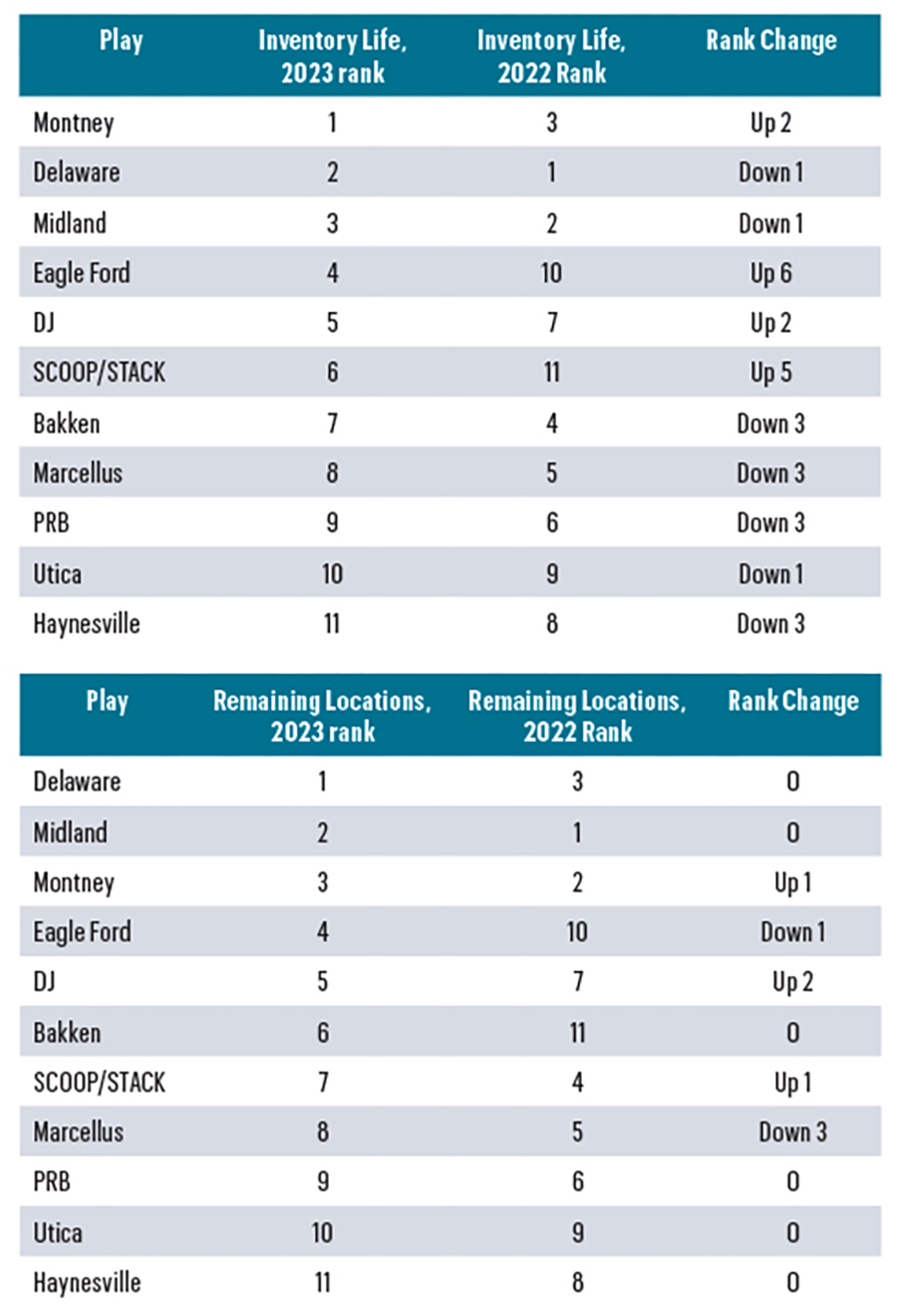

The North American play-level inventory rankings are always of interest, and Enverus is regularly tapped for insight on which plays have seen movement on our leaderboards. Operators and investors are more concerned than ever about remaining inventory. Who has it? Where is it? Will it be economic?

Basin trends

Enverus Intelligence Research (EIR), a subsidiary of Enverus, noted a number of trends as we exited 2023. We saw revisions to the quantity of remaining locations from the previous assessment that came at the expense of quality, which appears to have fallen across the board. Cost inflation, productivity degradation, improved data and other development trends drove most of the inventory quality reductions, but those variables did not change uniformly across North American plays. Some clear winners and losers emerged:

- Tier 1 and 2 (PV-10 breakeven less than $50/bbl or $2.50/mcf) inventory dropped 30% since last year, but some plays are more resilient than others.

- Winners include the Montney, Eagle Ford, Denver-Julesburg (D-J) Basin and SCOOP/STACK plays, which all moved up in the rankings.

- Losers include the Marcellus and Bakken, which slid down in the rankings.

