Utah’s Uinta Basin. (PICTURED): A multi-frac job being completed for Berry Corp. in Duchesne County, Utah. (Source: Berry Corp.)

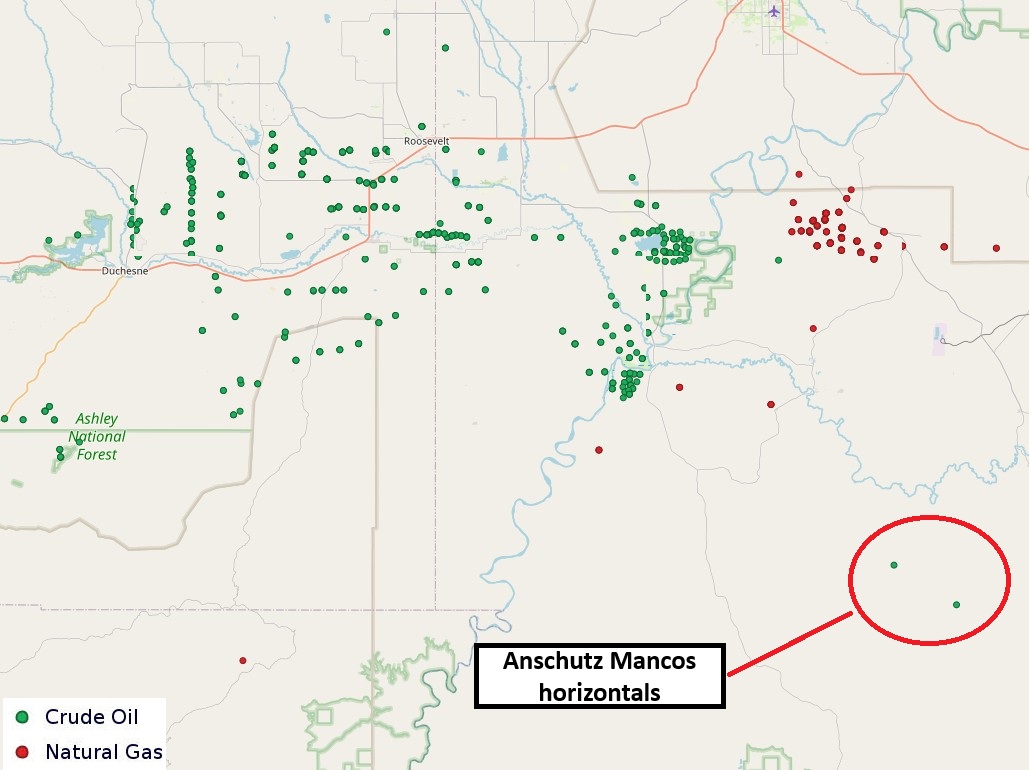

Near the red-hot Uinta Basin, privately held Anschutz Exploration is testing horizontal wells in Utah’s deeper Mancos Shale bench.

Denver-based Anschutz has landed a pair of Mancos laterals in Uintah County, Utah, according to Utah state records.

It’s a part of the Uinta Basin that has attracted relatively little horizontal development, compared to the activity in the oil play’s core further to the north.

