After years of noncompliance and underreporting of actual crude production, many OPEC+ members are voluntarily reducing output beyond set goals, according to analysis by Rystad Energy. (Source: Shutterstock)

OPEC’s reputation for skirting its own production quotas—former Pioneer Natural Resources CEO Scott Sheffield once said member countries cheat on their own caps—is not without merit. As recently as April, OPEC+ members blew through quotas, hitting their highest levels since April 2021, according Rystad Energy.

But since then, Rystad sees “rapidly improving compliance” among OPEC+ members, according to a July 8 report.

On June 2, the cartel announced a highly anticipated extension of its voluntary cuts until the end of the third quarter, as well as guidance through September 2025 in which voluntary cuts were expected to slowly unwind in equal monthly amounts, starting from October 2024.

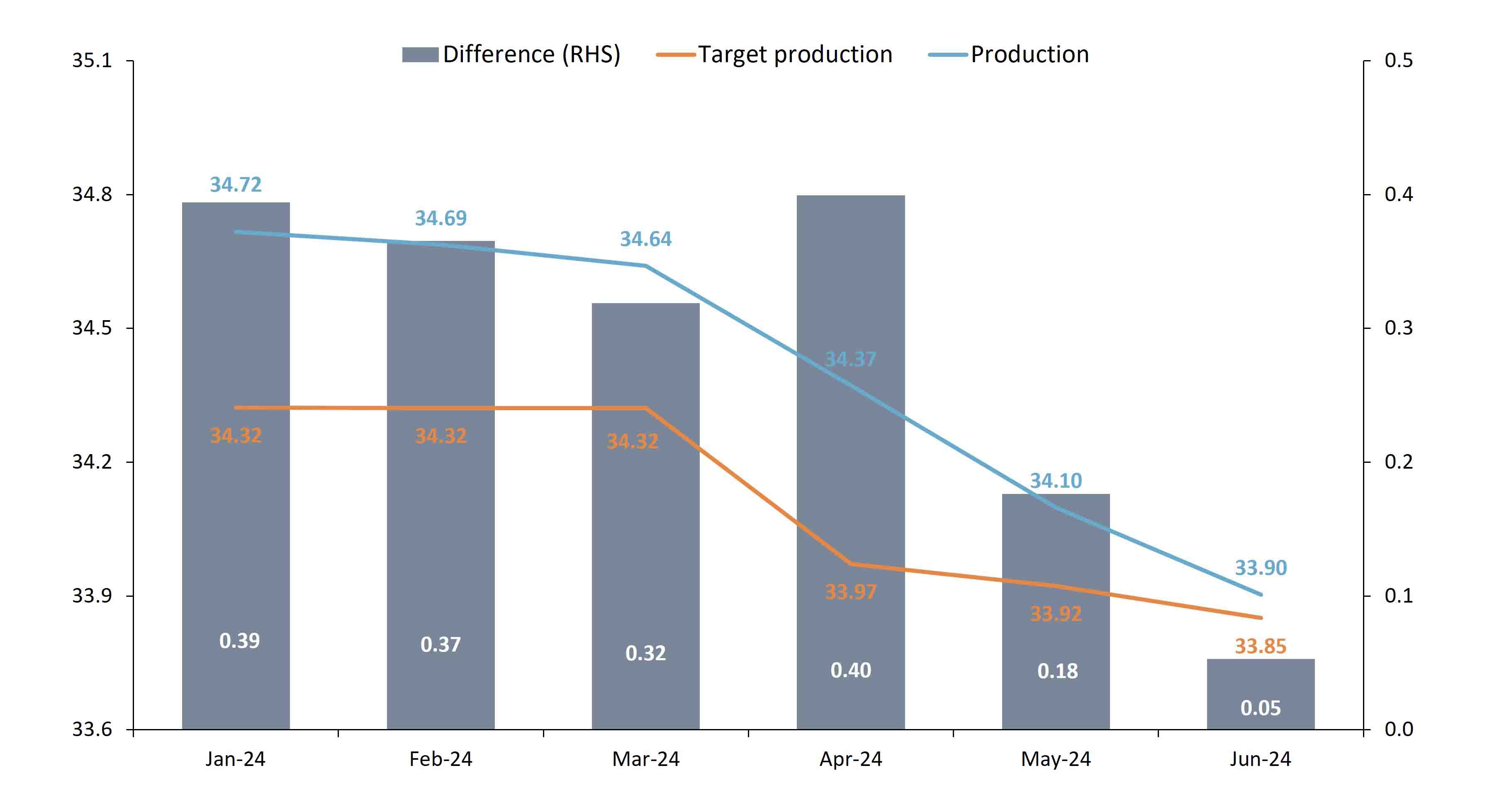

Since April, Rystad has seen rapidly improving compliance within the group. In May, OPEC+ overproduced by 176,000 bbl/d. In June, production was 53,000 bbl/d over quotas. June production averaged 33.9 MMbbl/d, just eclipsing the target of 33.85 MMbbl/d.

Recent improvement in production quotas within OPEC+ show “strong commitment and cohesion within the group,” Jorge León, Rystad Energy senior vice president, said in the report.

“It also documents that the compensation mechanism put in place is working as planned. Energy analysts expect to see strong compliance continuing in the coming months, according to Jorge León, senior vice president of Rystad Energy.

