KMI is also taking commitments for a new pipeline to move natural gas east from the Katy, Texas area to the Port Arthur, Texas area, where several LNG export projects are under development. (Source: Shutterstock)

Kinder Morgan (KMI) announced its intention to boost its natural gas transport capabilities throughout the southern U.S. through projects worth billions at its third-quarter earnings meeting Oct. 16.

“In my decades of experience in the midstream arena, I've never seen a macro environment so rich with opportunities for incremental buildout of natural gas infrastructure,” said Rich Kinder, KMI executive director. “And at Kinder Morgan, we expect to be a major player in developing that infrastructure.”

Executives discussed four projects, including a long-awaited final investment decision (FID) for its $455 million expansion of the Gulf Coast Express (GCX) pipeline. KMI is also developing other pipeline and storage facilities for natural gas.

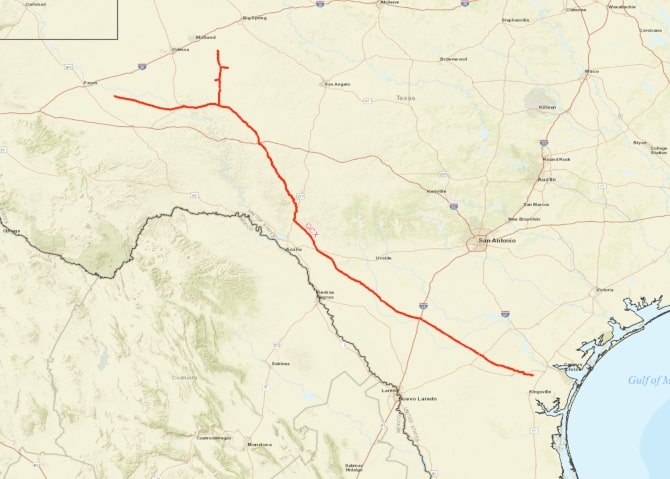

The GCX line has long been one of several projects from different midstream companies slated to increase much-needed natural gas egress out of the Permian Basin.

The GCX is a 500-mile pipeline system currently hauling up to 2 Bcf/d in natural gas from the Permian Basin to the Agua Dulce area close to Corpus Christi, Texas.

With a proposed capacity of 570 MMcf/d, the expansion project is not as large as the recently announced Blackcomb pipeline, which will also terminate near Corpus Christi and have a capacity of 2.5 Bcf/d.

Blackcomb is a joint venture operated by Whitewater Midstream.

RELATED

Blackcomb Takes Lead in Permian Pipeline Race for 2026

Two LNG liquefication projects, Texas LNG and Rio Grande LNG, are under development in the area. Both are in a legal battle for the necessary permits to begin operations, and one caller asked the executives if they were worried about an oversupply of gas in the area if the LNG projects were delayed.

KMI President Kim Dang responded that the GCX expansion project is underwritten by long-term customer contracts and that the company has several options to move the natural gas to where it is needed.