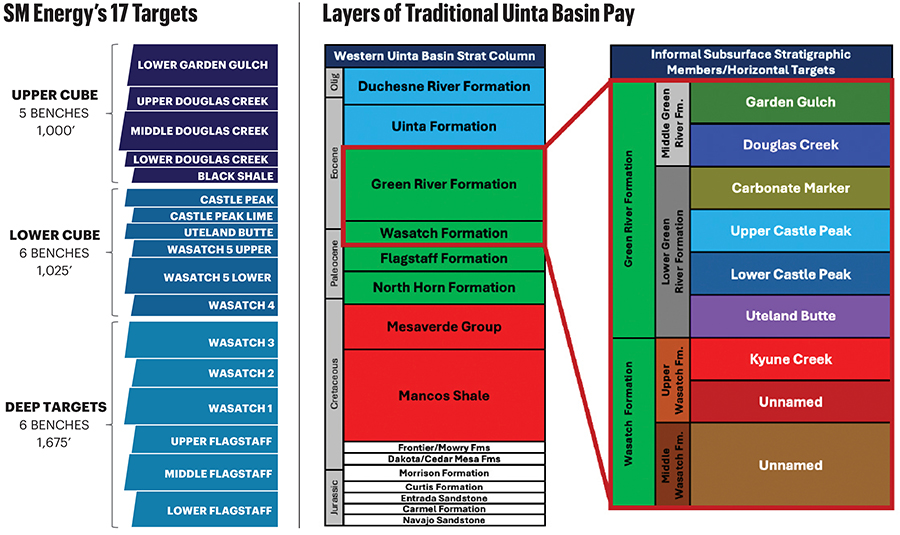

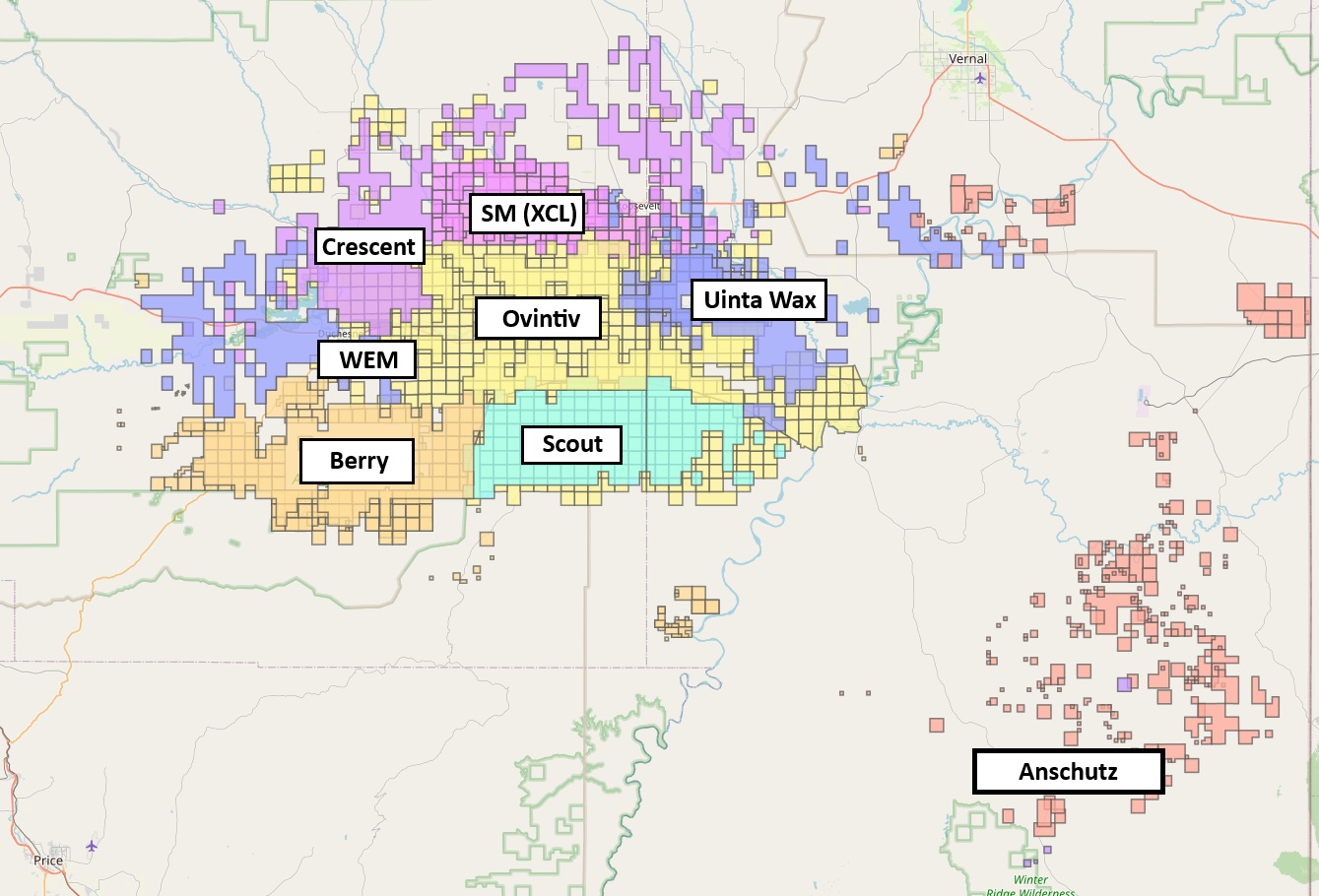

The most active Uinta producers have landed laterals in the Uteland Butte interval, the basin’s primary horizontal target, according to data analytics firm Novi Labs. The Uinta’s highest-quality rock, generally, has the best Uteland Butte inventory.

