Coal has fallen further from its throne as natural gas gains strength, according to a report released in August by the International Energy Agency (IEA).

Global output of coal dropped by 458 million tonnes in 2016, with the greatest decline evident in China. The country, which produces and consumes more coal than any other nation, saw its production drop by 9%, or about 320 million tonnes, in 2016, IEA said. The drop comes as China, the world’s most populous country, works to reduce emissions and increase the share of non-fossil fuels in its energy mix.

“One reason why production fell in China was lower demand, particularly for power generation, though China still uses half the world’s coal,” the IEA said. “Lower coal demand has also been seen across the OECD, specifically in the U.S. and the U.K. So globally, despite an increase in India, global coal consumption in 2016 fell by around 2% in energy terms.”

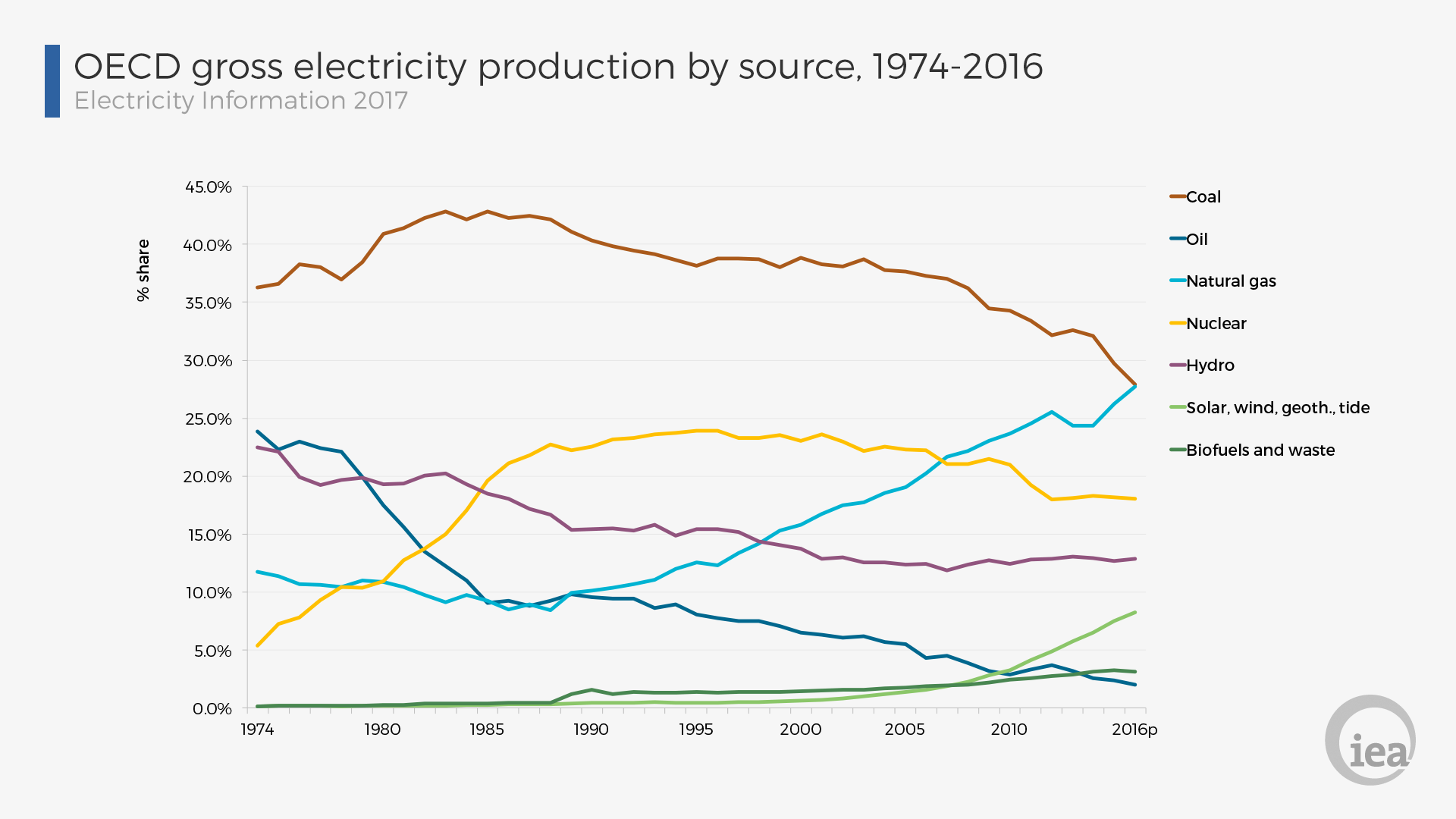

The world’s growing appetite for cleaner-burning fuels such as natural gas has also led to declines in coal use for electricity production. Data from the IEA show electricity generation has fallen since the 1990s when its share was more than 40%. However, since then it has fallen to about 27%—the same percentage for natural gas.

This shift has also led to increased trade for other energy sources, particularly LNG. This is good news considering the growing demand and ample resources.

“The greater demand for gas led to increases in trade, with growth in pipeline gas trade going into the OECD and LNG trade going to Asia,” the IEA said. “Together the increases saw total global gas imports increase by about 47 billion cubic meters in 2016—around 4.5% higher than 2015.”

Australia, which is poised to become the world’s top LNG producer with Qatar ramping up production plans, has seven operating LNG developments and three more—Prelude, Wheatstone and Ichthys—under construction. On the other side of the world, the U.S., which has a long list of LNG projects on tab, is set to become the largest exporter of natural gas. This comes as U.S. consumption of natural gas also increases.

However, the IEA pointed out in its report that it has not been any dramatic change in the shares of fuels in global energy demand in recent years.

“In fact, aside from oil and gas, which have changed their shares significantly over the past forty years, the overall shares of fuels in global energy demand have changed little since 1971,” the IEA said. “Oil remains the most used fuel, mainly for transport, followed by coal, mainly for electricity generation.”

Velda Addison can be reached at vaddison@hartenergy.com.

Recommended Reading

BKV Appoints Dilanka Seimon to New Chief Commercial Officer Position

2025-04-03 - BKV Corp. has created a new chief commercial officer position and placed industry veteran Dilanka Seimon in the role.

NGP Backs Wing Resources with $100MM to Buy Permian Mineral Interests

2025-04-02 - Wing Resources VIII, which is backed by NGP Royalty Partners III, will focus on acquiring “high-quality” mineral and royalty interests across the Permian Basin, the company said.

Exxon Mobil Vice President Karen McKee to Retire After 34 Years

2025-04-02 - Matt Crocker will succeed Karen T. McKee as vice president of Exxon Mobil and president of its product solutions company.

Double Eagle Team Re-Ups in Permian, Backed by EnCap’s $2.5B

2025-04-02 - The fifth iterations of Double Eagle Energy and its minerals subsidiary, Tumbleweed Royalty, have received a $2.5 billion equity commitment from EnCap Investments LP—the day the E&P finalized a $4.1 billion sale to Diamondback Energy.

Waterous Raises $1B PE Fund for Canadian Oil, Gas Investments

2025-04-01 - Waterous Energy Fund (WEF) raised US$1 billion for its third fund and backed oil sands producer Greenfire Resources.