- Permian Basin plays still hold the most remaining Tier 1 and 2 locations, but the Montney has a longer lifespan of Tier 1 and 2 sticks due to less activity in the play.

Biggest gain: Montney

Even with an increasing pace of development, the Montney Shale has dethroned the Delaware Basin for the top spot on sub-$50/bbl breakeven of Tier 1 and 2 inventory life. The Canadian play is no exception to the trends in degradation and inflation, but the quality of some Montney inventory received help from an improved Canadian Liquids Correction model in Enverus PRISM. The liquids-rich regions of the play now rank among the top North American plays, with sub-$45/bbl (or $2.25/Mcf) breakevens according to EIR. Many of EIR’s top gas equity picks operate in these regions and have more than a decade of sub-$3 Henry Hub inventory. With about one-third the number of wells put on production each year as the Permian plays, the Montney has a long runway if activity levels hold.

Big gains: Eagle Ford

The Eagle Ford play, including the Austin Chalk, moved up an astounding six spots on the inventory life leaderboard. Although rig day rates were up 18% from late 2022 to late 2023, operators continue to find material efficiency gains to offset inflation. EIR also expanded the extent of proven resource in the Austin Chalk and Upper Eagle Ford, adding some locations with surprisingly strong economics.

The story here is largely resiliency. The core of the Eagle Ford play still holds years of inventory, and those locations still break even in the low-$40/bbl range with some of the tightest spacing in North America. In the Austin Chalk, operators are also pushing some of the tightest limits of spacing, particularly in the Webb County, Texas, condensate window.

