Permian Resources has closed a bolt-on acquisition of Delaware Basin assets from Occidental Petroleum in a deal initially valued at $817.5 million, Permian Resources said in a Sept. 17 press release. (Source: Shutterstock, Permian Resources)

Permian Resources has closed a bolt-on acquisition of Delaware Basin assets from Occidental Petroleum in a deal initially valued at $817.5 million, Permian Resources said in a Sept. 17 press release.

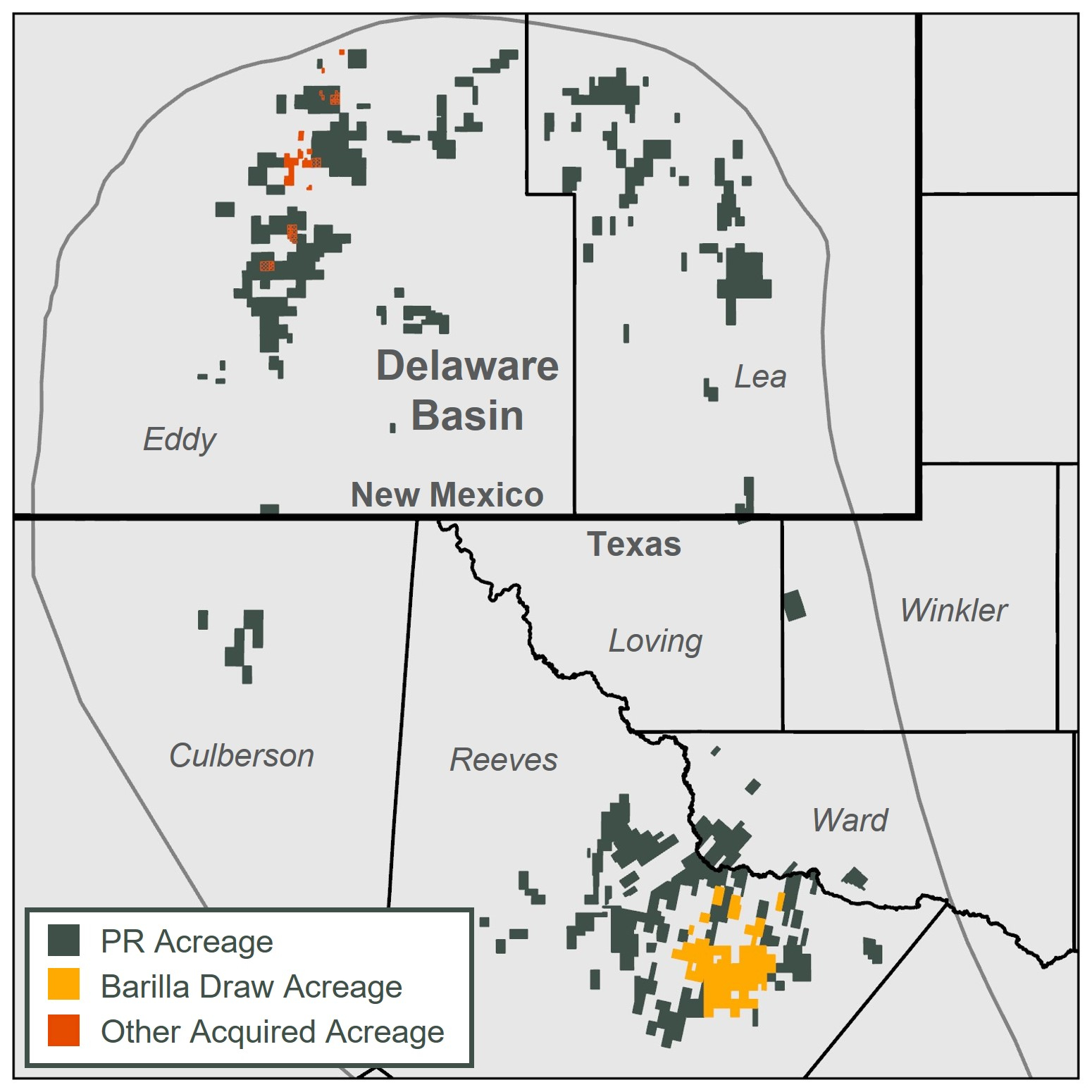

The acquisition includes about 29,500 net acres, 9,900 net royalty acres and average production of 15,000 boe/d predominantly located directly offset the company’s existing position in Reeves County, Texas. The leasehold includes assets in Occidental’s Barilla Draw Field.

Permian Resources also said it had acquired related midstream infrastructure from Occidental.

Occidental sold the assets as part of its divestment program, which is focused on reducing debt by between $4.5 billion and $6 billion. The targeted sales were to be completed within 18 months of Occidental closing the acquisition of CrownRock LP.

However, Occidental’s negotiations with Colombia-based Ecopetrol to purchase a 30% stake in CrownRock for $3.6 billion fell through on Aug. 1, leaving some analysts questioning what assets the company would sell instead. Credit rating services Fitch Ratings and Moody’s Ratings had factored in the 30% sale to Ecopetrol as part of their Oxy ratings reviews.

Occidental CFO Sunil Mathew said on an Aug. 8 earnings call that the debt reduction has actually already been 70% met due to prepayment of some borrowings and $970 million worth of other asset sales and other instruments.

Occidental President and CEO Vicki Hollub declined to speak in detail about what other assets the company might sell, saying that by doing so, she would “would compromise our ability to maximize the value of those divestitures.”

“We've said previously that we get a lot of incoming offers.”

Recommended Reading

Ørsted, PGE Greenlight Baltica 2 Wind Project Offshore Poland

2025-01-29 - Ørsted said Baltica 2 is expected to be fully commissioned in 2027.

Costs for Dominion’s 2.6-GW Offshore Wind Project Swell to $10.7B

2025-02-03 - With 176 turbines, Dominion Energy’s Coastal Virginia Offshore Wind has seen costs rise by about $900 million, or 9%, the company said.

Energy Transition in Motion (Week of Feb. 21, 2025)

2025-02-21 - Here is a look at some of this week’s renewable energy news, including a record for community solar capacity in the U.S.

8 Rivers, Wood Sign Pre-FEED Deal for Wyoming Carbon Capture Project

2025-03-13 - 8 Rivers Capital said pre-FEED activities are expected to be completed later in 2025.

Energy Transition in Motion (Week of Jan. 31, 2025)

2025-01-31 - Here is a look at some of this week’s renewable energy news, including two more solar farms in Texas.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.