New line near Katy

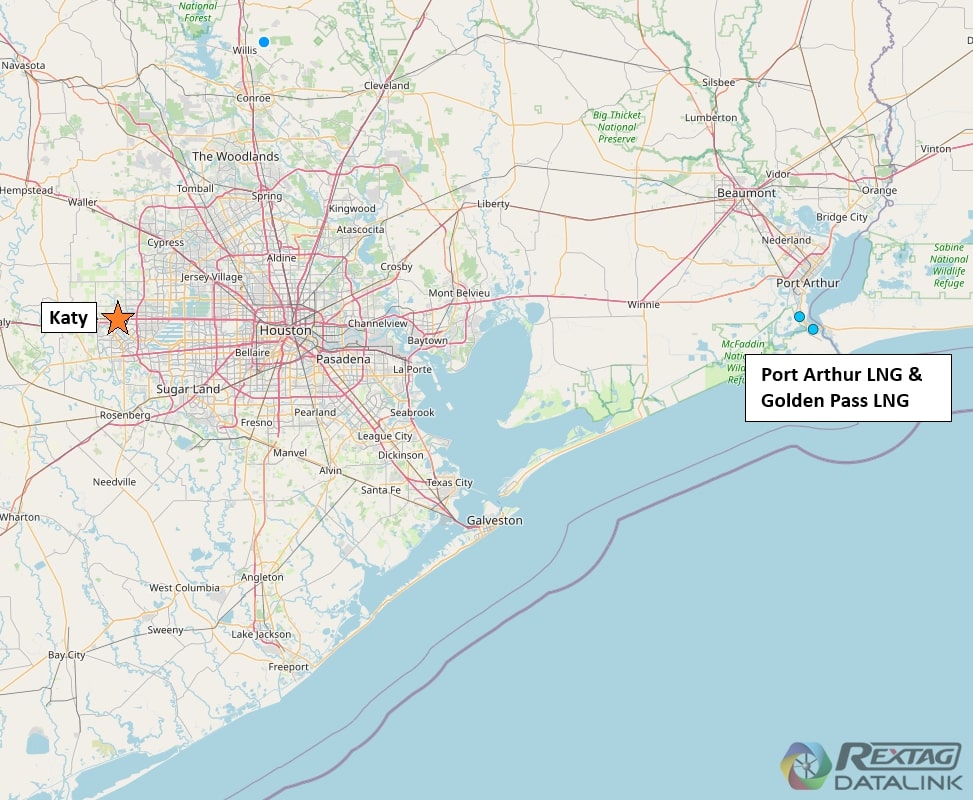

KMI is also taking commitments for a new pipeline to move natural gas east from the Katy, Texas area to the Port Arthur, Texas area, where several LNG export projects are under development.

The Trident Intrastate Pipeline project would have an operational capacity of 2.8 Bcf/d for natural gas and consists of 218 miles of 48- and 42-inch diameter mainline, according to Kinder Morgan’s website. Kinder Morgan is running an initial open season for capacity on the project, which started Oct. 14 and ends Nov. 12.

KMI has set Feb. 1, 2027, as Trident’s target in-service date. Trident Intrastate Pipeline LLC registered as a business with the Texas Secretary of State’s office on Sept. 13. Trident is a wholly owned subsidiary of Kinder Morgan, which will operate the line.

The project already has at least one anchor customer. Golden Pass LNG Chief Commercial Officer Jeff Hammad announced his company had signed on to the project at the Gulf Coast Energy Forum Conference in New Orleans, Energy Intelligence reported.

Port Arthur, Texas-based Golden Pass’ first LNG train is expected to begin service in the first quarter of 2026. The Port Arthur area is also the site of another LNG export project, Sempra Energy’s Port Arthur I & II. Phase 1 is slated for start-up in 2027. Golden Pass and Port Arthur have both received permits from the Federal Energy Regulatory Commission (FERC).

KMI’s Natural Gas Pipelines President Sital Mody confirmed the deal in an email to Hart Energy.

“We are pleased to already have Golden Pass as one of (Trident’s) anchor shippers,” Mody said. “We believe that this prospective project clearly indicates the positive tailwinds we are seeing and demonstrates the growing need for natural gas infrastructure.”

Other projects

Kinder Morgan is also developing an expansion on its 6,900-mile Southern Natural Gas pipeline system. Preliminary survey work for the $3 billion expansion has started. When finished, the network will have an extra 1.2 Bcf/d capacity.

The company is also advancing the NGPL Gulf Coast Storage Expansion project, which will add about 10 Bcf of natural gas storage along one of the company’s longer pipeline systems, stretching from South Texas to the Chicago area.

3Q results

For the quarter, the KMI’s board approved a cash dividend of $0.2875 per share, 2% higher than the third-quarter dividend in 2023. But due to low commodity prices, the company missed overall revenue projections by $360 million, Dang said. Overall revenues for the quarter were $3.69 billion.

Recommended Reading

Scott Sheffield Sues FTC for Abuse of Power Over Exxon-Pioneer Deal

2025-01-21 - A Federal Trade Commission majority opinion in May barred former Pioneer Natural Resources CEO Scott Sheffield from serving in any capacity with Exxon Mobil Corp. following its acquisition of the Permian Basin E&P.

Enterprise Products Considering Moving On from SPOT

2025-02-05 - Permitting delays and challenges finding customers have put the future of Enterprise Product Partners’ Seaport Oil Terminal Project in doubt.

Oil Industry Veteran Beyer Appointed to Key Interior Department Post

2025-02-05 - Energy industry veteran Leslie Beyer has been appointed to assistant secretary of land and minerals management at the U.S. Interior Department, where she will oversee key agencies including the Bureau of Land Management and Bureau of Ocean Energy Management.

VanLoh: US Energy Security Needs ‘Manhattan Project’ Intensity

2025-02-06 - Quantum Capital Group Founder and CEO Wil VanLoh says oil and gas investment, a modernized electric grid and critical minerals are needed to meet an all of the above energy strategy.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.