Oil and Gas Investor Magazine - October 2020

Magazine

Ships in 1-2 business days

Download

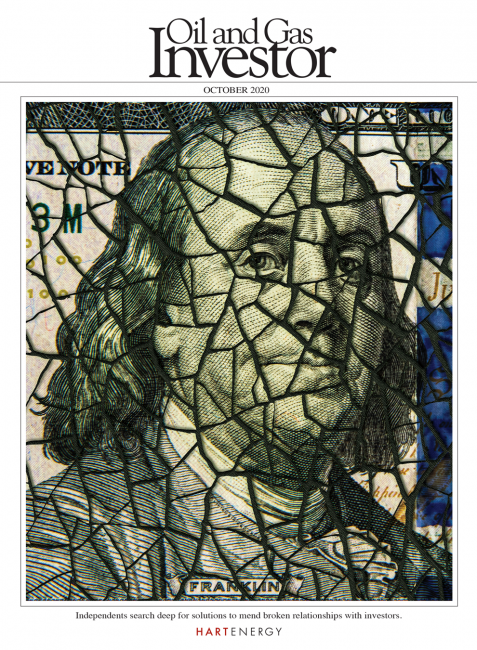

Wall Street kicked U.S. independents to the curb, fed up with a decade of capital destruction, misaligned executive incentives and an indifference to environmental impacts. Do E&P management teams have the chutzpah to transform their models to win back investors? Oil and Gas Investor's cover story investigates what it will take for capital to return to the upstream in full.

Also in this issue:

-

Castleton Resources LLC is now the U.S. E&P consolidation platform of investment-grade Tokyo Gas Co. Ltd.

-

Led by industry icon Tom Ward, Mach Resources this year bagged the vast portfolio of Alta Mesa Resources out of bankruptcy and for a song. His premise: Prepare to be the last owner of any asset acquired. And he’s far from done.

-

Nymex paper-trading of WTI normally represents the spot price. On April 20, the paper was worth less than zero.

-

More or less regulation? Will the pace of climate change measures accelerate? What about Washington gridlock? When the polarized electorate chooses leaders, it will also choose a course for national energy policy.

Cover Story

How to Make E&Ps Investable Again

Wall Street kicked U.S. independents to the curb, fed up with a decade of capital destruction, misaligned executive incentives and an indifference to environmental impacts. Do E&P management teams have the chutzpah to transform their models to win back investors?

Feature

Castleton Resources Executive Q&A: Haynesville & Flush

Castleton Resources is now the U.S. E&P consolidation platform of investment-grade Tokyo Gas Co. Ltd.

Less Than Zero: A CSI on WTI

Nymex paper-trading of WTI crude futures normally represents the spot price. On April 20, the paper was worth less than zero.

Mach Resources: Midcontinent Aggregator

Led by industry icon Tom Ward, Mach Resources this year bagged the vast portfolio of Alta Mesa Resources out of bankruptcy and for a song. His premise: Prepare to be the last owner of any asset acquired. And he’s far from done.

OFS Landscape: Preparing for the Turnaround

Williams recently provided an exclusive video interview in which he shared his views on the way forward for oilfield service companies.

Oil and Gas Investor Policy Outcomes: Energy and the Election

More or less regulation? Will the pace of climate change measures accelerate? What about Washington gridlock? When the polarized electorate chooses leaders, it will also choose a course for national energy policy.

Oil Executive Compensation: Rethinking Payment for Performance

Cracks have begun to show in the traditional performance metrics for executive compensation in the oil and gas industry, and there’s a growing push to reconsider them in the new environment.

A&D Trends

Oil and Gas Investor A&D Trends: Pardon the Dust

At the crack of a bankruptcy judge’s gavel, stalking-horse bidders slowly lurch out of the starting gate, lower their long necks and graze among the oil and gas bankruptcies. The slowly revealed results are fascinating.

At Closing

Oil and Gas Investor At Closing: Make the Downturn Last?

Some good oil and gas companies will fall by the wayside, which is a disappointing thing, terrible for employees and investors. But for those who remain, new efficiencies and better responses will propel them to greater heights. In this way, the one good side effect of this awful downturn—disciplined focus—will last.

From the Editor-in-Chief

From Oil and Gas Investor Editor-in-Chief: Promises and Pivots

Has the E&P sector learned its lessons from the most difficult quarter on record? Some signs show a shift occurring, and there's little question that a drastic industry transformation is required for investors to return.