Midstream Business Magazine - May 2012

Editor's Note

Construction Update

Feature

Chesapeake Midstream's Juicy Yield

After ringing the bell at the New York Stock Exchange on August 3, 2010, in celebration of the successful completion of its initial public offering, Chesapeake Midstream Partners LP hit the ground running, buying and building natural gas midstream services in today's hottest unconventional plays.

Closing Bell

Midstream Transactions Are On The Rise

Gas: A Bridge to Nowhere?

The transition to additional natural gas use might not be as short-lived as expected.

Great Expectations

In today's fast pace of new developments, producers have great expectations for their midstream partners.

Montney Midstream

Much like the shale itself, today's Montney midstream infrastructure is a mix of the old and the new.

Rails to Riches

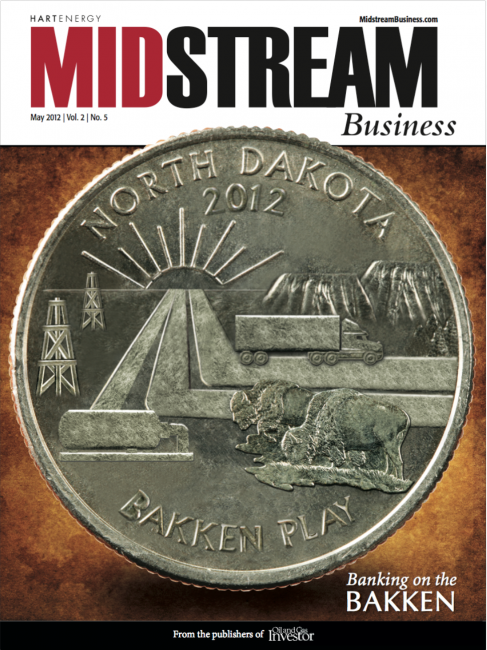

The increase of crude oil production from unconventional sources and the inability of the pipeline networks to keep up create challenges for producers and markets. Today, railroads roll to the rescue.

Static Control

Static electricity can be effectively controlled through grounding and bonding.

The Fight For Gas Supply

Transportation, petrochemical and liquefied natural gas companies see new opportunities for profit-taking by using low-cost natural gas liquids from shale plays as feedstock—but timing is everything.

WTI-Brent Mid-Year Review

High Brent prices versus low oil-product prices squeeze refiners' margins, but create opportunities for midstream companies to bridge gaps in crude oil and product supplies, thus giving them stability and pricing power.

Alerian Index

Finance Matters

M&A Activity Remains Robust

Those MLPs are, however, willing to take acquisition risk to acquire a system once enough assets are in place and operating to effectively de-risk the play.