Helmerich & Payne’s acquisition of U.K. service company KCA Deutag will expand its international reach, particularly in the Middle East. (Source: H&P)

Helmerich & Payne President and CEO John Lindsay put the company’s July 25 deal for the U.K.’s KCA Deutag in perspective, saying the $1.97 billion acquisition was akin to making a deal in the epicenter of the shale universe.

“We have often said, if you want to be big in the U.S., you have to be in the Permian, and if you want to be big globally, you have to be in the Middle East,” Lindsay said.

H&P’s acquisition will expand its international and onshore reach, including in the U.S., company executives said during a July 25 earnings call.

“Our acquisition of KCA Deutag establishes H&P as a global leader in onshore drilling and accelerates our international expansion delivering on a major strategic objective for the company,” Lindsay said.

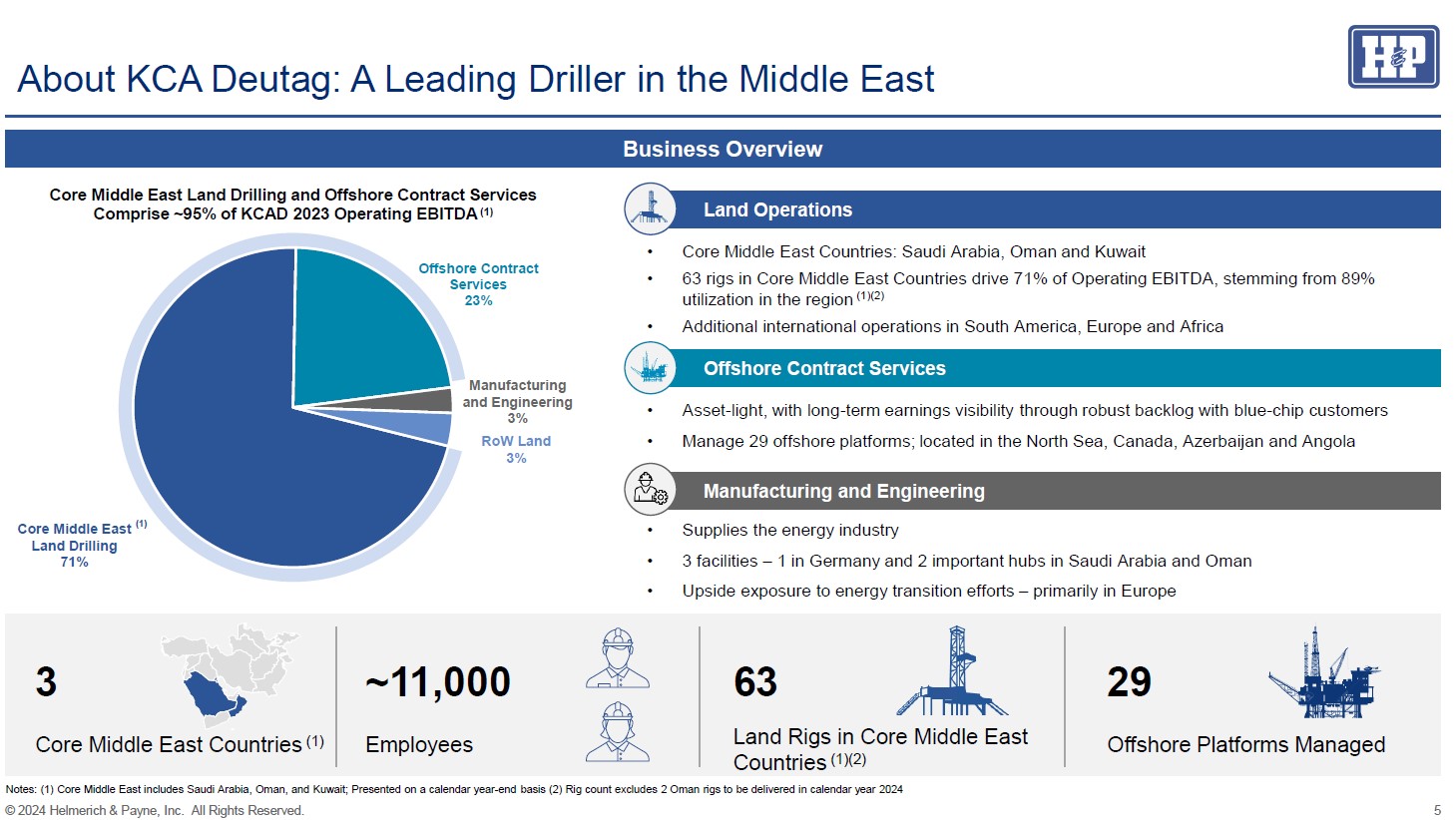

The transaction gives H&P immediate scale within core Middle East markets in a way that would be challenging to replicate organically, Lindsay said. H&P will increase its Middle East rig count to 88 rigs from 12 rigs.

