With water production often outpacing oil and gas, E&P companies turn to recycling, disposal and beneficial reuse to handle the water, but each solution has its limitations.

Some regions, such as the Delaware Basin, have a water-oil ratio (WOR) as high as 10 bbl of water per 1 bbl of crude, although an industry average WOR is closer to 4 bbl of water per 1 bbl of crude, XRI Water Vice Chairman John Durand told E&P. That means if the Permian Basin is pumping out 5 MMbbl/d of crude, it is accompanied by about 20 MMbbl/d of water.

All that water has to go somewhere, and for now, much of it is being sent back into the ground.

And as Laura Capper, principal at EnergyMakers Advisory Group, which consults on water management handling, told E&P, “capacity is not keeping up with our produced water growth.”

Capacity in Texas is further strained, she noted, because New Mexico’s produced water is brought to Texas for disposal.

The industry is doing an “admirable job” of recycling produced water for use in frac operations, with recycling “becoming a de facto thing,” but that still means operators have to find something to do with the rest of the produced water, she said.

Vast volumes

Speaking during a Pickering Energy Partners Permian-focused webinar on produced water in April, Kelly Bennett, co-founder and CEO of B3 Insight, said the industry needs solutions that can handle “something in the magnitude of several million barrels a day of water.”

Matthias Bloennigen, managing director at Pickering Energy Partners, speaking during the same webinar, expects water-handling costs in the Permian to rise over the coming years.

“If we don’t do any reuse, we are going to have too much produced water,” he said. “In 2029, if we don’t drill enough, we’re going to be running out of disposal capacity.”

Even if more disposal capacity is drilled, Bloennigen said he expects the Permian market will become tighter. “That’s why we especially think that the water-handling costs are going to continue to increase as we have seen over the last few years,” he said.

According to Bloennigen, this dynamic has changed how operators are thinking about produced water.

“Water used to be more of an afterthought,” considered only after the oil and gas strategy had been developed, he said. “Now water will have to be part of the oil and gas development.”

Seismic events

One of the long-favored solutions for all this produced water has been to store it in disposal wells or reinject it into enhanced oil recovery (EOR) wells to maintain reservoir pressure.

After the Railroad Commission (RRC) of Texas concluded that deep injection of produced water is the likely culprit behind recent seismic activity rocking the state, deep disposal wells came under scrutiny. The RRC has limited deep disposal wells in a bid to stave off additional earthquakes, but some question the correlation between these wells and increased regional seismic activity.

“People have a lot of fallacies about pressure and earthquakes,” Capper said. “People always think high volumes lead to high pressure, lead to earthquakes.”

That is not necessarily the case.

“It’s far more nuanced. It’s different in every region. It’s not a direct correlation. It’s very fuzzy and indeterminate science. Part of the reason is because we really don’t even know where the earthquakes happened with great accuracy. The reported stuff from TexNet (Texas Seismological Network and Seismology Research) could be a mile high or low off of where the actual earthquake happened. So, there’s a big error of margin in reporting,” Capper said.

A complicating factor, she added, is that parallel operations like production and injection in the same area make it hard to tell what truly affects seismicity.

Pressure of the formation is one of the concerns.

“The vast majority of shallow wells are highly over-pressured, while deep [wells] are moderate, and in many cases under-pressured. And actually, there may be more of a correlation with under-pressured wells and seismicity than over-pressured wells and seismicity. So, it’s really confounding,” Capper said.

Some places in Texas with quakes have no nearby disposal wells or very low-pressure wells, while others have a lot of over-pressured wells with no quake activity, she said.

“It’s not what people think. It’s a trickier science,” she said.

But the question remains: What can be done with the water that isn’t recycled if it can’t go into deep disposal wells?

“In the last year from seismic curtailments, if you will, we’ve lost almost 1 million barrels a day of actual injection that we used to be able to stick down wells, and now we’re not allowed to. We had to find new homes for that water, either make it go shallow or make it go farther away and go someplace else,” she said.

Doing that economically and efficiently is a challenge, especially because alternative shallow disposal wells are not an equal alternative to deep disposal wells.

“They cut us off deep, so we’re going shallow,” Capper said.

