The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

LPR Energy LLC retained EnergyNet For the sale of mineral and royalty interests in producing Marcellus Shale wells through an auction closing Feb. 20.

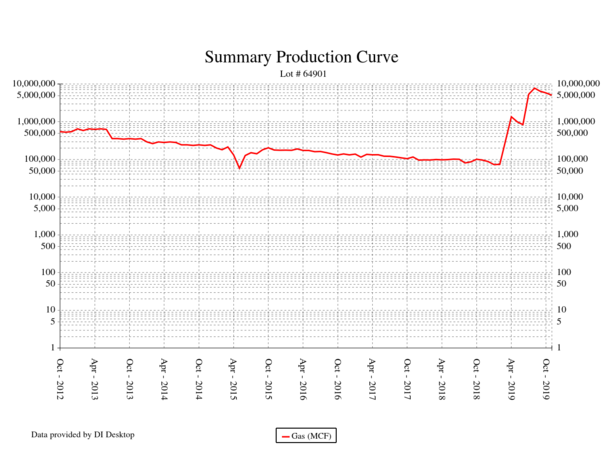

The offering includes 14 proved developed producing wells plus one permitted well and four proved undeveloped (PUD) locations located in Lycoming and Susquehanna counties, Pa.

Highlights:

- 40.1515 Net Mineral Acres (41.4453 Net Royalty Acres)

- 0.470427% to 0.01019% Royalty Interest in 14 Producing Horizontal Marcellus and Upper Marcellus Wells

- Four Additional PUD Locations

- One Additional Permitted Well

- Current Average 8/8ths Production: 200.383 million cubic feet per day

- Five-Month Average Net Income: $7,507 per Month

- Operators: Cabot Oil & Gas Corp. and Southwestern Energy Co.

Bids are due by 1:55 p.m. CST Feb. 20. For complete due diligence information visit energynet.com or email Michael Baker, vice president of business development, at Michael.Baker@energynet.com, or Denna Arias, vice president of corporate development, at Denna.Arias@energynet.com.