Oil and Gas Investor Magazine - June 2023

Magazine

Ships in 1-2 business days

Download

THE BIGGEST LITTLE PRODUCER IN THE PERMIAN

Mewbourne Oil CEO Ken Waits shares the strategy that propelled the 58-year-old private company to the top of the nation's most prolific play.

TOP 100 PRIVATE E&Ps

Enverus ran the numbers and analyzed the most prolific producers in the Lower 48 and Gulf of Mexico.

EXECUTIVE INSIGHT

Pioneer's incoming CEO Rich Daley talks M&A and the end of "free money" in an exclusive interview with Oil and Gas Investor's Nissa Darbonne.

ENERGY TRANSITION

Texas native Chris Powers shares insight on technology seen as crucial to helping the world hit net-zero ambitions and the role Chevron New Energies is playing.

MEGA MERGER

ONEOK will join midstream's mightiest with $18.8 billion cash-and-stock merger with Magellan, one of the largest midstream deals announced in recent years.

OCEANS OF POTENTIAL

Developments in deepwater oil and gas will play a critical role in the transition to cleaner energy, industry insiders say.

THE HUNT FOR M&A

After selling FireBird Energy LLC to Diamondback last year, FireBird Energy II is on the hunt for deals to develop another asset in the Permian.

INVESTOR INSIGHT

E&Ps continue robust buybacks as the energy industry offers investors more capital and stability, even as commodity prices falter.

2023 MINERALS & ROYALTIES REPORT

'WE'RE STILL TOO SMALL'

After growing into one of the nation's largest public mineral and royalty companies last year, Sitio Royalties continues to search for growth opportunities.

PRIVATE EQUITY RETURNS WITH OPEN MINDS AND OPEN WALLETS

As private equity firms return to upstream oil and gas, firms might raise up to $15 billion for the sector, but the industry could use up to $25 billion, experts say.

THE EVOLUTION OF MINERAL DEAL VALUATIONS, TEAMS

Experts say U.S. minerals and royalties teams are getting bigger, holding acreage for longer and being more sophisticated in their M&A approach.

MINERAL AND ROYALTY PLAYERS GAMING FOR MORE M&A

The value of oil and gas mineral and royalty transactions set a new $6.8 billion record in 2022, and dealmakers in the space are ready to up the ante.

2023 MINERALS AND ROYALTIES BUYERS AND SELLERS DIRECTORY

Cover Story

The Biggest Little Producer in the Permian

Mewbourne Oil CEO Ken Waits shares the strategy that propelled the 58-year-old private company to the top of the nation’s most prolific play, the Permian Basin.

Feature

E&Ps Continue Robust Buybacks Even as Commodity Prices Falter

Stock buybacks continue to be a robust part of energy companies’ capital-return-to-investors strategy which experts see as a sign of the industry’s maturity and move toward retiring large portions of its market share.

Exclusive: FireBird Energy Prowling Permian for Midland Basin M&A

After selling FireBird Energy LLC to Diamondback last year, the same team is searching for deals to develop another asset in the Midland, and possibly the Delaware Basin, too.

Like It or Not, Deepwater Oil and Gas Holds the Key to Energy Transition

Developments in deepwater oil and gas play a critical role in the quest to transition to cleaner energy.

ONEOK to Acquire Magellan Midstream Partners for $18.8 Billion

ONEOK Inc. and Magellan Midstream Partners LP are merging in a cash-and-stock deal to create a Tulsa, Oklahoma-based midstream giant with a combined 25,000 miles of liquids-oriented pipelines.

Pioneer’s Rich Dealy on M&A and the End of ‘Free Money’

“I think that these higher [interest] rates are going to lead to more equity [deals] from the smaller companies,” the Pioneer Natural Resources president and COO Rich Dealy said in an exclusive interview.

Q&A: Chevron’s $10 Billion, Low-carbon Game Plan

Texas native Chris Powers discusses carbon capture technology seen as crucial to helping the world hit net-zero ambitions and the role Chevron New Energies is playing to make it happen.

Ranked: The Top 100 Private E&Ps

Enverus ran the numbers and analyzed the most prolific private E&Ps in the Lower 48 and Gulf of Mexico.

Top 15 Private E&Ps in the Midcontinent, Gulf Coast

The leading private E&Ps in the Midcontinent and Gulf Coast, according to research from Enverus.

Top 20 Private E&Ps in the Permian, Rockies

Enverus lists the top 20 private E&Ps in the Permian and Rockies for Hart Energy.

Top 20 Private Oil, Gas Operators

Enverus lists the top 20 private oil and gas operators for Hart Energy.

Top Private E&Ps in Eastern U.S., GoM

Enverus lists the top 10 private E&Ps in the eastern U.S. and the top 5 in the Gulf of Mexico for Hart Energy.

A&D Trends

Analysts: Callon’s $1.1 Billion A&D Aids Debt Reduction, Investor Returns

Callon’s exit from the Eagle Ford Shale will refocus the E&P as a Permian pure-play and should help reduce debt and return capital to investors, analysts say.

Diamondback Closes Permian Divestitures, Eyes More Midstream Sales

Diamondback Energy plans to sell off $1 billion in non-core assets by the end of 2023, including interests in long-haul pipelines and gathering and processing systems.

