Expro Bags Chevron Contract for Riserless Well Intervention System

The five-year contract is for the supply of light well intervention vessel services for the Chevron-operated Gorgon facility.

Australia-China Row Halts Woodside LNG Asset Sale

Woodside Petroleum had been in talks with China's national oil firms, including PetroChina, and second-tier firms to sell a modest stake in the linked Scarborough gas field and Pluto LNG Train 2 project.

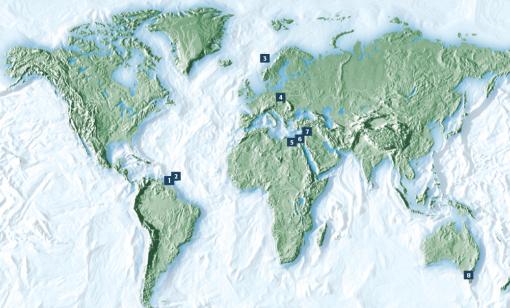

E&P Plus: October 2020 International Drilling Activity Highlights

Check out the latest oil and gas drilling activity highlights from around the world featured in the October issue of E&P Plus including Apache’s recent discovery offshore Suriname plus additional reservoirs in Guyana’s Stabroek Block.

CGG’s Releases 3D Seismic Survey Results from Australia’s Gippsland Basin

CGG has unveiled a fourth-quarter delivery of the fast-track results from its recently acquired 3D multiclient seismic survey of the Gippsland Basin in South East Australia on Sept. 22.

Australia to Invest $13 Billion in Energy Technology to Cut Emissions

Australia plans to invest AU$18 billion (US$13 billion) over the next 10 years in technologies to cut carbon emissions in the fight against climate change, the country’s energy minister said on Sept. 22.

Japan’s Inpex, Chevron Cut Jobs in Australia

Inpex operates the $45 billion Ichthys project in Darwin. Chevron’s operations in Australia have been hit this year by an outage at its giant Gorgon LNG plant.

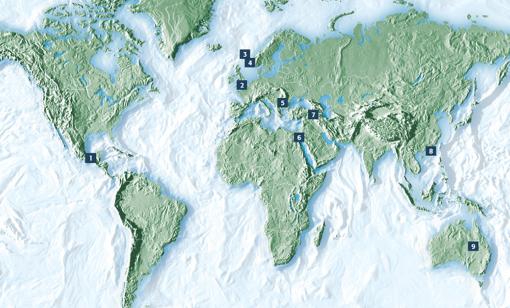

E&P Plus: September 2020 International Drilling Activity Highlights

Check out the latest oil and gas drilling activity highlights from around the world featured in the September issue of E&P including plans to drill and test a play offshore the U.K. originally discovered by ConocoPhillips in 1982.

Chevron Delays Restart of Gorgon LNG Unit to October for Extra Repairs

Train 2 at Australia’s second-largest LNG plant has been shut since May for maintenance, which was extended after cracks were found in the production unit’s propane kettles.

Exxon Mobil Weighs Global Job Cuts after Unveiling Australian Lay-off Plan

Exxon is the latest oil major to embark on axing jobs spurred by a historic collapse in fuel demand because of the coronavirus pandemic.

Best of This Week’s Drilling Activity Highlights (Aug. 28, 2020)

ConocoPhillips Alaska wildcat hits hydrocarbons plus high-volume Marcellus Shale completions by Chesapeake Energy in Pennsylvania’s Susquehanna County top this week’s drilling activity highlights from around the world.