The 14.5 million initial shares are anticipated to price at between $19 and $22, the company reported June 17. (Source: Shutterstock)

Permian Basin surface-acreage-owner LandBridge Co. LLC is set to IPO in an estimated raise of up to $367 million.

The 14.5 million initial shares are anticipated to price at between $19 and $22, the company reported June 17. Underwriters will have a 30-day option to purchase an additional 2.175 million shares, according to LandBridge’s filings with the Securities and Exchange Commission (SEC).

Shares are to trade as LB on the NYSE.

Lead book-running managers are Goldman Sachs and Barclays. Additional managers are Wells Fargo Securities, Citigroup, Piper Sandler and Raymond James. Co-managers are Janney Montgomery Scott, Johnson Rice & Co., Pickering Energy Partners, Texas Capital Securities and Roberts & Ryan.

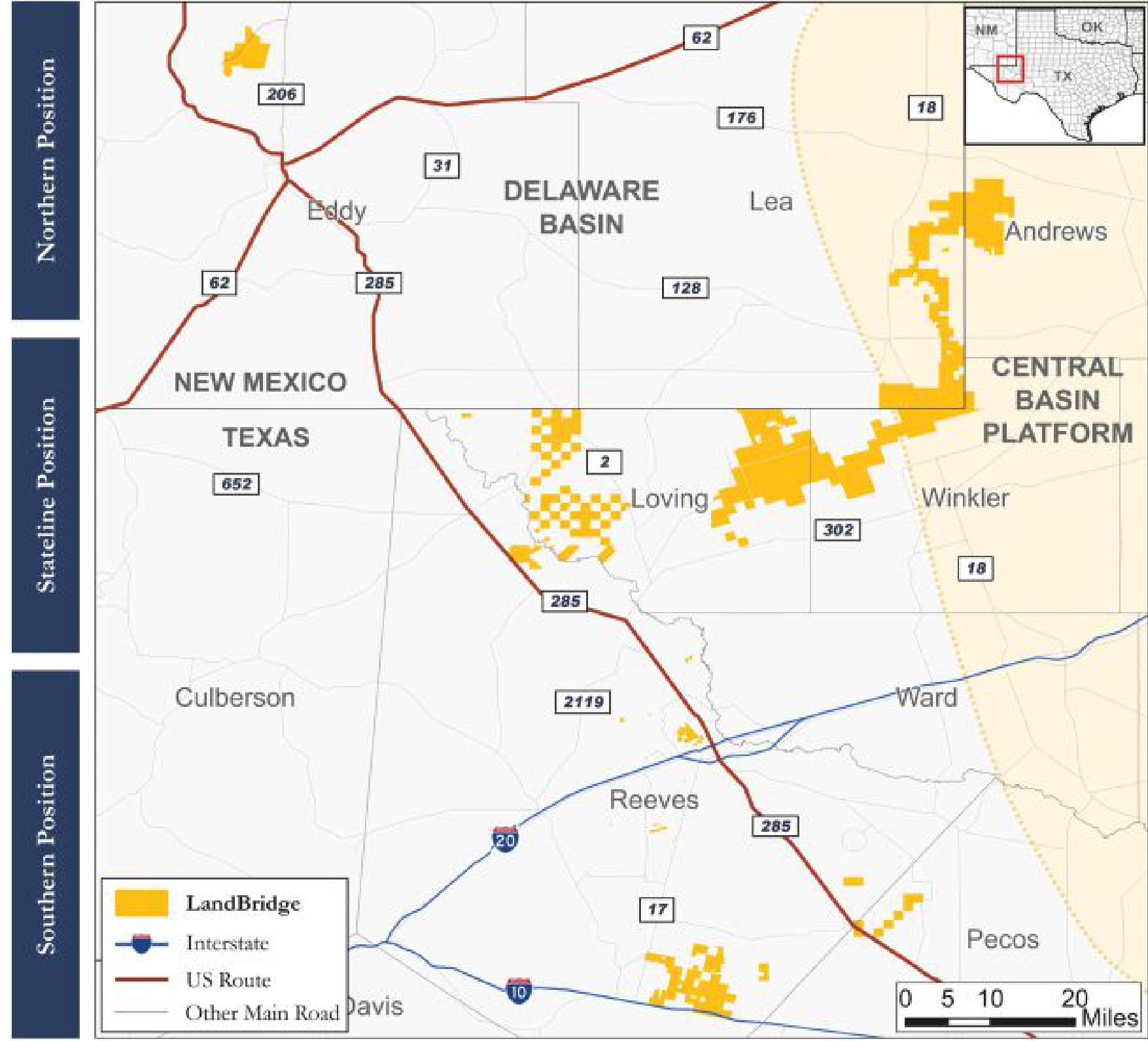

Formed in 2021 by private equity firm Five Point Energy LLC, Houston-based LandBridge owns and manages approximately 220,000 surface acres in Texas and New Mexico, primarily in the Delaware Basin.

In the Stateline area, the company holds 137,000 surface acres primarily in Loving, Reeves and Winkler counties, Texas, and Lea County, New Mexico, along the Texas-New Mexico state border, it reported in its SEC filings.

“… Approximately 11,527 identified well locations across seven formations exist within a 10-mile radius of our surface acreage in our Stateline position,” the company reported.

Also in the northern Delaware, LandBridge holds 49,000 fee-owned surface acres and 14,165 additional surface acres leased from the federal Bureau of Land Management and from the state of New Mexico.

These acres are in Eddy and Lea counties, New Mexico, and Andrews County, Texas.

“… Approximately 1,552 identified well locations across four formations exist within a 10-mile radius of our surface acreage in [this] position,” LandBridge reported.

In the southern Delaware, it holds some 34,000 surface acres in Reeves and Pecos counties, Texas.

“… Approximately 9,117 identified well locations across seven formations exist within a 10-mile radius of our surface acreage in [this] position,” LandBridge reported.

LandBridge also owns 4,180 gross mineral acres in the Delaware with a weighted average royalty interest of 23.9% and an average proved developed producing net revenue interest per well of 4.4%.

RELATED

Energy Execs Plan Blank-check IPO to Buy E&P, Midstream Property

Recommended Reading

Woodside Awards SLB Drilling Contract for Project Offshore Mexico

2025-03-31 - SLB will deliver 18 ultra-deepwater wells for Woodside Energy’s Trion ultra-deepwater project starting in early 2026.

Energy Technology Startups Save Methane to Save Money

2025-03-28 - Startups are finding ways to curb methane emissions while increasing efficiency—and profits.

Kelvin.ai the 'R2-D2' Bridging the Gap Between Humans, Machines

2025-03-26 - Kelvin.ai offers an ‘R2-D2’ solution that bridges the gap between humans and machines, says the company’s founder and CEO Peter Harding.

NatGas Positioned in a ‘Goldilocks’ Zone to Power Data Centers

2025-03-26 - On-site power generation near natural gas production is the tech sector's ‘just right’ Goldilocks solution for immediate power needs.

AI Moves into Next Phase of E&P Adoption as Tech Shows Full Potential

2025-03-25 - AI adoption is helping with operations design and improving understanding of the subsurface for big companies. Smaller companies are beginning to follow in their footsteps, panelists said at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.