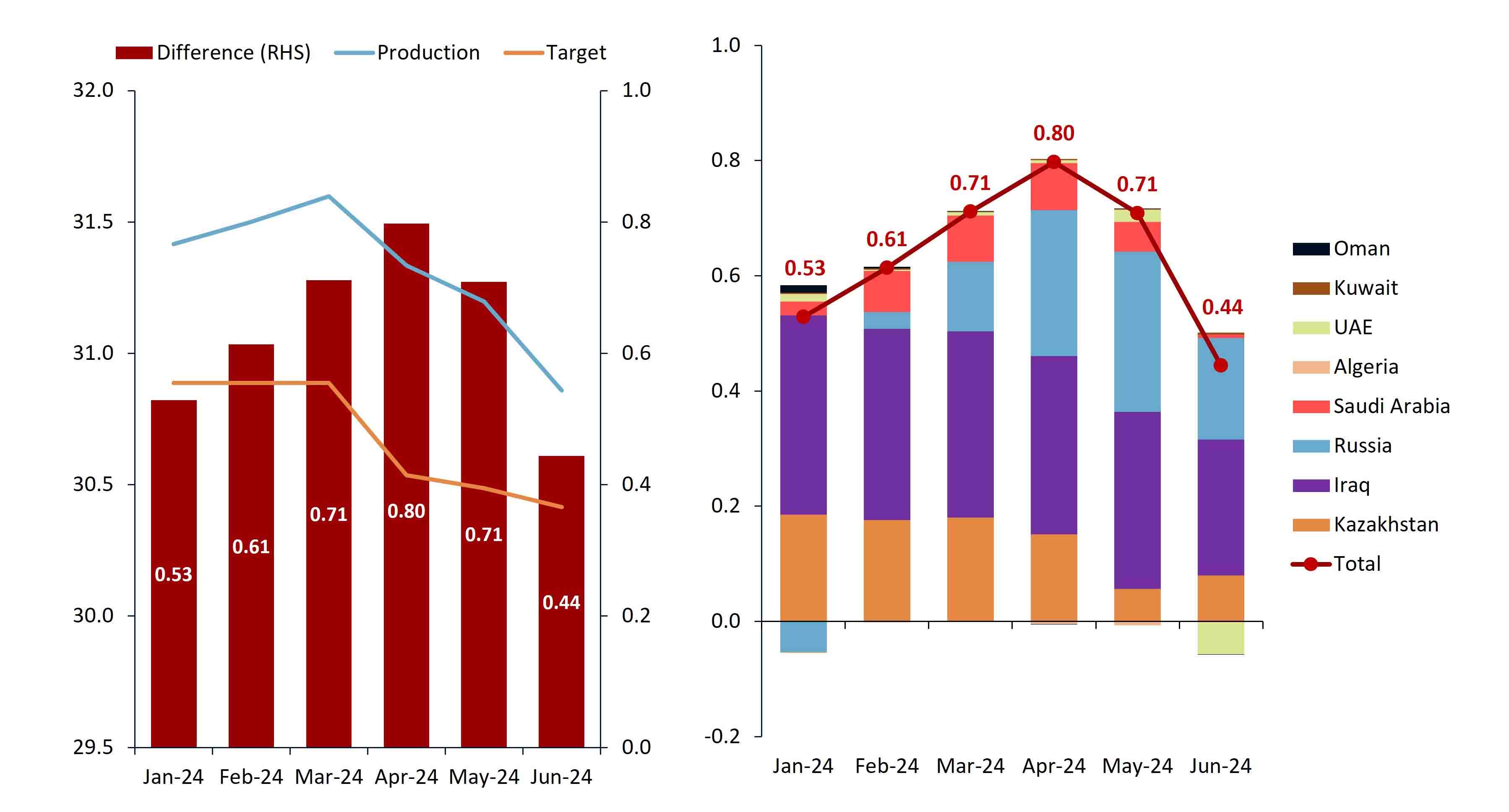

The production compensation plan is targeted toward overproduction in Iraq and Kazakhstan, with both countries scheduled to gradually reduce production through December, according to OPEC.

Overall compliance is attributable to eight voluntary cutters, León said: Oman, Kuwait, the United Arab Emirates (UAE), Algeria, Saudi Arabia, Russia, Iraq and Kazakhstan.

