The logo for the COP25 United Nations Climate Change Conference appears at the venue, IFEMA, in Madrid. (Source: hanleyfr/Shutterstock)

LONDON—Tighter government climate regulations by 2025 could wipe up to $2.3 trillion off the value of companies in industries ranging from fossil fuel producers to agriculture and car makers, an investor group warned in a report.

Rules aimed at lowering carbon emissions are expected to accelerate in the coming years as countries scramble to meet obligations under the 2015 Paris climate agreement limiting global warming.

Any abrupt policy shifts risk severely disrupting current investment strategies, U.N.-backed Principles of Responsible Investing (PRI), a group representing investors with $86 trillion of assets under management, said in a report.

“As the realities of climate change catch up, social pressure mounts, and low carbon solutions get cheaper, it’s highly improbable that governments will be allowed to let the world sleep-walk into greater rises in temperature without being compelled into forceful action sooner,” PRI Chief Executive Fiona Reynolds said.

“This poses huge threats for assets and for the wider system.”

Most exposed is the fossil fuel sector, which could lose one-third of its current value, the report said. Fossil fuels account for around two thirds of global greenhouse gas emissions.

Coal firms could lose as much as 44% in value, while the world’s top oil and gas companies risk losing up to 31% of their current market share, according the report which forecasts oil demand peaking around 2027.

The analysis showed that broad index-based funds such as the iShares MSCI ACWI ETF could lose up to 4.5% or $2.3 trillion in its value under the most extreme scenario.

The shift would nevertheless also lead to winners.

Auto makers heavily invested in electric vehicles and electric utility firms using low-carbon power could more than double their values, the report said.

The report came out as world leaders meet in Madrid for the 2019 United Nations climate change conference, known as COP25.

Recommended Reading

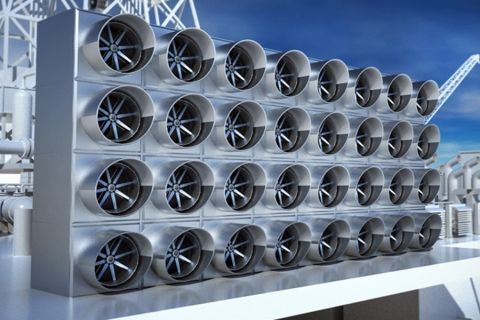

Optimizing Direct Air Capture Similar to Recovering Spilled Wine

2024-09-20 - Direct air capture technologies are technically and financially challenging, but efforts are underway to change that.

KKR, Solar Developer Birch Creek Close $150MM Credit Facility

2024-10-31 - KKR will provide a $150 million credit facility with Birch Creek Energy, which owns 160 megawatts of power projects, with more expected in place by year-end 2024.

ConocoPhillips Adds Connors to Board

2024-09-05 - Nelda J. Connors will serve on the audit and finance committee and public policy and sustainability committee of ConocoPhillips’ board.

Exclusive: How E&Ps Yearning Capital can Stand Out to Family Offices

2024-10-15 - 3P Energy Capital’s Founder and Managing Partner Christina Kitchens shares insight on the “educational process” of operators looking at opportunities in the U.S. and how E&Ps looking for capital can interest family offices, in this Hart Energy Exclusive interview.

Souki’s Saga: How Tellurian Escaped Ruin with ‘The Pause,’ $1.2B Exit

2024-09-11 - President Biden’s LNG pause in January suddenly made Tellurian Inc.’s LNG export permit more valuable. The company’s July sale marked the end of an eight-year saga—particularly the last 16 months, starting with when its co-founder lost his stock, ranch and yacht in a foreclosure.