Devon Energy is dissolving a joint venture with BPX Energy. (Pictured): The Devon Energy Center tower in downtown Oklahoma City, Oklahoma. (Source: Shutterstock.com)

Two of South Texas’ top producers, Devon Energy and BPX Energy, agreed to dissolve their joint venture (JV) partnership in the Eagle Ford Shale.

The move ends a 15-year partnership originally structured by Petrohawk Energy and GeoSouthern Energy, two early pioneers in developing the Eagle Ford play.

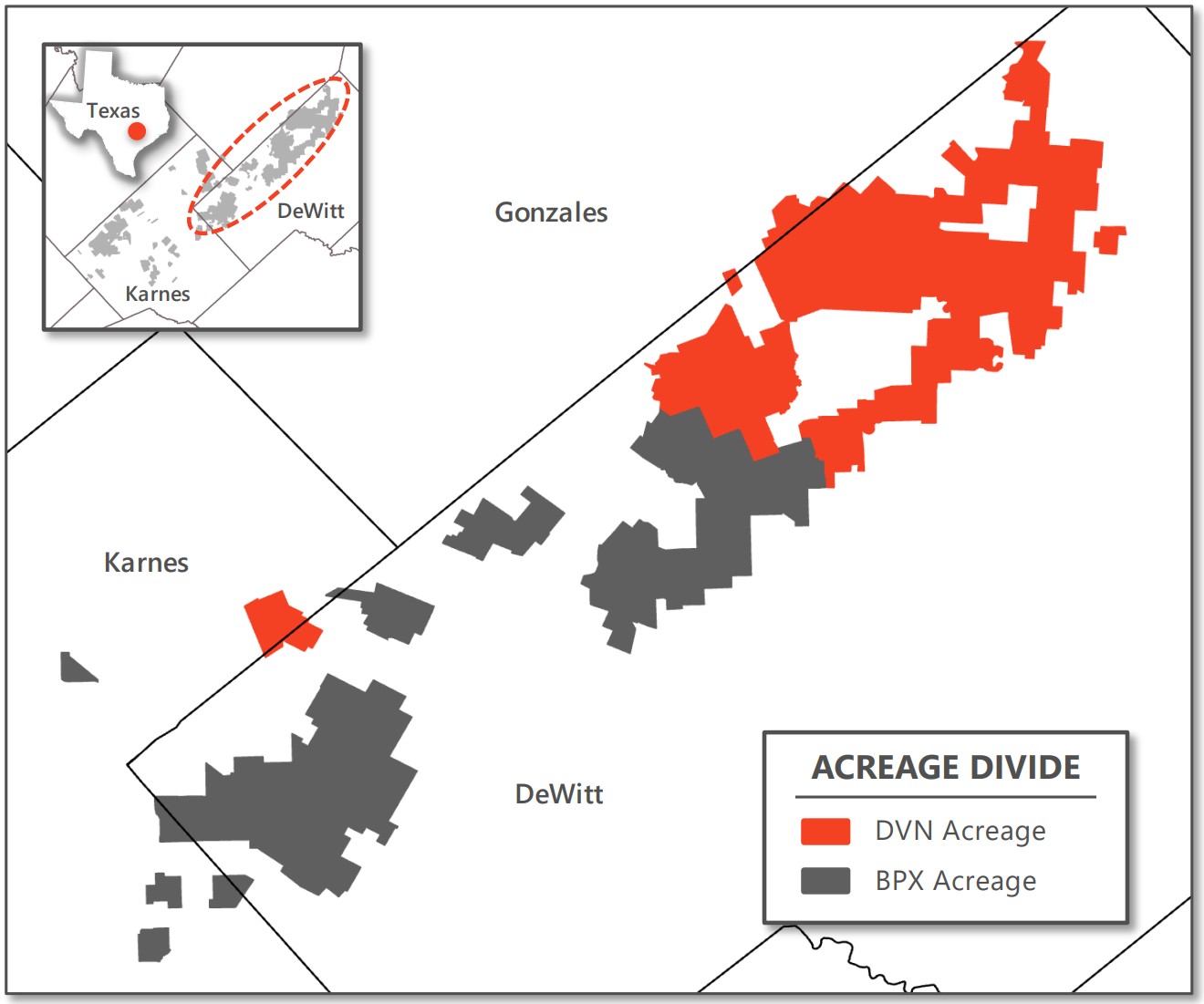

The JV program inherited by Devon Energy and BPX, the U.S. shale segment for international supermajor BP Plc, covered the Eagle Ford’s Blackhawk Field.

The transaction is expected to close on April 1.

After closing, Devon will hold approximately 46,000 net acres in the Eagle Ford play, with greater than a 95% working interest and operatorship, the company said in its fourth-quarter earnings on Feb. 18.

Devon said dissolving the JV with BPX will gain “greater flexibility to allocate capital and anticipates material drilling and completion savings per well, significantly enhancing returns.”

Devon and BPX have both recently touted recompletion projects—or “refracs”—on their Eagle Ford assets.

BPX is seeing “triple-digit plus” returns from Eagle Ford refracs and EUR uplifts “we didn’t really predict in shale,” BP CEO Murray Auchincloss said during the company’s Feb. 11 earnings call.

Auchincloss called Eagle Ford refracs “the most interesting” space the company is watching across its U.S. shale footprint right now.

“The refracs and downspacing are actually creating more flow than the original motherbores,” he said.

The original JV was structured in 2010 between GeoSouthern and Petrohawk, two original trailblazers in drilling the horizontal Eagle Ford play.

Petrohawk was acquired by BHP Billiton in 2011 for $12.1 billion.

BP finally dove more heavily into U.S. shale in 2018 when it acquired BHP’s onshore assets for $10.5 billion.

And in 2014, Devon acquired GeoSouthern’s Eagle Ford assets for $6 billion in cash.

RELATED

BP’s Eagle Ford Refracs Delivering EUR Uplift, ‘Triple-Digit’ Returns

Recommended Reading

Ring May Drill—or Sell—Barnett, Devonian Assets in Eastern Permian

2025-03-07 - Ring Energy could look to drill—or sell—Barnett and Devonian horizontal locations on the eastern side of the Permian’s Central Basin Platform. Major E&Ps are testing and tinkering on Barnett well designs nearby.

Hibernia IV Joins Dawson Dean Wildcatting Alongside EOG, SM, Birch

2025-01-30 - Hibernia IV is among a handful of wildcatters—including EOG Resources, SM Energy and Birch Resources—exploring the Dean sandstone near the Dawson-Martin county line, state records show.

Formentera Joins EOG in Wildcatting South Texas’ Oily Pearsall Pay

2025-01-22 - Known in the past as a “heartbreak shale,” Formentera Partners is counting on bigger completions and longer laterals to crack the Pearsall code, Managing Partner Bryan Sheffield said. EOG Resources is also exploring the shale.

Analysis: Middle Three Forks Bench Holds Vast Untapped Oil Potential

2025-01-07 - Williston Basin operators have mostly landed laterals in the shallower upper Three Forks bench. But the deeper middle Three Forks contains hundreds of millions of barrels of oil yet to be recovered, North Dakota state researchers report.

E&Ps Pivot from the Pricey Permian

2025-02-01 - SM Energy, Ovintiv and Devon Energy were rumored to be hunting for Permian M&A—but they ultimately inked deals in cheaper basins. Experts say it’s a trend to watch as producers shrug off high Permian prices for runway in the Williston, Eagle Ford, the Uinta and the Montney.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.