Chevron CEO: Permian, D-J Basin Production Fuels US Output Growth

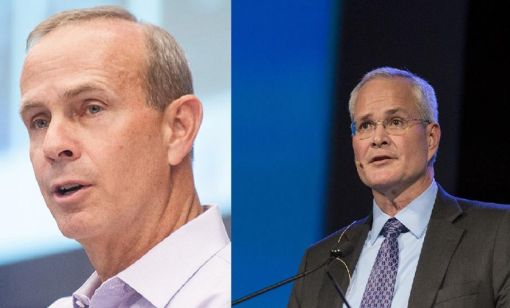

Chevron continues to prioritize Permian Basin investment for new production and is seeing D-J Basin growth after closing its $6.3 billion acquisition of PDC Energy last year, CEO Mike Wirth said.

Exxon Mobil, Chevron See Profits Fall in 1Q Earnings

Chevron and Exxon Mobil are feeling the pinch of weak energy prices, particularly natural gas, and fuels margins that have cooled in the last year.

Guyana’s Stabroek Boosts Production as Chevron Watches, Waits

Chevron Corp.’s planned $53 billion acquisition of Hess Corp. could potentially close in 2025, but in the meantime, the California-based energy giant is in a “read only” mode as an Exxon Mobil-led consortium boosts Guyana production.

Hess Midstream Increases Class A Distribution

Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.

EIA: Permian, Bakken Associated Gas Growth Pressures NatGas Producers

Near-record associated gas volumes from U.S. oil basins continue to put pressure on dry gas producers, which are curtailing output and cutting rigs.

Chord, Enerplus’ $4B Deal Clears Antitrust Hurdle Amid FTC Scrutiny

Chord Energy and Enerplus Corp.’s $4 billion deal is moving forward as deals by Chesapeake, Exxon Mobil and Chevron experience delays from the Federal Trade Commission’s requests for more information.

Marketed: Williston, Powder River Basins 247 Well Package

A private seller has retained EnergyNet for the sale of a Williston and Powder River basins 247 well package in Sheridan, Montana, Burke and McKenzie counties, North Dakota and Campbell County, Wyoming.

Marketed: Stone Hill Minerals Holdings Williston Basin 10 Well Package in North Dakota

Stone Hill Minerals Holdings has retained EnergyNet for the sale of a Williston Basin 10 well package opportunity in Williams County, North Dakota.

Continental Resources Makes $1B in M&A Moves—But Where?

Continental Resources added acreage in Oklahoma’s Anadarko Basin, but precisely where else it bought and sold is a little more complicated.

Williston Warriors: Enerplus’ Long Bakken Run Ends in $4B Chord Deal

Chord Energy and Enerplus are combining to create an $11 billion Williston Basin operator. The deal ends a long run in the Bakken for Enerplus, which bet on the emerging horizontal shale play in Montana nearly two decades ago.