With deeper wells, she said, it is possible to store quite a bit of water, but shallow wells cannot accept the same quantity of water, and they tend to be more over-pressured.

“Most operators think they can put the same amount of water in shallow as deep. I’m like, ‘Oh no,’” she said.

The capacity of shallower wells simply does not match the capacity of deep disposal wells because of the formation pressures. With produced water rates increasing, it is problematic that capacity is “pretty much flat” for shallow and EOR wells, Capper said.

Storage capacity aside, shallow disposal wells could lead to problems with orphan wells, she added.

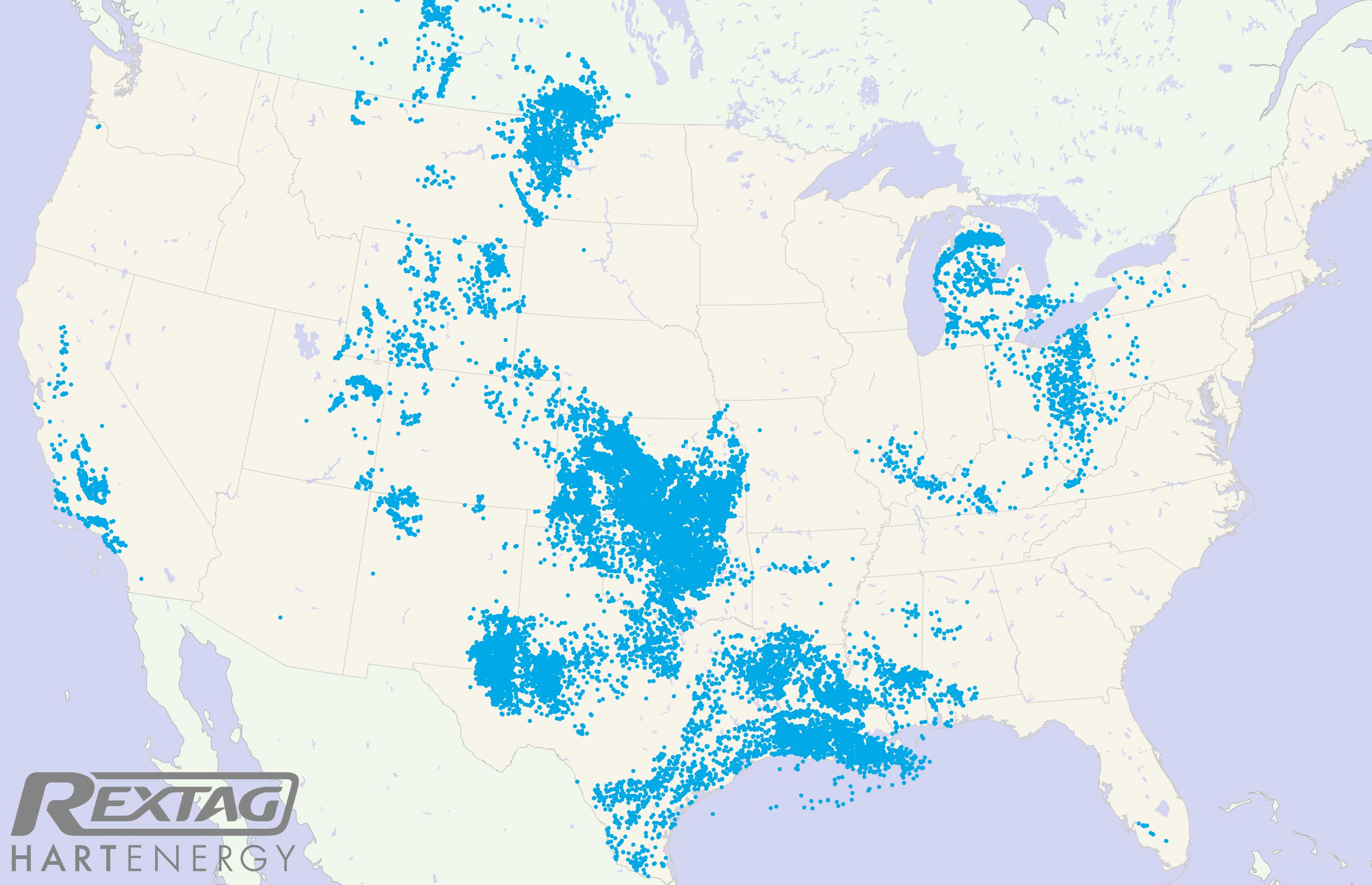

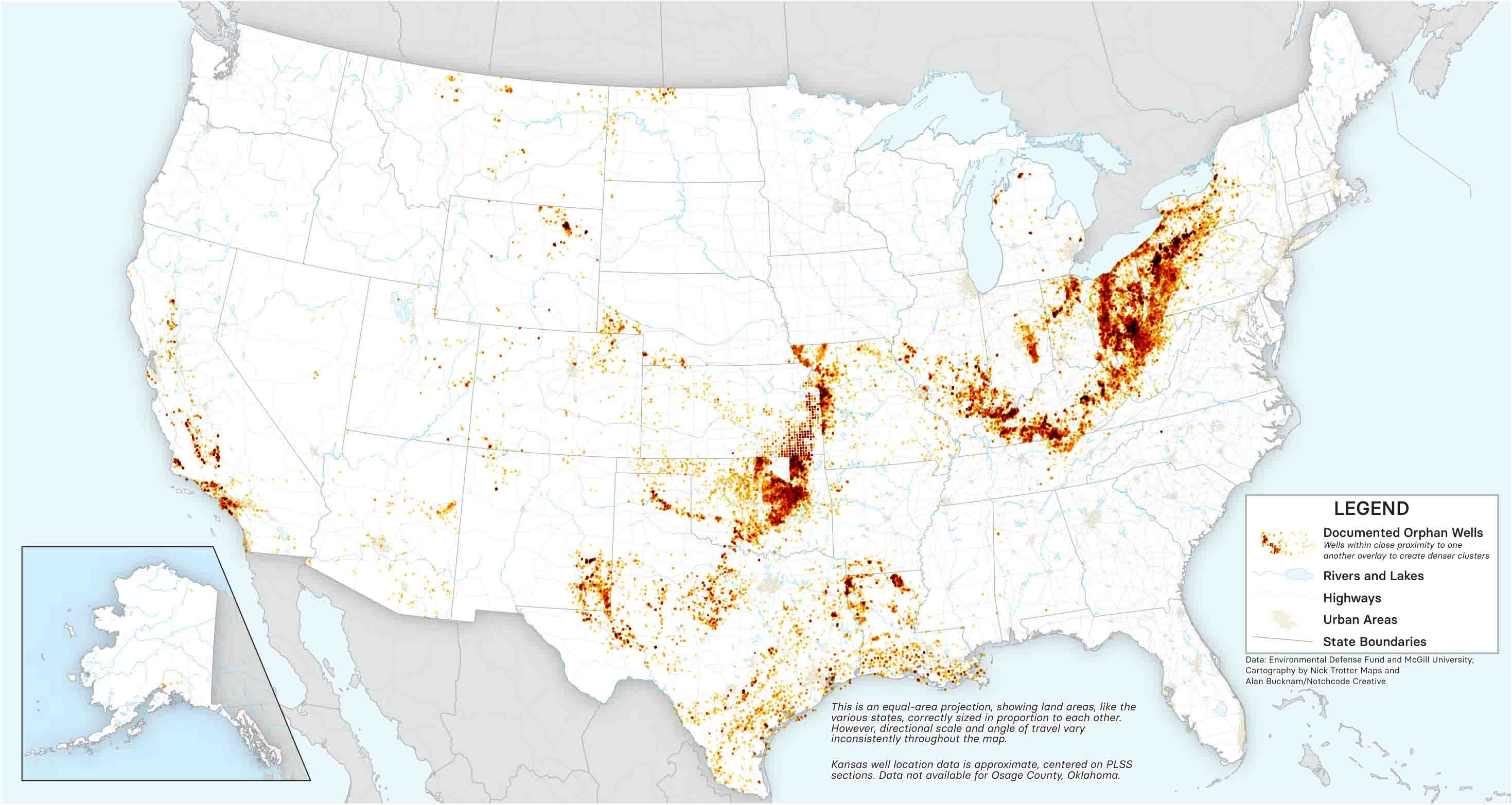

Roughly 125,000 documented orphan wells—those for which no company is financially liable for plugging—exist throughout the country. Many of these orphan wells are thought to have compromised infrastructure.

