HOUSTON—Some publicly traded U.S. energy pipeline and oil-storage partnerships are restructuring into simpler business models to help attract new investors and spur growth.

Rising oil and gas production has spawned billions of dollars of new transport, gathering and storage projects. But the companies most responsible for these projects can allocate up to 50% of their income to the general partner, leaving less for other holders or to invest in new projects.

Historically, these firms have passed most of their income along to holders and sold equity or debt to finance new projects or acquisitions. But in the last year, what they have had to offer investors has jumped. MPLX Energy Logistics LP, for instance, paid a 9.7% annualized distribution last quarter to its holders, up from 7.9% a year earlier, according to figures from investment firm East Daley Capital Advisors.

“The higher cash yield makes the economics of these projects a little tougher,” said Kendrick Rhea, an analyst at East Daley Capital. He estimates the cost of equity has risen nearly one-third for some companies in the last year.

NuStar Energy (NYSE: NS) and ArchRock Inc. (NYSE: AROC) in recent weeks said they would cut income distributions to the general partners and combine units, shifting away from the general and limited partners structures common among energy pipeline and storage firms. Competitor TallGrass Energy (NYSE: TEP) in early February said it was considering a similar change.

“Removing a layer of complexity makes [partnerships] a lot more investible,” said James Mick, a portfolio manager for Tortoise, which invests in energy master limited partnerships (MLPs). Private equity firms have been successfully acquiring pipeline operators in the shale patch because of their lower cost of capital. They are proving strong rivals to MLPs for these deals because of their willingness to use more debt financing.

Nustar, Archrock and TallGrass did not respond to requests for comment.

An early move away from partnership models came in 2014 when Kinder Morgan Inc. (NYSE: KMI) then the largest publicly traded pipeline partnership, folded three units into a single company to address investor concerns about its growth and financial structure.

Mick estimates that up to 75% of the MLPs Tortoise covers will have eliminated incentive distribution rights within the next two years to free up cash for growth. As of last year, about 51% had eliminated their payouts, called Incentive Distribution Rights (IDRs), compared with 4% in 2007, he said.

Another factor in the restructurings are institutional investors seeking stronger governance and more independent boards. In some cases, about 80% of a limited partner’s board will be comprised of individuals appointed by the general partner, investors said.

“In the real world, I don’t see how directors can be truly independent and represent the best interests of the limited partners if they can be fired by the general partner,” said Kevin McCarthy, a managing partner at investment firm Kayne Anderson Capital Advisors.

Restructuring the partnerships to resemble corporations could draw renewed interest from investors, helping the firms raise new cash.

“Our view is that governance has to change if the sector is going to move to the next level and attract the attention of long-only institutional investors,” McCarthy added.

Although mature MLPs are revamping their structures, newer firms that go public are expected to continue using mechanisms such as IDRs to encourage growth. Hess Corp. (NYSE: HES) and BP Plc (NYSE: BP) last year both launched MLPs that included incentive distribution payments to partners.

“It is unlikely they will go away for new issuance and partnership structures moving forward. They are simply too lucrative if executed correctly,” said Ethan Bellamy, a senior research analyst with R.W. Baird & Co.

Recommended Reading

Twenty Years Ago, Range Jumpstarted the Marcellus Boom

2024-11-06 - Range Resources launched the Appalachia shale rush, and rising domestic power and LNG demand can trigger it to boom again.

Midstream M&A Adjusts After E&Ps’ Rampant Permian Consolidation

2024-10-18 - Scott Brown, CEO of the Midland Basin’s Canes Midstream, said he believes the Permian Basin still has plenty of runway for growth and development.

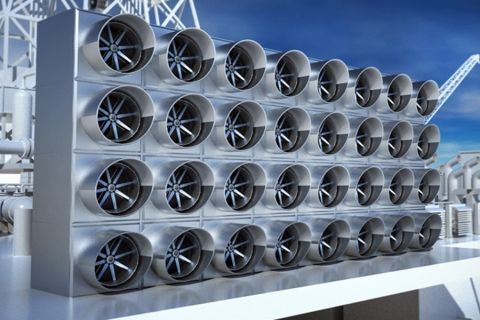

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

Post Oak Backs New Permian Team, But PE Faces Uphill Fundraising Battle

2024-10-11 - As private equity begins the process of recycling inventory, likely to be divested from large-scale mergers, executives acknowledged that raising funds has become increasingly difficult.

Sheffield: E&Ps’ Capital Starvation Not All Bad, But M&A Needs Work

2024-10-04 - Bryan Sheffield, managing partner of Formentera Partners and founder of Parsley Energy, discussed E&P capital, M&A barriers and how longer laterals could spur a “growth mode” at Hart Energy’s Energy Capital Conference.