S.

Energy Transition in Motion (Week of Jan. 17, 2025)

2025-01-17 - Here is a look at some of this week’s renewable energy news, including more than $8 billion more in loans closed by the Department of Energy’s Loan Programs Office.

Energy Transition in Motion (Week of March 7, 2025)

2025-03-07 - Here is a look at some of this week’s renewable energy news, including Tesla’s plans to build a battery storage megafactory near Houston.

Energy Transition in Motion (Week of Jan. 31, 2025)

2025-01-31 - Here is a look at some of this week’s renewable energy news, including two more solar farms in Texas.