Matador Resources’ $1.83 billion bolt-on acquisition of the Delaware Basin’s Ameredev II adds 33,500 acres and brings the company’s inventory to approximately 2,000 net locations. (Source: Shutterstock)

Matador Resources has completed a $1.83 billion bolt-on acquisition in the Delaware Basin that increases the company’s inventory to approximately 2,000 net locations. The deal was the largest in the company’s history, the company said on Sept. 19.

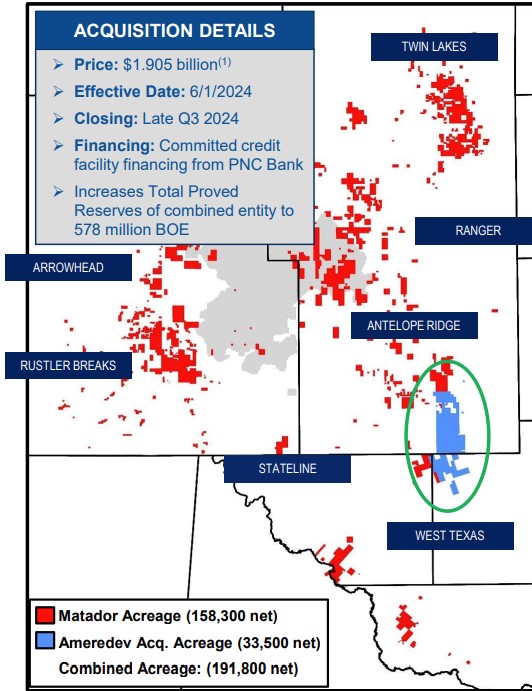

In June, Matador agreed to acquire a subsidiary of Ameredev II Parent LLC’s footprint that includes approximately 33,500 contiguous net acres (82% HBP and more than 99% operated) in the core of the basin.

Matador said that the assets’ production is expected to average between 25,500 boe/d and 26,500 boe/d for the rest of the third quarter, then decline in the fourth quarter of 2024. The reduced production will result from natural declines and the temporary shut-in of wells for offset completion operations. Production is expected to begin increasing again in the first half of 2025.

Matador, based in Dallas, acquired Ameredev, a portfolio company of private equity firm EnCap Investments LP to add producing assets and undeveloped acreage in Lea County, New Mexico, and Loving and Winkler counties, Texas.

The deal also includes 371 net (431 gross) operated locations with targets prospective for the Wolfcamp and Bone Spring formations. Matador estimated total proved oil and natural gas reserves of approximately 118 MMboe, 60% oil.

Matador also acquired a 19% equity interest in the parent company of Piñon Midstream LLC, which has assets in southern Lea County.

Joseph Wm. Foran, Matador’s founder, chairman and CEO, noted that the Ameredev midstream portion of the deal includes gathering assets comprised of 135 miles of water, natural gas and oil pipelines.

“The Ameredev assets include one of the largest, contiguous blocks of available acreage in the core of the Delaware basin—directly between two of our better asset areas—and we are excited to have the opportunity to integrate the Ameredev properties into our existing assets,” he said. The Ameredev gathering assets include 135 miles of water, natural gas and oil pipelines.

Foran noted that Enterprise Products Partners said in August it will acquire Piñon Midstream for $950 million cash.

“Matador expects to receive its proportionate share of such proceeds, in accordance with the applicable payout mechanism, following the closing of the Piñon acquisition, which Enterprise has indicated is expected to occur in the fourth quarter of 2024, subject to customary regulatory approvals,” Foran said.

With the addition of Ameredev’s assets, Matador’s footprint will collectively encompass more than 190,000 net acres in the core of the Delaware Basin, with production exceeding 180,000 boe/d and proved oil and natural gas reserves of over 600MMboe.

The 2,000 net locations provide inventory of 10 years to 15 years, with wells exceeding a 50% average rate of return, Foran said.

Matador funded the Ameredev acquisition through borrowings under its credit facility “after we took significant strides early in 2024 to strengthen our balance sheet and, more recently, increased the commitments under our credit facility from $1.5 billion to $2.5 billion, including a $250 million term loan,” Foran said.

Foran pointed to Matador’s history of successfully integrating past acquisitions, including its $1.6 billion acquisition of Advance Energy Partners’ assets in 2023.

“We are confident that we will successfully integrate the Ameredev assets as we go forward in much the same manner,” he said. “To start, our operations team expects to implement on new wells’ operational efficiencies such as ‘simul-frac’ and ‘trimul-frac’ completion operations, dual fuel technologies and other operational efficiencies on the Ameredev assets that have worked well on other properties.”

Matador estimates that operational efficiencies will result in synergies of approximately $160 million over the next five years.

“We are excited about our positive outlook for the remainder of 2024 and 2025. We look forward to further discussing the Ameredev assets, including our plans for the fourth quarter of 2024, during our third quarter 2024 earnings release and conference call next month,” he said. “We especially want to express our respect and appreciation for Ameredev’s professionalism and cooperation in the transition process, both with its management team and its field and office staff.”

Recommended Reading

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.