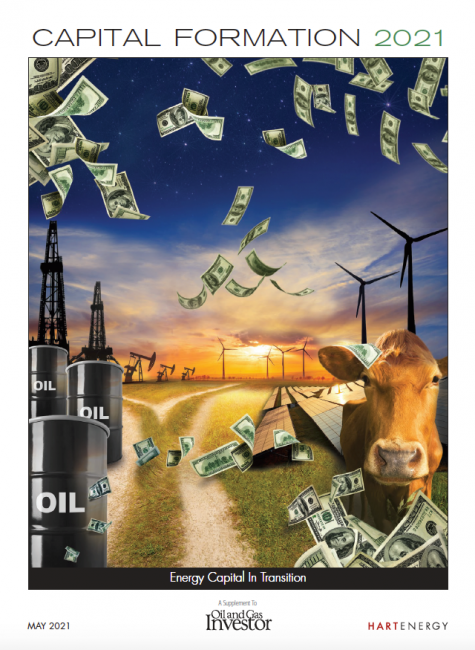

Capital Formation 2021

Publication

Ships in 1-2 business days

Download

Energy Capital In Transition

Oil and Gas Investor’s Capital Formation: Clearing the PE Logjam

Much as the current market for oil and gas assets functions today at a relatively lower level than in recent years, the trading of private equity energy investments in the $60 billion secondary market is “logjammed.”

Oil and Gas Investor’s Capital Formation: Near and Present Future of RBLs

Fewer and fewer commercial banks are making reserve-based loans for oil and gas producers, and those that do are tightening up the borrowing base. Here’s an update on what’s happening within this area of the capital stack, and where it’s going.

Oil and Gas Investor’s Capital Formation: PE’s New Game

As the era of build-and-flip ends, private equity investors are keen to find ways to generate returns.

Oil and Gas Investor’s Capital Formation: The Return of Debt and Equity

The stagnation for new capital in the oil and gas industry is breaking; however, 2020 will continue to influence debt and equity sources in 2021.