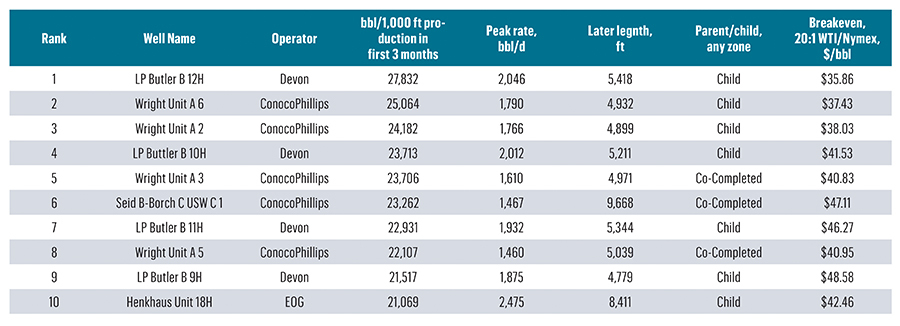

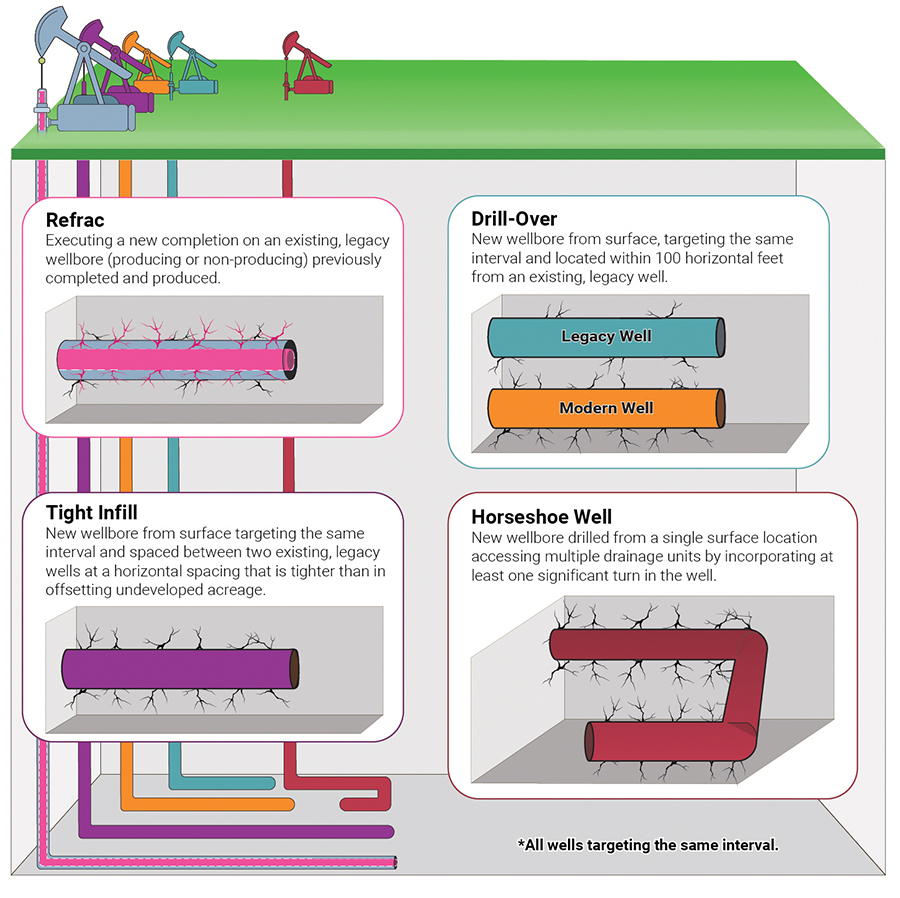

Enverus ranked top Eagle Ford oil wells from the first half of 2023 by production volumes over the first three months, per 1,000 ft of lateral. The four top-ranked wells were all tight infill child wells drilled with a horizontal spacing of 300 ft to 350 ft and having parent wells that were on average six years older. Seven of the top 10 wells were tight infills. The success of these tight infill wells has provided Eagle Ford operators with a second chance to develop their assets, a luxury that Bakken operators do not have because of significant differences in the petrophysical properties between the two plays.

Tight infills are one of several strategies that we can broadly characterize as “redevelopment.” Others include refracs, drillovers and even “horseshoe” wells. In 2024, EIR expects these late-life development strategies to be top of mind for operators in mature plays, but there is no blanket answer for which technique is the right choice. The optimal solution in each drill spacing unit depends on a multitude of inputs and the operator’s desired output.

RELATED

URTeC: E&Ps Tap Refrac Playbook for Eagle Ford, Bakken Inventory

Biggest losses: Marcellus

Cost inflation between 2022 and 2023 in the Marcellus was among the highest in North America. Rig day rates were up 25% year-over-year in September, compared to about 15% across the Lower 48. Total well costs per lateral foot are up about 20% since early 2022, according to estimates within PRISM. Some operators have managed to minimize per foot productivity degradation by widening spacing, but at the cost of some inventory. Productivity degradation is worst in the Northeast Pennsylvania Core, according to EIR, meaning the area with the highest potential for Tier 1 locations must be risked down.

Big losses: Bakken

The bulk of the remaining inventory in the Bakken is no longer in EIR’s Tier 1 or 2 categories. Cost inflation has not been as kind to the Bakken as other Rockies plays, according to estimates in PRISM. The D-J Basin moved up in both inventory rankings thanks to efficiency gains offsetting inflation and minimal productivity degradation. Compounding the shift in non-core development strategies to wider spacing, longer laterals and less wells targeting the Three Forks intervals—with a significant increase in the pace of development—translates to a shorter Tier 1 and 2 runway and a drop in the leaderboard behind rival Rockies play, the D-J.

Looking ahead

There are still opportunities for resource expansion, even within mature plays, to extend the duration of remaining inventory. This can come in the form of pushing the extents of viability in a play or target interval, or downspacing within a play, as previously covered in the Eagle Ford. Here’s one of the many developments to watch around North America with potential to unlock new inventory.

Midland Basin/Barnett

EIR expects the Barnett Formation to continue to be delineated well into the core of the Midland Basin. When we first heard about a Barnett play in the Midland Basin, we figured it would be mostly gas at those depths. But even in some of the deepest parts of the basin, like Martin and Midland counties, resource expansion in the Barnett is attracting a plethora of capital from several large operators, in large part because it’s so oily.

These producers are finding volatile oil at depths greater than 11,000 ft, with initial gas-oil ratios around 3,000 cf/bbl, or 67% oil. There are already more than 100 producing wells in, or adjacent to, the Midland Basin, with consistent sub-$50/bbl breakevens. Roughly 60 permits and wells-in-progress are on their way, including initial tests and downspacing trials.

Tucker Keren and Jared Kugler, are principal consultants at Enverus.

Recommended Reading

Civitas Makes $300MM Midland Bolt-On, Plans to Sell D-J Assets

2025-02-25 - Civitas Resources is adding Midland Basin production and drilling locations for $300 million. To offset the purchase price, Civitas set a $300 million divestiture target “likely to come” from Colorado’s D-J Basin, executives said.

Occidental to Up Drilling in Permian Secondary Benches in ‘25

2025-02-20 - Occidental Petroleum is exploring upside in the Permian’s secondary benches, including deeper Delaware Wolfcamp zones and the Barnett Shale in the Midland Basin.

Matador Touts Cotton Valley ‘Gas Bank’ Reserves as Prices Increase

2025-02-21 - Matador Resources focuses most of its efforts on the Permian’s Delaware Basin today. But the company still has vast untapped natural gas resources in Louisiana’s prolific Cotton Valley play, where it could look to drill as commodity prices increase.

Vital, SM: Woodford-Barnett Wildcats Flush with Barrels in Southern Midland

2025-02-25 - An initial SM Energy test made 250,000 boe in its first eight months online. Vital Energy is reporting more than 150,000 gross boe per 10,000 ft of lateral in its first-six-month output.

Ovintiv Closes $2B Uinta Sale to FourPoint Resources

2025-01-22 - Ovintiv is exiting Utah’s Uinta Basin in a $2 billion sale to FourPoint Resources, which will take over some of the play’s highest quality acreage.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.