The deal continues a rash of oilfield service consolidation, most recently including Noble Corp.’s June agreement to acquire Diamond Offshore Drilling in a cash-and-stock transaction worth $1.59 billion. Among more sizeable deals, in April SLB agreed to acquire ChampionX in a $7.7 billion transaction.

H&P will primarily fund the acquisition with new debt as well as cash on hand.

KCA Deutag has a highly complementary geographic footprint with little overlap to H&P’s existing assets and operations. The transaction is expected to be immediately accretive to both cashflow and free cashflow per share, Lindsay said.

The transaction stands to accelerate H&P’s international growth strategy, adding a significant drilling presence in South America, Europe and Africa.

H&P will become a larger, more diversified and resilient company with greater earnings visibility and cash flow generation, Lindsay said.

The acquisition is also expected to enhance H&P's geographic and operational mix across the U.S. and add complementary asset-light offshore management contract business and manufacturing and engineering operations in Europe and the Middle East, James West, senior managing director for Evercore ISI, wrote in a July 25 analysis.

West said H&P’s quarterly results also highlighted the resiliency of its U.S. land business—a market where other service companies are seeing a general softening.

“The North America Solutions segment remains resilient despite industry headwinds, showing stable rig count during the quarter and improved margins; contractual churn continues to be part of the story in the U.S. market, along with seasonal factors impacting activity,” West said.

During the company’s fiscal third-quarter, H&P stayed busy while delivering solid operating and financial results.

“It is notable that despite the more sizable decline in the overall NAM rig count, our active rig count remained relatively stable during the quarter,” Lindsay commented.

With E&Ps sticking to strict capital discipline, the operating environment is steadier but creates slower growth, Lindsay said.

“We believe that prioritizing return on invested capital will bring about a more positive outlook for the industry over time,” he said.

H&P has also responded well to rampant consolidation among E&Ps, he said.

“Another important influence is the recent operator driven M&A deals intended to increase efficiency and reliability,” Lindsay said. “H&P’s operational and contracting strategy meshes well with our customers and produces a win-win situation.”

Lindsay anticipates the company’s active U.S rig count to be flat with perhaps a modest improvement heading toward the end of H&P’s fiscal year.

That contrasts with the outlook of executives at Halliburton, Weatherford and Liberty Energy, who expect lagging E&P activity in North America.

H&P’s North America segment reported operating income of $163 million compared to $147 million in the previous quarter. The increase was due to a higher direct margin and higher depreciation and R&D expenses, the company said.

In the Gulf of Mexico, H&P generated operating income of $5 million compared to $100,000 in the previous quarter. Direct margin for the quarter was $7.6 million compared to $2.9 million in the previous quarter.

“We believe H&P’s F3Q24 earnings release has slightly positive implications for the stock,” West said. “H&P reported revenue of $698 million, up 1.4% sequentially, but down 3.6% yoy.”

The company’s revenue grew in all regions compared to the previous quarter, West said.

On the international front, H&P’s first super-spec flex rig has arrived in Saudi Arabia, marking a major step in the company’s strategy to increase its operational presence in the region. In February, H&P made a deal to supply Saudi Aramco with seven of its super-spec rigs.

“Activity levels in the international segment in the fourth fiscal quarter are expected to be comparable with the third fiscal quarter,” Lindsay said. “We're looking forward to working with Saudi Aramco and building a long-term relationship with our new customer.”

Recommended Reading

ADNOC Contracts Flowserve to Supply Tech for CCS, EOR Project

2025-01-14 - Abu Dhabi National Oil Co. has contracted Flowserve Corp. for the supply of dry gas seal systems for EOR and a carbon capture project at its Habshan facility in the Middle East.

Tamboran, Falcon JV Plan Beetaloo Development Area of Up to 4.5MM Acres

2025-01-24 - A joint venture in the Beetalo Basin between Tamboran Resources Corp. and Falcon Oil & Gas could expand a strategic development spanning 4.52 million acres, Falcon said.

E&P Highlights: Jan. 21, 2025

2025-01-21 - Here’s a roundup of the latest E&P headlines, with Flowserve getting a contract from ADNOC and a couple of offshore oil and gas discoveries.

VoltaGrid to Supply Vantage Data Centers with 1 GW of Powergen Capacity

2025-02-12 - Vantage Data Centers has tapped VoltaGrid for 1 gigawatt of power generation capacity across its North American hyperscale data center portfolio.

Judgment Call: Ranking the Haynesville Shale’s Top E&P Producers

2025-03-03 - Companies such as Comstock Resources and Expand Energy topped rankings, based on the greatest productivity per lateral foot and other metrics— and depending on who did the scoring.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.