Majority owned by Warburg Pincus, Stronghold Energy was founded in 2017 by father and son duo Steve and Caleb Weatherl. (Source: Stronghold Energy Operating II)

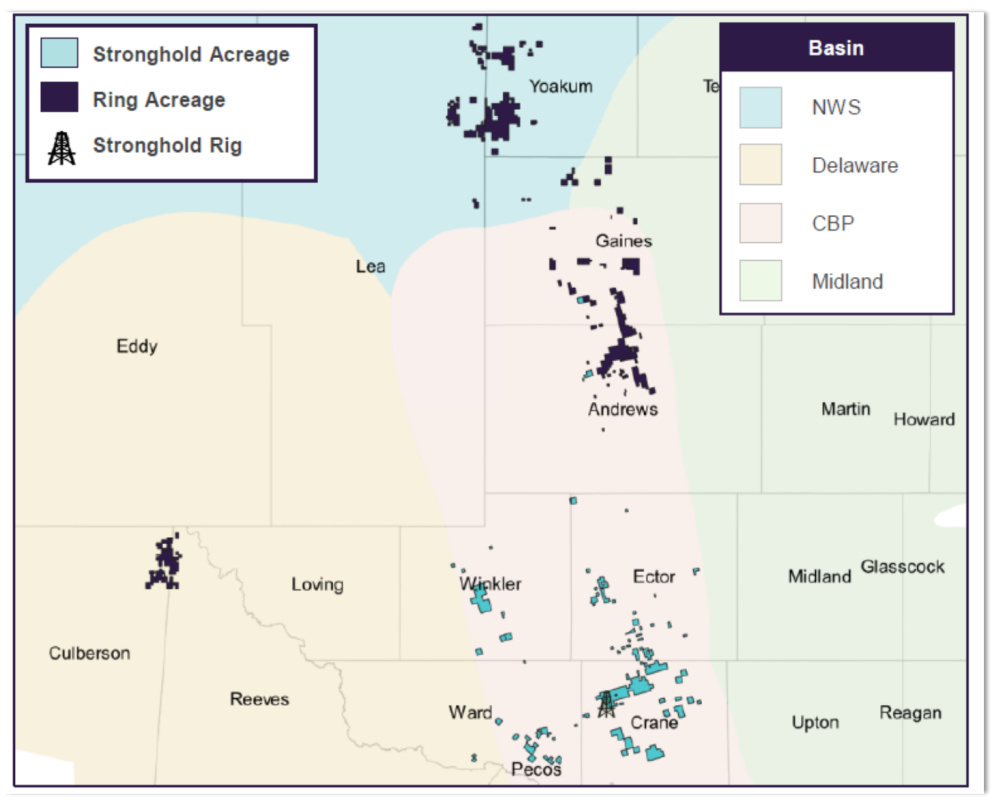

Ring Energy Inc. completed its acquisition of privately-held Stronghold Energy on Aug. 31 adding operations are located primarily in Crane County, Texas, in the Permian Basin’s Central Basin Platform.

“This transaction truly complements our conventional-focused Central Basin Platform and Northwest Shelf asset positions in the Permian Basin,” Paul D. McKinney, chairman and CEO of Ring Energy, commented in a Sept. 1 release.

Majority owned by Warburg Pincus LLC, Stronghold’s operations are focused on the development of approximately 37,000 net acres located primarily in Crane County. The company was founded in 2017 by father and son duo Steve and Caleb Weatherl.

Ring Energy announced in July an agreement to acquire Stronghold Energy II Operating LLC and Stronghold Energy II Royalties LP for $200 million in cash at closing and $230 million in Ring equity based on a 20-day volume weighted average price. Consideration also includes $15 million deferred cash payment due six months after closing and $20 million of existing Stronghold hedge liability bring the total transaction value to $465 million.

The cash portion of the consideration was funded primarily from borrowings under a new fully committed revolving credit facility underwritten by Truist Securities, Citizens Bank NA, KeyBanc Capital Markets and Mizuho Securities.

Stronghold’s asset base is approximately 99% operated, 99% working interest and 99% HBP. In July, Ring said current net production of Stronghold’s asset base was about 9,100 boe/d (54% oil, 75% liquids).

McKinney said the acquisition further diversifies Ring Energy’s commodity mix, significantly enhancing the company’s size and scale and lowering its per barrel operating costs while also providing for meaningful synergies and increased operations optionality on multiple fronts.

“The combination of lower per barrel operating costs and a substantially expanded inventory of high-margin, capital efficient development opportunities is expected to increase free cash flow, accelerate the rate at which we pay down debt, and improve our leverage metrics,” he said. “This places us in a much stronger position to expand through additional acquisitions or enhance stockholder returns through potential return of capital opportunities in the future.”

Collectively, Stronghold’s owners now are Ring’s largest stockholder, according to the release. Ring’s board of directors has been expanded from seven to nine directors, including two members proposed by Stronghold.

The effective date of the transaction was June 1. Raymond James and Truist Securities are financial advisers to Ring, and Piper Sandler & Co. is financial adviser to Stronghold for the transaction. Mizuho Securities provided a fairness opinion to Ring’s board. Jones & Keller, P.C. provided legal counsel to Ring and Kirkland & Ellis LLP provided legal counsel to Stronghold.

Recommended Reading

SM Energy Adds Petroleum Engineer Ashwin Venkatraman to Board

2024-12-04 - SM Energy Co. has appointed Ashwin Venkatraman to its board of directors as an independent director and member of the audit committee.

BP Profit Falls On Weak Oil Prices, May Slow Share Buybacks

2024-10-30 - Despite a drop in profit due to weak oil prices, BP reported strong results from its U.S. shale segment and new momentum in the Gulf of Mexico.

NOV Appoints Former Denbury CEO Chris Kendall to Board

2024-12-16 - NOV Inc. appointed former Denbury CEO Chris Kendall to its board, which has expanded to 11 directors.

Geologist James Parr Joins Ring as EVP of Exploration, Geosciences

2024-11-26 - James Parr joins Ring Energy with over 30 years of experience as a petroleum geologist and leader in multiple energy organizations.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.