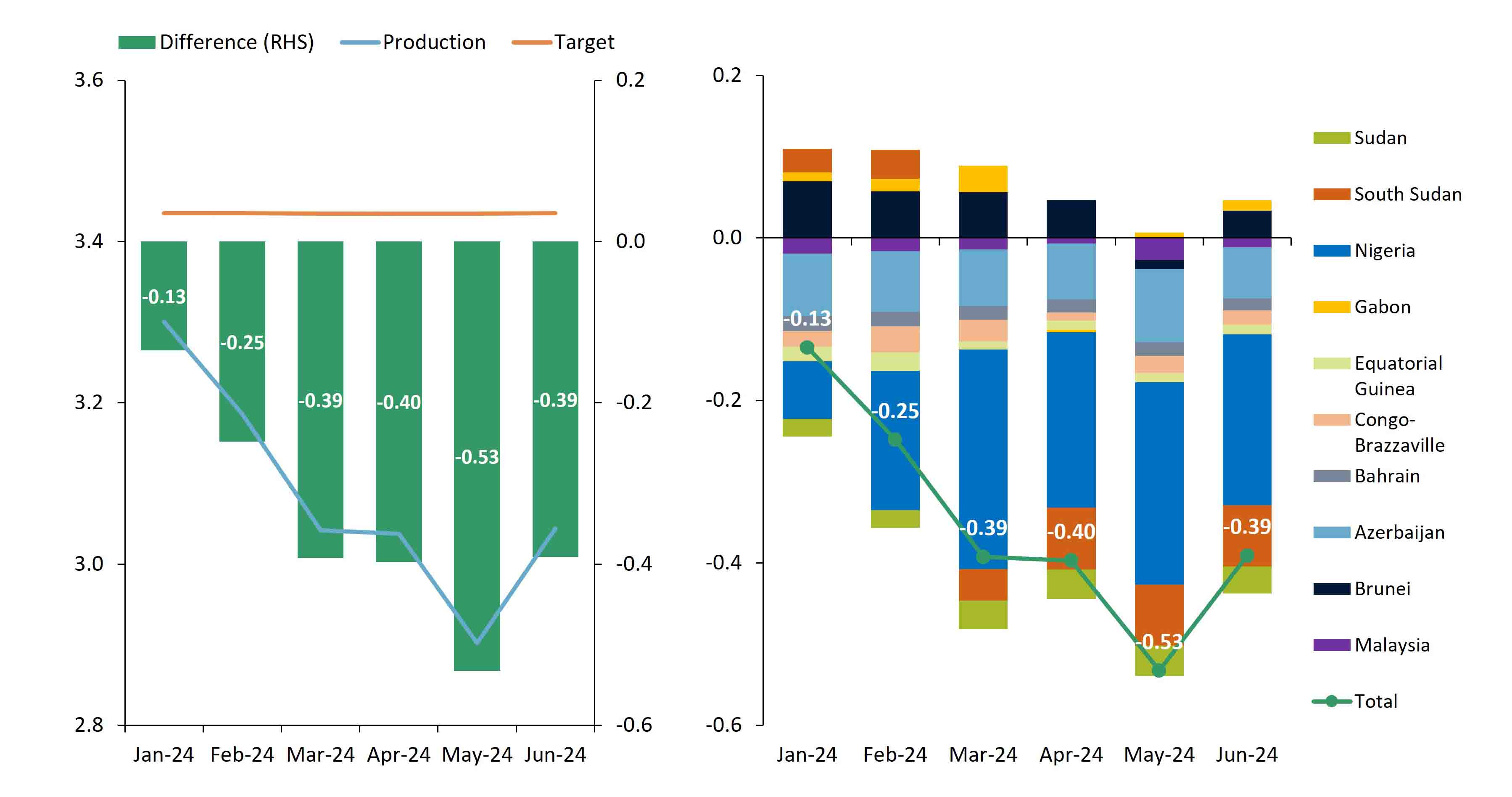

Other OPEC+ countries, including Sudan, South Sudan, Nigeria, Gabon, Equatorial Guinea, Congo-Brazzaville, Bahrain, Azerbaijan, Brunei and Malaysia, continue to over-comply with official cuts.

“In April this year, the voluntary cutter production exceeded their target by a jaw-dropping” 798,000 bbl/d, León said.

Since then, under compliance has improved, with excess production decreasing by June to 444,000 bbl/d.

Increased April compliance came from lower overproduction in:

- Kazakhstan (151,000 bbl/d in April down to 80,000 bbl/d in June);

- Iraq (310,000 bbl/d in April versus 236,000 bbl/d in June);

- Russia (253,000 bbl/d in April to 176,000 bbl/d in June); and

- Saudi Arabia (82,000 bbl/d in April compared to 6,000 bbl/d in June).

Overall, the voluntary cutting countries produced 30.86 MMbbl/d in June, while their target was 30.42 MMbbl/d for the month, Rystad said.

For the group of non-voluntary cutters, production increased in June to 3.04 MMbbl/d, or 142,000 bbl/d higher than in May, mainly due to output recovery in Nigeria and Brunei.

Overall, production for those 10 OPEC countries was 391,000 bbl/d lower than their 3.44 MMbbl/d June target.

Under compliance was primarily due to Nigerian output falling short of its target by 210,000 bbl/d in June. Tension between Sudan and South Sudan has also impacted their production. June output in South Sudan was only 48,000 bbl/d, which is 76,000 bbl/d lower than its target, while Sudan produced only 31,000 bbl/d, 33,000 bbl/d below its quota.

