The following information is provided by EnergyNet. All inquiries on the following listings should be directed to EnergyNet. Hart Energy is not a brokerage firm and does not endorse or facilitate any transactions.

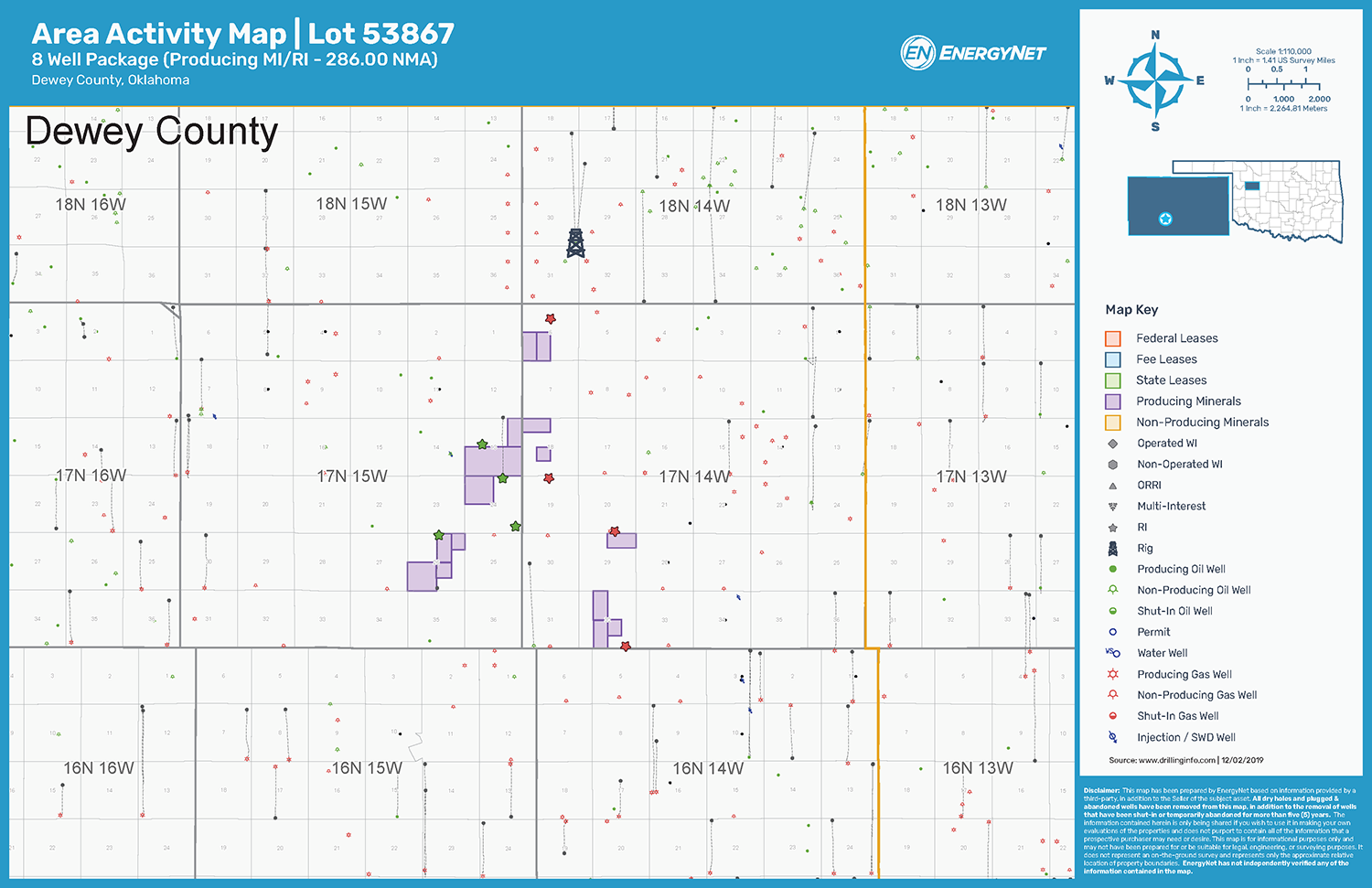

Colcord Capital LLC retained EnergyNet for the sale of producing royalties in Oklahoma through an auction closing Dec. 19. The offering includes mineral and royalty interests in an eight well package in Dewey County, Okla.

Highlights:

- 286.00 Net Mineral Acres

- 3.295898% to 1.24226% Royalty Interest in Eight Wells:

- Five Producing Wells | Three Non-Producing Wells

- Six-Month Average 8/8ths Production: 12 barrels per day of Oil and 119,000 cubic feet per day of Gas

- Six-Month Average Net Income: $467 per Month

- Operators include Comanche Exploration Co. LLC, Continental Resources Inc., Devon Energy Production Co LP, Dewey Energy GP LLC, NOG LLC and Sandridge Exploration & Production LLC

Bids are due by 1:55 p.m. CST Dec. 19. For complete due diligence information visit energynet.com or email Emily McGinley, vice president of business development, at Emily.McGinley@energynet.com, or Denna Arias, director of transaction management, at Denna.Arias@energynet.com.

Recommended Reading

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

USD Completes Final Asset Sale of Hardisty Terminal

2025-04-13 - USD Partners was obligated to sell the Hardisty Terminal, in Alberta, Canada, after entering a forbearance agreement with its lenders on June 21 2024.

Utica Oil Player Ascent Resources ‘Considering’ an IPO

2025-03-07 - The 12-year-old privately held E&P Ascent Resources produced 2.2 Bcfe/d in the fourth quarter, including 14% liquids from the liquids-rich eastern Ohio Utica.