Enverus: Eagle Ford Upstream Deal Activity Soars in Q1

E&Ps continue to look at the Permian Basin for undeveloped acreage, but deal activity in the Eagle Ford Shale surged in the first quarter as buyers searched for producing assets.

Exclusive: Scott Sheffield Offers Peek Behind the Permian’s M&A Curtain

In an interview with Hart Energy, Pioneer CEO Scott Sheffield and his newly announced successor Richard Dealy discussed the future of the Permian Basin and the E&Ps own M&A strategy.

Matador Resources Prioritizes Reducing Debt After $1.6B Acquisition

Matador expects a boost in production from its $1.6 billion Permian Basin acquisition and touts new “horseshoe” wells as first-quarter results came in above expectations

Will ConocoPhillips Play Spoiler to Suncor’s $4B TotalEnergies Deal?

ConocoPhillips is “carefully” reviewing its first refusal rights in Surmont right of refusal to buy out partner TotalEnergies’ Surmont project as Suncor looks to buy TotalEnergies EP Canada for $4 billion.

At Closing

The Great Eagle Ford Refrac

Recompletions in the Eagle Ford are underway, with future refrac wells identified by companies such as Devon Energy and Murphy Oil.

Editors Comment

Column: How to Blow Up an Eco-Terrorist Manifesto

‘How to Blow Up a Pipeline’ rates somewhere between nauseating and terrifying in its rationalization of climate violence.

From the Editor-in-Chief

Private Investment Dynamic Holds Crucial Role in Supply, Security, Future

Private equity is coming back to the upstream sector, but is dramatically outweighed by the forecasted market supply needed to prevent a shortfall.

International Highlights

OTC: African Investment and the West’s Energy Transition ‘Double Standard’

An all-African panel at OTC in Houston talked about what Africa needed to do to attract investors, why Africa would transition at its pace and double standards with Africa’s development path compared to other countries.

Pitts: Africa Questions Pace of West’s Energy Transition Push

Africa understands that the energy transition is necessary; the problem is the pace desired by the West.

Q&A: Eurasia’s Raad Alkadiri Talks US LNG Risks, Geopolitical Issues

Eurasia Group’s managing director Raad Alkadiri spoke with Hart Energy about the Russia-Ukraine war, the Harry Potter world of energy and Qatar and the U.S.’ plans to supply Europe and Asia with more LNG.

NewsWell

Could Geothermal Be the Next Drilling Boom?

Some experts say geothermal energy could follow a path similar to the unconventional oil and gas revolution.

High Demand Equals Higher Midstream Q1 Earnings

Midstream is focused on buying, building and growing in all ways, but in the meantime, first-quarter earnings are good.

Hydrogen? Sure—Just Don’t Mention a Carbon Tax

At the BNEF Summit in New York, panelists gabbed about hydrogen—and whispered about a carbon tax.

Midstream, Investors Dive into the Business of CCS Tax Credits

Midstream companies are attempting to wrap new CCS business models around their existing organizations to take advantage of lucrative tax incentives created by the Inflation Reduction Act.

NextEra to Sell Eagle Ford, Pennsylvania Pipelines, Shift to Renewables Only

NextEra Energy Partners will first launch a process to sell its Eagle Ford assets in 2023 and its Pennsylvania assets in 2025, John Ketchum, NextEra’s chairman, president and CEO said.

Technology Report

AI and the Path Toward Making Sense of Everything

A new automated field production solution uses digital technologies to break down silos.

In the Battle for Cybersecurity, End Users are First Line of Defense

Cybersecurity behaviors must become as automatic as the use of hard hats and steel toe boots, experts at the Offshore Technology Conference said.

OTC: Well Abandonment: A Procrastination Case Study

Decommissioning activities are expected to reach nearly $100 billion through 2030, but planning early can minimize the outlay.

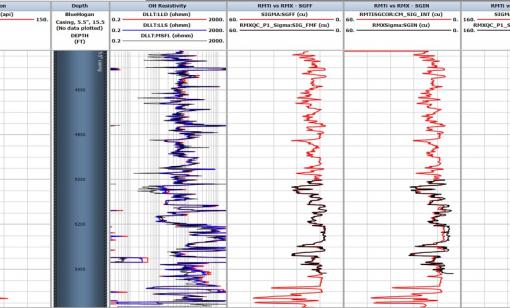

Shining a Light on Downhole Completions

Optimal well spacing and solving downhole issues depends on complete data, extensive collaboration — and fiber optics.

Taking the Pulse of Older Reservoirs

Pulsed neutron logging service for cased hole environment can help operators understand where oil-water, gas-water contacts exist in aging reservoirs.

Trends & Analysis

Carlson: As Haynesville Goes, So Goes the Gas Market

High storage inventory is likely to render the current trajectory of U.S. natural gas supply unsustainable, East Daley Analytics research has concluded.

Midyear Outlook: Will Crude and Gas Prices Rebound This Year?

Volatility exists in every corner of the market, but demand is the real wild card.

Paisie: Global, Domestic Uncertainty Weigh on Oil Prices

“Without a supply shock, we do not expect oil prices will break through $100 this year,” says industry analyst John Paisie.