Figures for June show that OPEC+ production, including all 22 countries, fell 140,000 bbl/d to 40.91 MMbbl/d.

The decline was mainly due to lower output in Russia and the UAE—a combined 249,000 bbl/d that offset increased production by Brunei and Nigeria, totaling a combined 84,000 bbl/d.

Output from OPEC+ countries with quotas (excluding Mexico) was 33.9 MMbbl/d, 195,000 bbl/d lower than last month.

Recommended Reading

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Sabine Oil & Gas to Add 4th Haynesville Rig as Gas Prices Rise

2025-03-19 - Sabine, owned by Japanese firm Osaka Oil & Gas, will add a fourth rig on its East Texas leasehold next month, President and CEO Carl Isaac said.

SM Energy Marries Wildcatting and Analytics in the Oil Patch

2025-04-01 - As E&P SM Energy explores in Texas and Utah, Herb Vogel’s approach is far from a Hail Mary.

EOG Ramps Gassy Dorado, Oily Utica, Slows Delaware, Eagle Ford D&C

2025-03-16 - EOG Resources will scale back on Delaware Basin and Eagle Ford drilling and completions in 2025.

Huddleston: Haynesville E&P Aethon Ready for LNG, AI and Even an IPO

2025-01-22 - Gordon Huddleston, president and partner of Aethon Energy, talks about well costs in the western Haynesville, prepping for LNG and AI power demand and the company’s readiness for an IPO— if the conditions are right.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.