Oil and Gas Investor Magazine - March 2024

Magazine

Ships in 1-2 business days

Download

The OGInterview - Between a Rock and a Liquefied Place

TG Natural Resources rides the LNG wave with Rockcliff deal amid shale consolidation.

The Pause that Depresses

Industry leaders worry that the DOE's suspension of approvals for LNG projects will persuade global customers to seek other suppliers and wreak havoc on energy security.

Excelerate Energy CEO Kobos Bullish on US LNG

In a world rattled by instability, his company offers a measure of energy security to natural gas users via its fleet of FSRUs.

Gushing, Ohio: EOG Joins Ascent, Encino at the Top

All three producers are landing 3-milers. Some are 3.5 miles.

Vitol: Saudis to Quit Supply Cuts

International trader also predicts that oil demand will peak in the early 2030s.

2024 Influential Women in Energy

Oil and Gas Investor presents the 2024 Influential Women in Energy honorees. Now in its seventh year, this program recognizes 36 extraordinary leaders based on their numerous professional accomplishments, demonstrated leadership aptitudes and service to the community and the industry. These women come from all walks of life and represent a small but growing group of impressive women who are breaking through barriers in a male-dominated field. In these pages of this special report, you will find in-depth profiles on each honoree, highlighting their achievements and how they got there.

Cover Story

From Tokyo Gas to Chesapeake: The Slow-burning Fuse that Lit Haynesville M&A

TG Natural Resources rides the LNG wave with Rockcliff deal amid shale consolidation boom.

Feature

Excelerate Energy’s CEO Kobos Bullish on US LNG

In a world rattled by instability, his company offers a measure of energy security to natural gas users via its fleet of floating storage and regasification units.

Gushing, Ohio: EOG Joins Ascent, Encino in Top Oil Wells

EOG’s latest wells in its new Ohio oil play are rolling into state public records, while Ascent Resources and Encino Energy are reporting the biggest producers. All three are landing 3-milers. Some are 3.5 miles.

The Problem with the Pause: US LNG Trade Gets Political

Industry leaders worry that the DOE’s suspension of approvals for LNG projects will persuade global customers to seek other suppliers, wreaking havoc on energy security.

Vitol: Oil Demand Peaks in 2030s, Saudis to Quit Supply Cut This Year

Vitol executive Ben Marshall told oil and gas producers at IPAA’s Private Capital Conference that Saudi Arabia is losing patience. Also, the energy transition will take longer than expected.

A&D Watch

4Q Deal-Making Was $144B; What’s Next?

U.S. takeout targets are few now. Operators may go abroad to add reserves, according to Enverus. Private E&Ps may pick up offshoots from portfolio pruning.

Analysts: Diamondback-Endeavor Deal Creates New Permian Super Independent

The tie-up between Diamondback Energy and Endeavor Energy—two of the Permian’s top oil producers—is expected to create a new “super-independent” E&P with a market value north of $50 billion.

Energy Transfer’s Sunoco Buys NuStar Energy for Scale, Permian Oil Footprint

Sunoco LP is gaining greater scale and adding new business lines through its $7.3 billion acquisition of NuStar Energy LP. But given Energy Transfer’s 100% ownership of the Sunoco partnership, could the deal face pushback by regulators?

Commentary

Carlson: $17B Chesapeake, Southwestern Merger Leaves Midstream Hanging

East Daley Analytics expects the $17 billion Chesapeake and Southwestern merger to shift the risk and reward outlook for several midstream services providers.

Commentary: Fact-checking an LNG Denier

Tampa, Florida, U.S. Rep. Kathy Castor blamed domestic natural gas producers for her constituents’ higher electricity bills in 2023. Here’s the truth, according to Hart Energy's Nissa Darbonne.

Kissler: The Challenge for Oil is Falling Demand, Despite Heightened Middle East Conflicts

Even though demand is the bigger weight on traders’ minds right now, Red Sea attacks and the U.S.’ “shadow war” with Iran still have the potential to impact the global oil supply, and consequently, prices.

Markman: I’d Like to Not Thank the Academy…

The oil industry does not come off well in the movies and the public can miss the big picture.

Energy Transition

A Year of Probable Improvement: The Energy Transition in 2024

The year ahead could include more technology stacking, commercialization of geothermal technologies and improved economic conditions, analysts say.

Tax Credit’s Silence on Blue Hydrogen Adds Uncertainty

Proposed rules for the 45V hydrogen production tax credit leave blue hydrogen up in the air, but producers planning to use natural gas with carbon capture and storage have options.

Finance & Investment

BKV CEO: Barnett E&P Waits for Right Window to Launch IPO

After volatility in natural gas prices and broader economic instability in 2023, could BKV Corp.—the largest Barnett Shale producer—move forward with its IPO this year?

Private Equity: Seeking ‘Scottie Pippen’ Plays, If Not Another Michael Jordan

The Permian’s Tier 1 acreage opportunities for startup E&Ps are dwindling. Investors are beginning to look elsewhere.

Sabadus: US to Steer Global Energy Markets Amid Clashing Forces

Increased geopolitical risk and the shift from fossil fuels to renewables are pulling the world in different directions, and the U.S. will be called to play a significant role in the global tug of war.

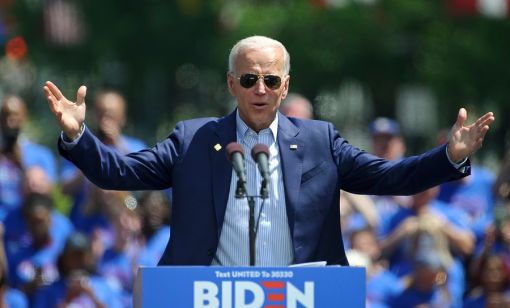

Silver Linings in Biden’s LNG Policy

In the near term, the pause on new non-FTA approvals could lift some pressure of an already strained supply chain, lower both equipment and labor expenses and ease some cost inflation.

Global Energy

Beach Town Corpus Christi Grows into America’s Top Energy Port

The Port of Corpus Christi is the U.S.’ largest energy export gateway and in terms of total revenue tonnage as increased midstream investments have opened export markets for the prolific Permian Basin.

Pitts: Producers Ponder Ramifications of Biden’s LNG Strategy

While existing offtake agreements have been spared by the Biden administration's LNG permitting pause, the ramifications fall on supplying the Asian market post-2030, many analysts argue.

Midstream

Midstream Operators See Strong NGL Performance in Q4

Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.

Technology

Well Logging Could Get a Makeover

Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Trends & Analysis

Daugherty: Diamondback Scales Up Amid Consolidation Super Cycle

It’s time for the strongest among the services sector to follow Diamondback's lead: find fortifying prey and hunt.

Oil Market Shifting Back to Supply/Demand

Stratas Advisors' John Paisie forecasts the price of Brent crude to increase during the second and third quarters of this year and move toward $90/bbl.

Watson: Implications of LNG Pause

Critical questions remain for LNG on the heels of the Biden administration's pause on LNG export permits to non-Free Trade Agreement countries.