From FPSO purchases to tropical storm updates, below is a compilation of the latest headlines in the E&P space.

Contracts and company news

Equinor to Acquire Sval Energi’s Stake in the Halten East Project

Equinor agreed to acquire Sval Energi’s 11.8% share in the Halten East project, the Norwegian company announced Nov. 7. This acquisition increases Equinor’s ownership in the development to 69.5%.

Approved in May 2022 and on track to start production in 2025, Halten East is an ongoing offshore development located in the Kristin-Åsgård area in the Norwegian Sea.

The development consists of six gas discoveries and three prospects, which will use the existing infrastructure and processing capacity at the Åsgard B platform. The project’s recoverable reserves are estimated to be around 100 MMboe, with 60% being gas planned to be exported to Europe via the Kårstø processing plant.

The first phase of the project, which will be carried out between 2024 and 2025, will drill six wells for five discoveries. The second phase, which will begin in 2029, includes a sidetrack to one discovery and three optional wells for the prospects.

Equinor is the operator of Halten East. Vaar Energi holds 24.6% and Norway’s Petoro holds the remaining 5.9%.

ExxonMobil Completes FPSO Purchase

Exxon Mobil Guyana Ltd. completed the purchase of FPSO Prosperity from SBM Offshore, according to a Nov. 7 press release.

The $1.23 billion transaction comes ahead of the maximum lease term, which would have expired in November 2025.

The FPSO Prosperity has been on hire since November 2023 and will continue to be operated through the integrated operations and maintenance model combining SBM Offshore and Exxon Mobil’s expertise. The purchase allows Exxon Mobil Guyana to assume ownership of the unit while SBM Offshore continues to operate and maintain the FPSO up until 2033.

Weatherford Secures Three-Year Contract with ADNOC

As part of the reactivation of ADNOC onshore strings, Weatherford was awarded a three-year contract for the provision of rigless services, the company announced Nov. 7.

The contract leverages Weatherford’s expertise in comprehensive rigless services, allowing ADNOC to maximize well productivity while minimizing downtime and operational risks. Weatherford will deploy a suite of technologies designed to enhance wellbore integrity, streamline reactivation processes and optimize reservoir performance.

The project is slated to begin in the fourth quarter of 2024.

Black & Veatch, Baker Hughes Announce LNG Collaboration at ADIPEC 2024

During ADIPEC 2024, Black & Veatch announced a collaboration agreement with Baker Hughes to combine the company’s LM9000 gas turbine and compression technology with Black & Veatch’s PRICO liquefaction technology for clients seeking mid-scale LNG solutions.

The collaboration, announced Nov. 5, aims to bring a standard LNG solution to the market for both onshore and offshore projects and is capable of producing up to 2 million tonnes per annum (mtpa) per train.

“[Black & Veatch is in the] process of deploying PRICO with Baker Hughes’ LM9000 and compression technology on a current project in construction, and we are excited to now be able to offer this optimized solution to both onshore and floating LNG facilities that are considering mid-scale trains to monetize their natural gas assets and enable global LNG trading necessary to support the energy transition,” said Youssef Merjaneh, Black & Veatch’s senior vice president and managing director for Europe, Middle East and Africa.

Regulatory updates

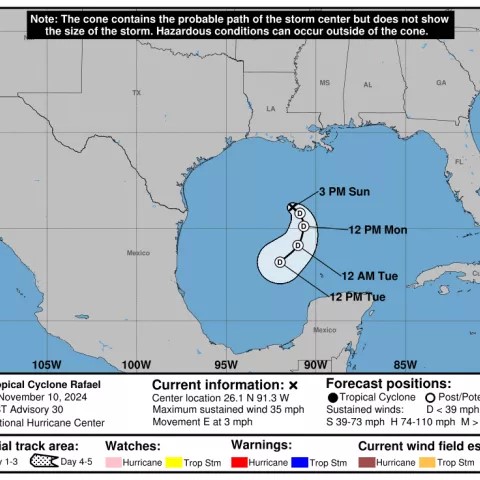

BSEE Monitors GoM Activities in Response to Tropical Storm Rafael

The Bureau of Safety and Environmental Enforcement (BSEE) activated its hurricane response team to monitor offshore oil and gas operators in the Gulf of Mexico (GoM).

In an update based on data from offshore operator reports submitted on Nov. 11, the BSEE estimates that approximately 25.69% of the current daily oil production and 13.06% of the current daily natural gas production in the GoM has been shut-in.

Personnel remain evacuated from a total of 23 of the 371 production platforms in the Gulf of Mexico and one of the GoM’s non-dynamically positioned rigs. Two dynamic-position rigs remain off location out of the storm’s path as a precaution.

After the storm has passed, facilities will be inspected and once all standard checks have been completed, production from undamaged facilities will be brought back online immediately.

Recommended Reading

US NatGas Prices Hit 23-Month High on Increased LNG Feedgas, Heating Demand

2024-12-24 - U.S. natural gas futures hit a 23-month high on Dec. 24 in thin pre-holiday trading.

Segrist: American LNG Unaffected by Cut-Off of Russian Gas Supply

2025-02-24 - The last gas pipeline connecting Russia to Western Europe has shut down, but don’t expect a follow-on effect for U.S. LNG demand.

DOE: ‘Astounding’ US LNG Growth Will Raise Prices, GHG Emissions

2024-12-17 - The Biden administration released Dec. 17 a long-awaited report analyzing the effects of new LNG export projects, which was swiftly criticized by the energy industry.

European NatGas Prices Drop Despite Norwegian Outage

2025-01-09 - The European continent continues to pull in U.S. LNG, offsetting Norway’s Hammerfest LNG outage.

Bernstein Expects $5/Mcf Through 2026 in ‘Coming US Gas Super-Cycle’

2025-01-16 - Bernstein Research’s team expects U.S. gas demand will grow from some 120 Bcf/d currently to 150 Bcf/d into 2030 as new AI data centers and LNG export trains come online.

Comments

Add new comment

This conversation is moderated according to Hart Energy community rules. Please read the rules before joining the discussion. If you’re experiencing any technical problems, please contact our customer care team.