The Green River Formation’s Uteland Butte is generally homogeneous across SM Energy’s new Uinta asset, acquired from leading private producer XCL Resources in a $2.1 billion deal this summer. SM acquired an 80% undivided interest in XCL’s assets for $2.1 billion, while non-operated specialist Northern Oil & Gas (NOG) picked up a 20% stake.

Ovintiv’s Uinta asset—which it recently agreed to sell to private E&P FourPoint Resources for $2 billion—also has significant Uteland Butte inventory. But the Ovintiv asset also boasts upside in the Uinta’s secondary benches, the Castle Peak and Douglas Creek.

A few operators, including Berry Corp. and Wasatch Energy Management, are landing laterals in the Uinta’s deeper Wasatch bench.

But Anschutz is leading delineation of the Mancos Shale bench, which underlies the Wasatch, Uteland Butte, Castle Peak and Douglas Creek formations.

“Almost no one has tried this where they’re at,” said Brandon Myers, head of research at Novi Labs.

RELATED

Scout Taps Trades, Farm-Outs, M&A for Uinta Basin Growth

Liquids-rich Mancos

Horizontal Mancos development has historically been a bigger story in New Mexico’s gassy San Juan Basin.

But Anschutz has seen interesting results from its two Uinta Mancos wildcats, according to an analysis of Utah state data.

The wells—Bierstadt Fed 1123-16-28 14 MCH and Torreys Fed 1124-32-29-4X MCH—produced nearly 176,000 bbl of oil since first coming online in October 2023 through September 2024, according to the most recent data. Gas output reached nearly 3 Bcf.

Production from the Bierstadt well averaged 934 bbl/d of oil (~2,267 boe/d) over 30 days in November 2023.

“This is liquids-rich Mancos,” Myers said. “The San Juan is typically very dry—though there is liquids-rich San Juan if you go way to the southwest.”

Based on Novi Labs forecasts, Anschutz’ Uinta Mancos wells could see EURs of between 250,000 bbl and 400,000 bbl of oil; Gas EURs could range between 4 Bcf to 8 Bcf.

Joe DeDominic, Anschutz Exploration president, declined to comment on the company’s Utah Mancos activity so far.

Exploration of the Uinta Basin’s stacked pay is still in the earliest innings. On the asset it acquired from XCL Resources, SM Energy has identified 17 productive zones with potential upside.

RELATED

Laying in Wait: San Juan’s ‘Remarkable’ Mancos Shale Oil Wells

Rockies powerhouse

Outside of its Uinta Basin wildcatting, Anschutz Exploration is one of the most active developers in Wyoming’s Powder River Basin.

During the third quarter, Anschutz acquired additional assets in the northern Powder River Basin from Occidental Petroleum, Oxy CEO Vicki Hollub said during a November earnings call.

The deal with Anschutz included assets that Occidental picked up through its own blockbuster acquisition of Anadarko Petroleum in 2019.

“But we saw early on that the southern part of the Powder River Basin was by far the most contiguous and the part that we felt like we could get the most value out of,” Hollub said during the company’s Nov. 13 third-quarter earnings call.

Anschutz confirmed the acquisition, noting that Oxy retained its core position in Converse County, Wyoming.

RELATED

Now, the Uinta: Drillers are Taking Utah’s Oily Stacked Pay Horizontal, at Last

Recommended Reading

Alliance Resource Partners Adds More Mineral Interests in 4Q

2025-02-05 - Alliance Resource Partners closed on $9.6 million in acquisitions in the fourth quarter, adding to a portfolio of nearly 70,000 net royalty acres that are majority centered in the Midland and Delaware basins.

What's Affecting Oil Prices This Week? (Feb. 3, 2025)

2025-02-03 - The Trump administration announced a 10% tariff on Canadian crude exports, but Stratas Advisors does not think the tariffs will have any material impact on Canadian oil production or exports to the U.S.

Chevron to Lay Off 15% to 20% of Global Workforce

2025-02-12 - At the end of 2023, Chevron employed 40,212 people across its operations. A layoff of 20% of total employees would be about 8,000 people.

Shell Raises Shareholder Distributions and LNG Sales Target, Trims Spending

2025-03-25 - Shell trimmed its annual investment budget to a $20 billion to $22 billion range through 2028 after spending $21.1 billion last year.

Utica Oil’s Infinity IPO Values its Play at $48,000 per Boe/d

2025-01-30 - Private-equity-backed Infinity Natural Resources’ IPO pricing on Jan. 30 gives a first look into market valuation for Ohio’s new tight-oil Utica play. Public trading is to begin the morning of Jan. 31.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.