“The old wells have already rotted out and corroded. They’re just a leaky straw waiting to be used as a conduit,” she said.

The orphan wells likely weren’t designed to handle the increased formation pressure that might result if water disposal in a shallow well drives up the pressure in the formation, making it possible for produced water to migrate into an orphan well. The result, she said, is that the orphan well could become a conduit to pollute groundwater or cause other issues.

“It’s really the intersection of legacy, compromised well infrastructure and then modern-day operations,” she said.

Beneficial reuse

Restrictions on deep disposal wells, the limited capacity of shallow disposal wells and concerns that shallow disposal wells could potentially lead to problems with orphan wells leaves operators with a weighty decision to make about what to do with all that produced water.

Durand said, “We’re talking about a vast amount of water getting pumped every day, and we are all in agreement as an industry that you’ve got to limit disposal.”

Recycling is one answer, but that still leaves a lot of water to be dealt with. Enter beneficial reuse.

In the near term, beneficial reuse possibilities include industrial use, closed loop and zero liquid discharge applications, mining and dissolution mining, aquifer recharge for future use and agriculture for non-edible crops like cotton, hemp, switchgrass and oil seeds. In the long term, beneficial reuse could include agriculture for consumable crops and for animals as well as water sent to municipal drinking water facilities for further treatment. Durand also sees the possibility for the produced water to be used to help cool large-scale data centers.

Durand said the industry is working on pilot testing beneficial reuse projects.

While beneficial reuse is still in its infancy, “we’re fast tracking it as an industry to figure out ways to potentially discharge on the ground, but that’s going to take a lot of testing and a lot of commitment from the industry,” he said.

According to Durand, XRI will be working alongside its clients to solve this challenge. He said it is critical that the industry reach “the right results to make sure the beneficial reuse becomes a reality sooner than later because there’s going to be a direct correlation between limiting the use of disposal water to increasing the use of water for beneficial reuse.”

Standards for water treatment for beneficial reuse are in progress, and pilots are showing that the technologies to treat the water work in the field and at scale, Capper said.

“The challenge is these aren’t going to be cheap projects. They’re going to be tens to hundreds of millions of dollars to implement,” she said.

On the other hand, because Texas is also going to be “in a perpetual drought for the rest of its foreseeable future” without sufficient water supply, there is plenty of incentive to find a way to make it work, she said.

Durand sees the possibility of a greener future for Texas.

“West Texas is a massive desert-like area. Imagine us being able to utilize and green up West Texas on a year-round basis with water that before was going downhill and potentially causing issues such as seismic activity,” he said. “And then, all of a sudden, hopefully we’re talking in a very few short years, a lot less disposal injections and a lot more beneficial reuse.”

Recommended Reading

EIA: NatGas Storage Plunges, Prices Soar

2025-01-16 - Frigid weather and jumping LNG demand have pushed natural gas above $4/MMBtu.

Expand CFO: ‘Durable’ LNG, Not AI, to Drive US NatGas Demand

2025-02-14 - About three-quarters of future U.S. gas demand growth will be fueled by LNG exports, while data centers’ needs will be more muted, according to Expand Energy CFO Mohit Singh.

Pipeline Maintenance Drives Waha Negative, Again

2025-03-20 - Analysts predict plenty of natural gas demand on the Gulf Coast is coming as LNG operations ramp up.

NatGas Shouldering Powergen Burden, but Midstream Lags, Execs Warn

2025-02-14 - Expand Energy COO Josh Viets said society wants the reliability of natural gas, but Liberty Energy CEO Ron Gusek said midstream projects need to catch up to meet demand during a discussion at NAPE.

LNG Leads the Way of ‘Energy Pragmatism’ as Gas Demand Rises

2025-03-20 - Coastal natural gas storage is likely to become a high-valued asset, said analyst Amol Wayangankar at Hart Energy’s DUG Gas Conference.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.