IEA: Permian, Bakken, Eagle Ford Hit Record NGL Production

The U.S. and Canada were the biggest drivers of non-OPEC+ supply with the Permian Basin, Eagle Ford Shale and the Bakken drove U.S. NGL production to a record high in April, the IEA said.

Hess: Cash Flow to Rise 25% Annually for Half Decade

U.S. oil producer Hess Corp. expects an increase in cash flow of 25% per year for the next five years, with oil remaining about $75 per barrel, CEO John Hess told an investor conference on June 25.

Ovintiv Completes $4.2B Midland Basin Buy, Bakken Exit

Ovintiv closed its previously announced $4.2 billion Midland Basin acquisition adjacent to its current operations in the Permian, as well as the sale of the entirety of its Bakken position, the company said on June 12

Water Management in Shale Basins No Waltz

Water management and ESG goals move in tandem across the Permian, Eagle Ford, Bakken and Appalachian regions.

SUPER DUG: Enerplus Banks on ‘Underappreciated’ Bakken, Refracs

Enerplus COO Wade Hutchings expects the company to generate free cash flow of $475 million in 2023 with plans to launch refracturing efforts in the Bakken while easing down Marcellus Shale production.

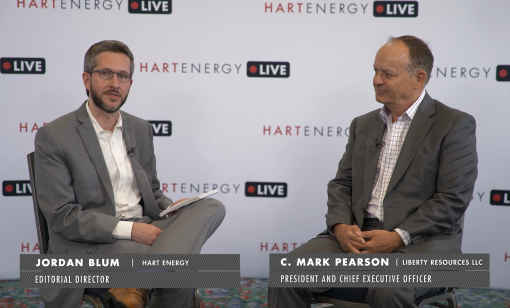

SUPER DUG: Liberty CEO Pearson Talks EOR in the Bakken

At the SUPER DUG conference in Fort Worth, Texas, Liberty Resources CEO C. Mark Pearson sat down with Hart Energy's Jordan Blum to discuss his company's usage of Bakken-produced gas and EOR in the Bakken.

ConocoPhillips’ Stratagem: Permian, Bakken, Eagle Ford Dominance

ConocoPhillips is not just the largest unconventional producer, but its Midland, Delaware, Eagle Ford and Bakken positions average $32 WTI breakevens, the company’s Lower 48 chief said at Hart Energy’s SUPER DUG conference.

Chord Energy Aims to Bulk Up in Bakken, Divest Non-core

As the company sheds non-core assets around the U.S., Chord Energy is looking for opportunities to grow its premier Williston Basin position.

Hess Declares Regular Quarterly Dividend

Hess Corp.’s board of directors declared a regular quarterly dividend of $0.4375 per share, the company said on May 17.

Permian, Haynesville Driving U.S. Oil, Gas Production Growth

The prolific Permian Basin will lead gains in both crude oil and natural gas production next month, according to new figures from the U.S. Energy Information Administration.